Analysis of Trades and Trading Tips for the British Pound

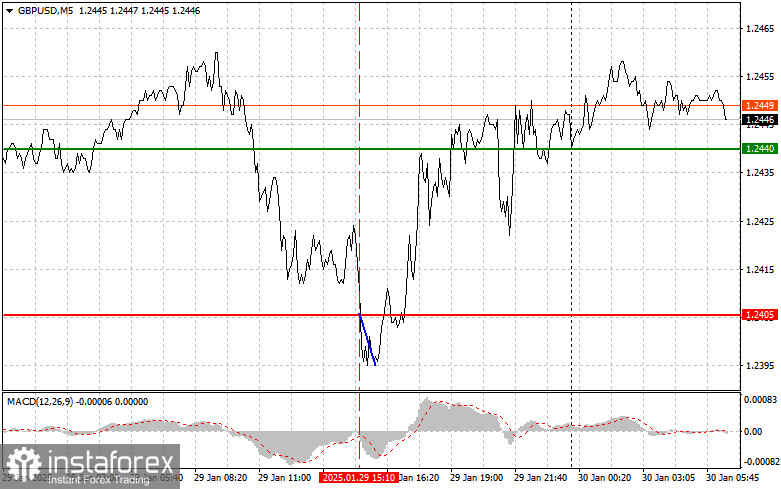

The testing of the 1.2405 level coincided with the moment when the MACD indicator began to move downward from the zero mark, indicating a favorable entry point for selling GBP. However, the pair only dropped 10 pips before demand returned.

Traders closely monitored the economic data released yesterday, awaiting clarification from the Federal Reserve regarding its future actions. As no new information was provided, many major players hesitated to buy the dollar, which allowed the pound to recover after the earlier sell-off that occurred during the first half of the day.

Today, several economic indicators are being released that could influence economic policy and household wealth. An increase in the M4 money supply in the UK suggests that the central bank is continuing to support liquidity, which could indicate a willingness to stimulate the economy. Rising mortgage applications also reflect consumer confidence in the property market, potentially contributing to economic growth. Additionally, net lending to individuals is a crucial indicator of financial health; an increase in this metric signifies greater consumer demand and indicates that people feel able to apply for loans to finance their purchases. This could positively impact the value of the pound sterling.

For my intraday strategy, I will primarily focus on implementing scenarios No. 1 and No. 2.

Buy Signal

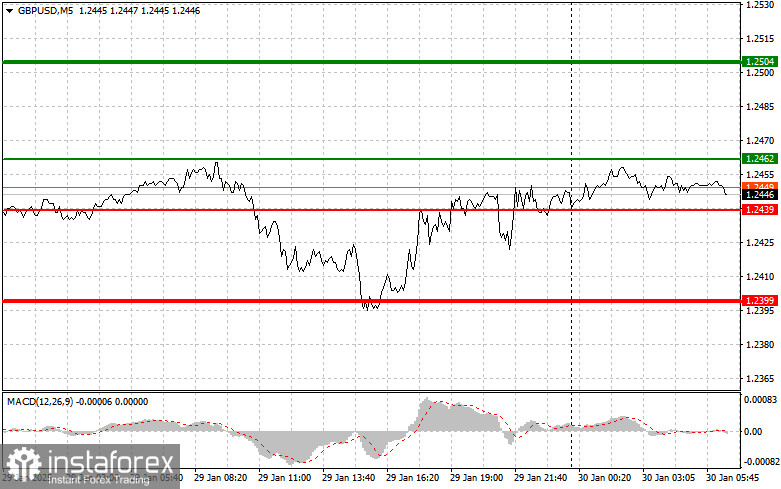

Scenario #1: I plan to buy the pound today when the price reaches the entry point around 1.2462 (marked by the green line on the chart). The goal is to see growth up to 1.2504 (represented by the thicker green line on the chart). Once the price hits 1.2504, I intend to exit purchases and initiate sales in the opposite direction, anticipating a movement of 30-35 pips against this level. I expect the pound to increase in value soon, supported by positive data and an upward trend. Important! Before purchasing, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive price tests at 1.2439 and the MACD indicator is in the oversold area. This situation would limit the pair's downward potential and likely result in an upward market reversal. We can anticipate growth towards the forthcoming levels of 1.2462 and 1.2504.

Sell Signal

Scenario #1: I plan to sell the pound today after updating the level of 1.2439 (red line on the chart), which will lead to a rapid decline in the pair. The key target of sellers will be the level of 1.2399, where I plan to exit sales and immediately open purchases in the opposite direction (calculating a movement of 20-25 pips in the opposite direction from the level). Selling the pound as high as possible is better since trading will be conducted against the trend. Important! Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound today if the price of 1.2462 is tested twice consecutively when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the opposite levels of 1.2439 and 1.2399 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.