Bitcoin and Ethereum crashed after growing panic over US trade tariffs on China, Mexico and Canada. However, by the end of the day, Bitcoin fully recovered its losses after news broke that Trump had made concessions and postponed the introduction of tariffs on Canada and Mexico. The tariffs on China, however, remained in effect. Although Ethereum also saw a rise, it was not as pronounced as Bitcoin's recovery, and it remained somewhat sidelined from major market movements.

One of the key factors contributing to the rebound of the cryptocurrency market was the announcement that Trump signed an executive order to establish a sovereign wealth fund. This decision sent a significant signal to investors looking for safe and profitable assets. The creation of such a fund opens up new opportunities for cryptocurrencies, suggesting that digital assets could be used as a reserve tool to ensure financial stability. Many experts believe that, amid the instability of traditional markets, cryptocurrencies may become an ideal option for asset diversification. Moreover, the news about the fund has increased trust in digital currencies among large investors. The anticipation that the fund might begin investing in crypto assets is fueling interest and driving prices higher in the market.

Senator Lummis commented on Trump's signing of the executive order, indicating, "It's possible that this fund will include Bitcoin purchases," and she urged for greater trust in the crypto market. It is also worth noting that legislative proposals for the creation of a strategic Bitcoin reserve have already been introduced in 19 U.S. states, up from just 11 at the end of January. These positive developments are clearly stimulating and supporting the cryptocurrency market during these challenging times.

In terms of intraday strategy for the cryptocurrency market, I will continue to take action, particularly during significant drawdowns of Bitcoin and Ethereum. I remain optimistic about the ongoing development of the bull market in the medium term, which is still very much in play.

For short-term trading, the strategy and conditions are outlined below.

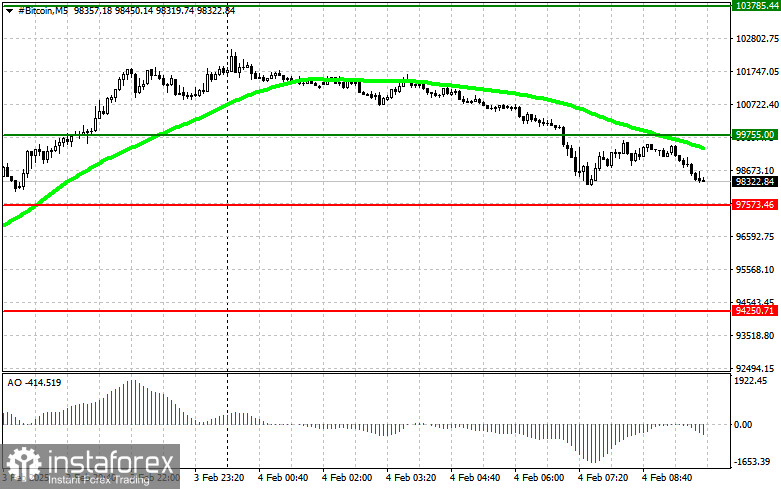

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today if the entry point reaches around $99,700, targeting a rise to $103,700. At $103,700, I will exit the buy position and immediately sell on the rebound. Before buying on the breakout, ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2: Bitcoin can be bought from the lower boundary of $97,500 if there is no market reaction to its breakout, aiming for levels at $99,700 and $103,700.

Sell Scenario

Scenario #1: I will sell Bitcoin today if the entry point reaches around $97,500, targeting a decline to $94,250. At $94,250, I will exit the sell position and immediately buy on the rebound. Before selling on the breakout, ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2: Bitcoin can be sold from the upper boundary of $99,700 if there is no market reaction to its breakout, targeting levels at $97,500 and $94,250.

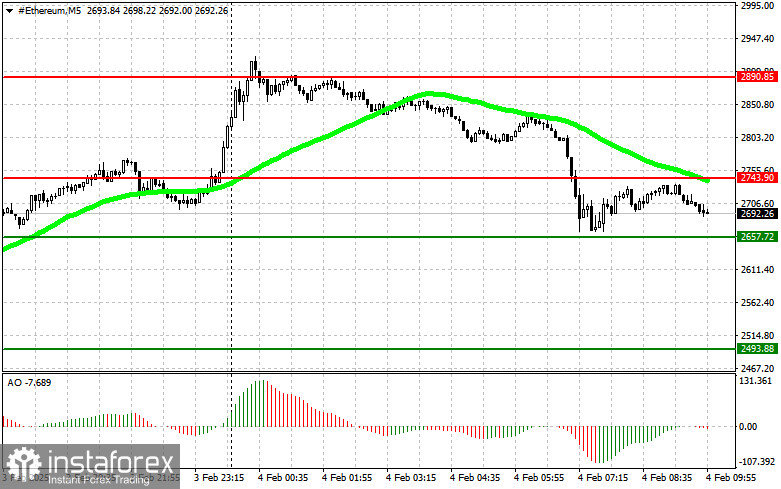

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today if the entry point reaches around $2,743, targeting a rise to $2,890. At $2,890, I will exit the buy position and immediately sell on the rebound. Before buying on the breakout, ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2: Ethereum can be bought from the lower boundary of $2,657 if there is no market reaction to its breakout, aiming for levels at $2,743 and $2,890.

Sell Scenario

Scenario #1: I will sell Ethereum today if the entry point reaches around $2,657, targeting a decline to $2,493. At $2,493, I will exit the sell position and immediately buy on the rebound. Before selling on the breakout, ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2: Ethereum can be sold from the upper boundary of $2,743 if there is no market reaction to its breakout, targeting levels at $2,657 and $2,493.