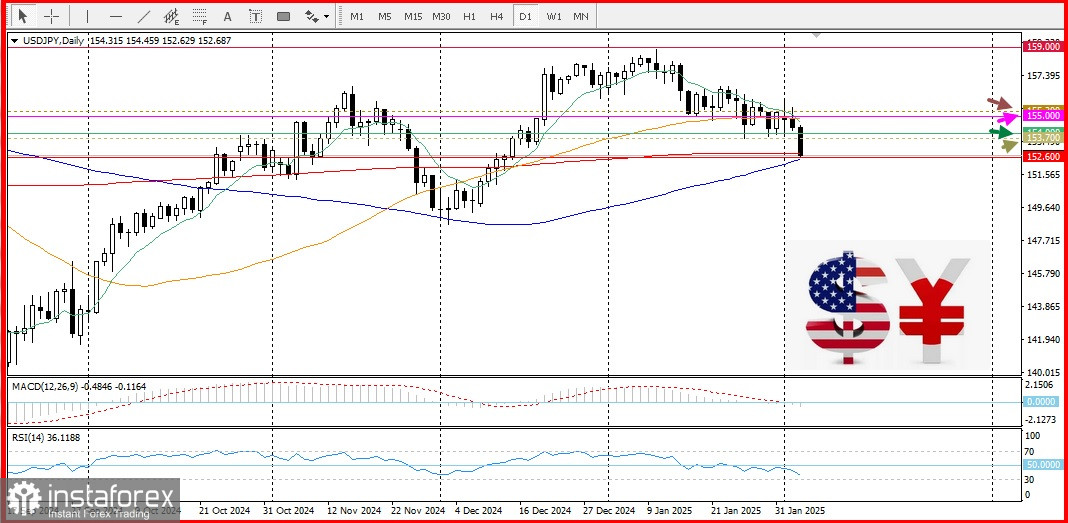

The USD/JPY currency pair is showing active downward movement, dropping to the 153.00 level, marking its lowest point since December amid expectations of hawkish monetary policy from the Bank of Japan.

A strong increase in nominal wages in Japan for December, rising by 4.8%, along with a 3.6% increase in real wages for the second consecutive month, has fueled expectations for further interest rate hikes in the country.

Additionally, data from S&P Global Market Intelligence on service sector activity reinforces growing optimism about Japan's economy. The au Jibun Bank Services PMI rose from 50.9 to 53.0 in January, reaching its highest level since September 2024. This supports market expectations of further tightening by the Bank of Japan, providing strong upside momentum for the Japanese yen.

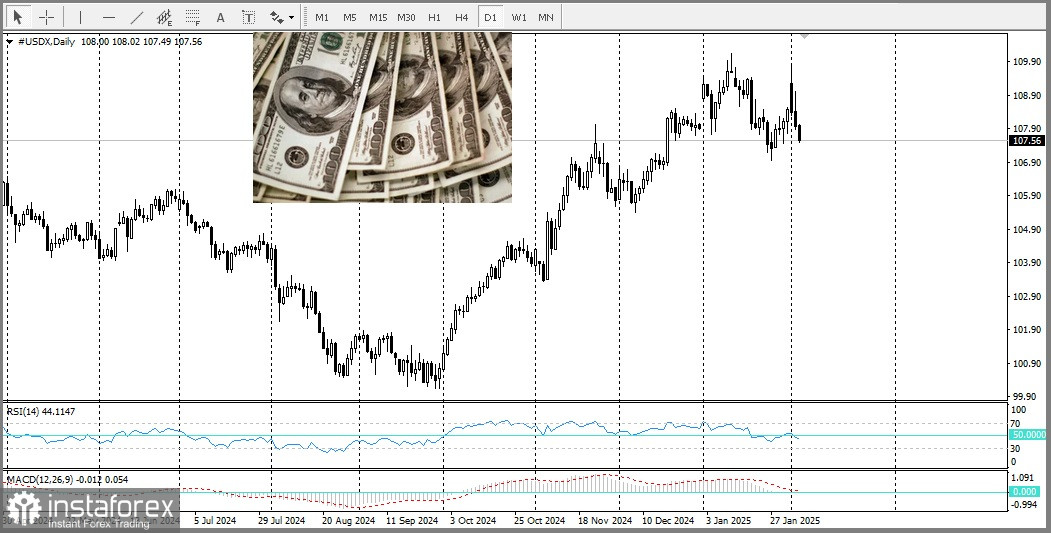

At the same time, weakness in the U.S. dollar continues to support USD/JPY's decline, with the Dollar Index (DXY) falling, indicating softening expectations regarding the Federal Reserve's policy stance.

Concerns over a potential U.S.-China trade war further bolster the outlook for the safe-haven yen.

Key Events to Watch Today

- ADP U.S. Employment Report (Private Sector)

- ISM Services PMI

A break below 154.00 is seen as a key bearish signal. Oscillators on the daily chart indicate negative momentum, but traders may wait for a decisive break below the 200-day and 100-day SMAs near 152.60 before entering new short positions.

On the other hand, any recovery may face resistance within the 153.70-153.80 range, ahead of the 154.00 round level. Sustained strength beyond this level could trigger a short-covering rally, pushing USD/JPY back toward the psychological 155.00 level. However, further upside moves are likely to face selling pressure near 155.25-155.30, which acts as a pivot zone. A breakout above this level would shift the short-term bias in favor of the bulls.

Conclusion

In the short term, the outlook for USD/JPY remains bearish.