The euro and pound experienced a slight decline following the strong growth observed earlier this week. This correction was directly linked to positive U.S. economic data, which the dollar had been lacking in recent weeks.

The robust U.S. labor market data, indicating economic recovery—especially in employment and unemployment rates—prompted investors to reassess their positions in the foreign exchange market. The strengthening of the dollar was driven not only by actual figures but also by expectations that the Federal Reserve will maintain high interest rates for an extended period. This situation creates additional pressure on risk assets, including the euro and pound.

As for European data, there are no significant reports scheduled for the first half of the day. While December's retail sales data for the Eurozone is not expected to have a major impact, Germany's industrial orders data could cause volatility if it significantly deviates from economists' forecasts.

The British pound is currently facing a different scenario. Bearish sentiment is already apparent, with traders waiting for another opportunity to capitalize on potential downsides, especially as key economic events approach. The Bank of England's upcoming interest rate decision will play a crucial role in determining the future direction of the pound.

Governor Andrew Bailey has repeatedly stressed that interest rates are closely linked to both inflation expectations and economic growth, both of which continue to face challenges. If the BoE decides to keep rates unchanged, it could lead to a short-term rise in the pound. However, if the BoE cuts rates and indicates a dovish stance, it is likely to increase selling pressure on GBP/USD. Regardless of the decision, market volatility is expected, so traders should be prepared for sudden trend changes.

If the economic data aligns with economist expectations, it is advisable to employ the Mean Reversion strategy. Conversely, if the data significantly exceeds or falls short of forecasts, the Momentum strategy is recommended.

Momentum Strategy (on breakout):

EUR/USD

Buy on breakout of 1.0404 could lead to a rise in the euro to 1.0440 and 1.0468

Sell on breakout of 1.0368 could lead to a fall in the euro to 1.0340 and 1.0312

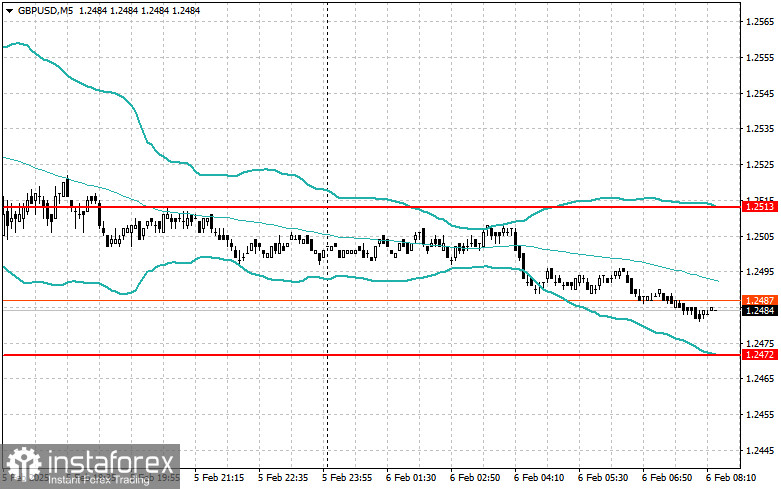

GBP/USD

Buy on breakout of 1.2505 may lead to a rise in the pound to 1.2545 and 1.2592

Sell on breakout of 1.2463 may lead to a fall in the pound to 1.2421 and 1.2380

USD/JPY

Buy on breakout of 152.82 may lead to the dollar's growth to the area of 153.19 and 153.65

Sell on breakout of 152.42 may lead to the dollar's sell-off to the area of 152.10 and 151.70

Mean Reversion Strategy (Trading on Pullbacks):

EUR/USD

Sell after a failed breakout above 1.0409, once the price returns below this level.

Buy after a failed breakout below 1.0378, once the price returns above this level.

GBP/USD

Sell after a failed breakout above 1.2513, once the price returns below this level.

Buy after a failed breakout below 1.2472, once the price returns above this level.

AUD/USD

Sell after a failed breakout above 0.6284, once the price returns below this level.

Buy after a failed breakout below 0.6252, once the price returns above this level.

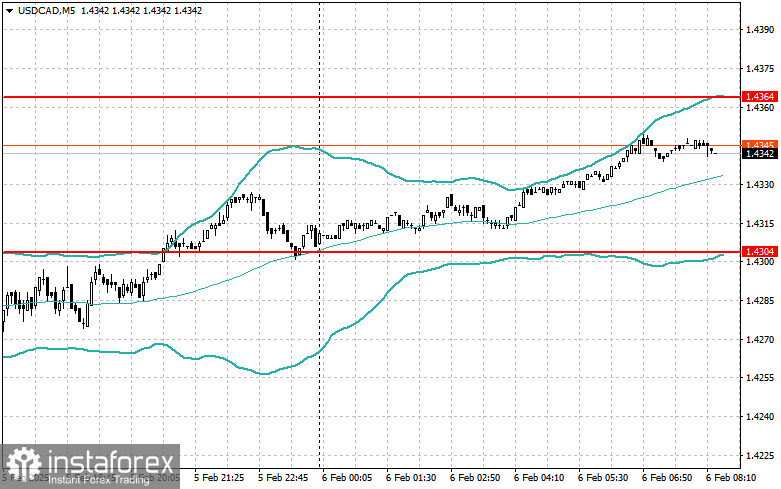

USD/CAD

Sell after a failed breakout above 1.4364, once the price returns below this level.

Buy after a failed breakout below 1.4304, once the price returns above this level.