Gold prices are showing signs of consolidation after reaching an all-time high in the $2882–2883 range, as the U.S. dollar stages a modest rebound from its more than one-week low. This development has prompted bulls to take a step back, given the market's overbought conditions.

Despite some profit-taking, downside momentum remains limited for gold, requiring caution from sellers before assuming that the precious metal has peaked. Several key drivers continue to support gold's strength:

- U.S.-China Trade War: Uncertainty surrounding trade tensions and potential economic repercussions from increased tariffs sustain demand for gold as a safe-haven asset.

- Federal Reserve Policy: Expectations of continued Fed rate cuts in 2025 and a recent decline in U.S. Treasury yields further enhance gold's attractiveness.

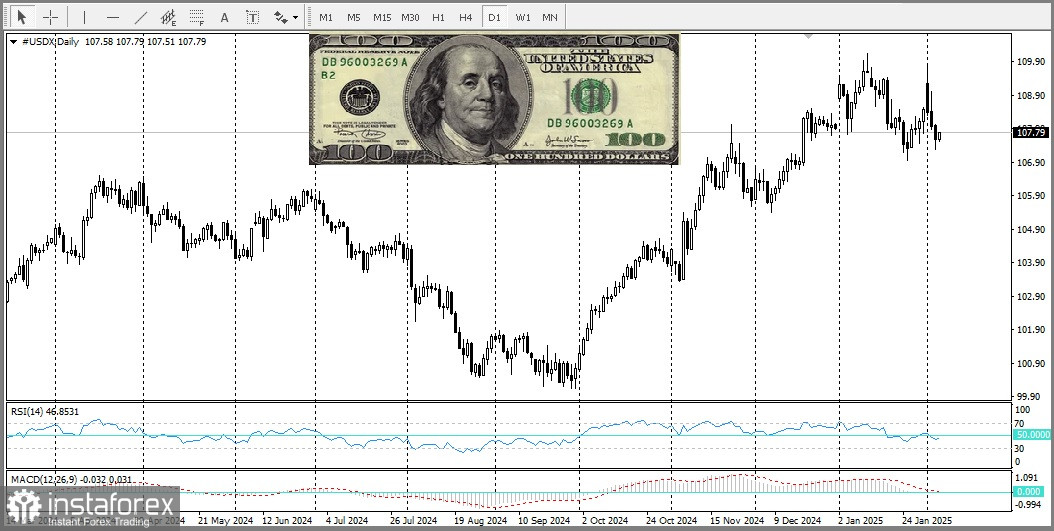

- Technical Overbought Conditions: The Relative Strength Index (RSI) has surpassed the 70 level, indicating overbought conditions. This suggests that short-term consolidation or a moderate pullback may provide a safer entry opportunity for new buyers.

Key Technical Levels to Watch

If a correction occurs, support is expected in the $2855–2850 level, where buyers may step in to stabilize prices. A break below this zone could expose gold to further downside toward $2810–2800. The $2773–2772 level serves as a major support level—a breakdown below this threshold could trigger technical selling, leading to a deeper retracement.

However, the recent breakout through key resistance levels suggests that the path of least resistance for gold remains to the upside.