Bitcoin made an attempt to break through a major daily resistance level, but after an active move around $99,000, it failed to secure its position above it. Meanwhile, Ethereum remains within a sideways range and, for now, appears likely to continue consolidating.

While everyone is waiting for Bitcoin to rally and for the cryptocurrency market to move upward, some research firms are already speculating on how Bitcoin would react if the U.S. government established a strategic Bitcoin reserve.

Katalin Tischhauser, head of investment research at Sygnum, believes that a $1 billion Bitcoin purchase by such a strategic reserve could trigger a supply shock and increase the market capitalization of the digital asset by $20 billion.

According to her, each additional $1 billion inflow could add up to $20 billion in Bitcoin's market cap—a phenomenon she attributes not only to direct capital inflows but also to the psychological effect of rising prices.

It's worth noting that in his first week in office, U.S. President Donald Trump initiated the creation of a Presidential Task Force on Digital Asset Markets within the National Economic Council. Among other objectives, this initiative aims to assess the feasibility of creating a U.S. strategic Bitcoin reserve. If this reserve fund is indeed established, it would serve as a major catalyst for Bitcoin's surge to new all-time highs.

Regarding intraday cryptocurrency market strategy, I will continue to look for major declines in Bitcoin and Ethereum, as the bullish market trend remains intact in the medium term.

For short-term trading, the strategy and conditions are outlined below.

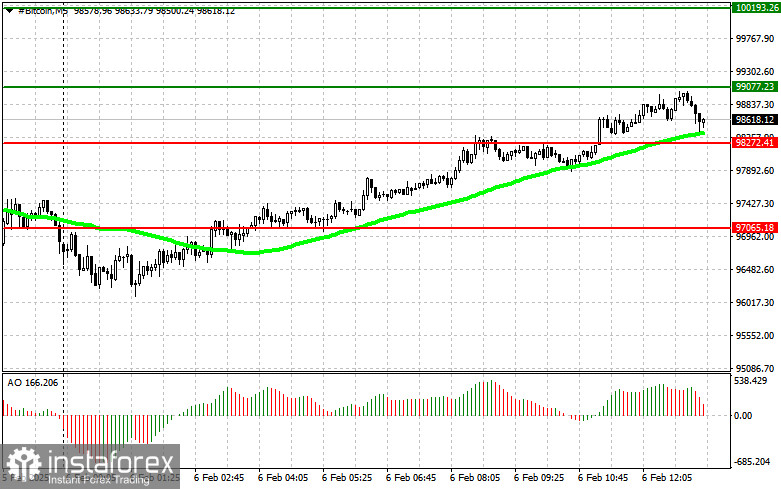

Bitcoin (BTC/USD)

Buy Scenario

Scenario #1: Buy Bitcoin at $99,000, targeting a rise to $100,100. At $100,100, I plan to exit long positions and sell on a pullback. Before buying on a breakout, confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario #2: Buy Bitcoin from the lower boundary at $98,200, only if there is no strong market reaction to a break below this level. Target levels: $99,000 and $100,100.

Sell Scenario

Scenario #1: Sell Bitcoin at $98,200, targeting a decline to $97,000. At $97,000, I plan to exit short positions and buy on a pullback. Before selling on a breakout, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is below zero.

Scenario #2: Sell Bitcoin from the upper boundary at $99,000, only if there is no strong market reaction to a break above this level. Target levels: $98,200 and $97,000.

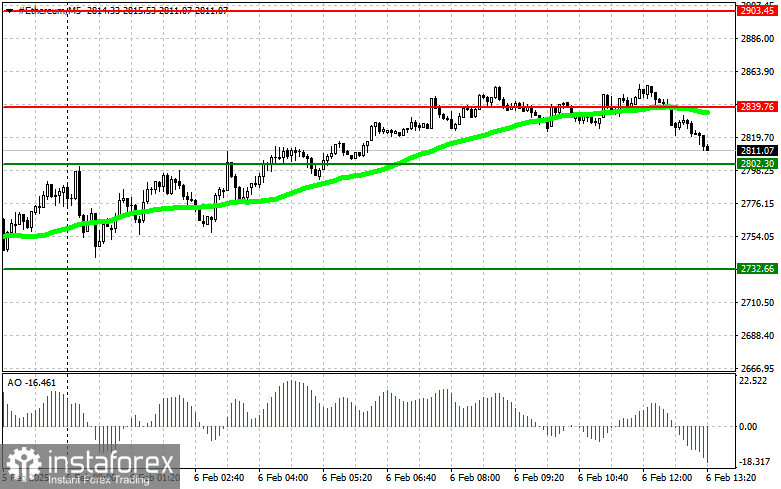

Ethereum (ETH/USD)

Buy Scenario

Scenario #1: Buy Ethereum at $2,839, targeting a rise to $2,903. At $2,903, I plan to exit long positions and sell on a pullback. Before buying on a breakout, confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario #2: Buy Ethereum from the lower boundary at $2,802, only if there is no strong market reaction to a break below this level. Target levels: $2,839 and $2,903.

Sell Scenario

Scenario #1: Sell Ethereum at $2,802, targeting a decline to $2,732. At $2,732, I plan to exit short positions and buy on a pullback. Before selling on a breakout, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is below zero.

Scenario #2: Sell Ethereum from the upper boundary at $2,839, only if there is no strong market reaction to a break above this level. Target levels: $2,802 and $2,732.