While Donald Trump fuels discussions with tariffs, central banks are actively working towards maximum transparency in financial markets. By the end of the week, specifically on February 7, the European Central Bank will release its assessment of the neutral rate—an ideal rate that neither restrains nor stimulates economic growth. This so-called "sweet spot" is the ultimate goal for any central bank, providing valuable insight for EUR/USD traders.

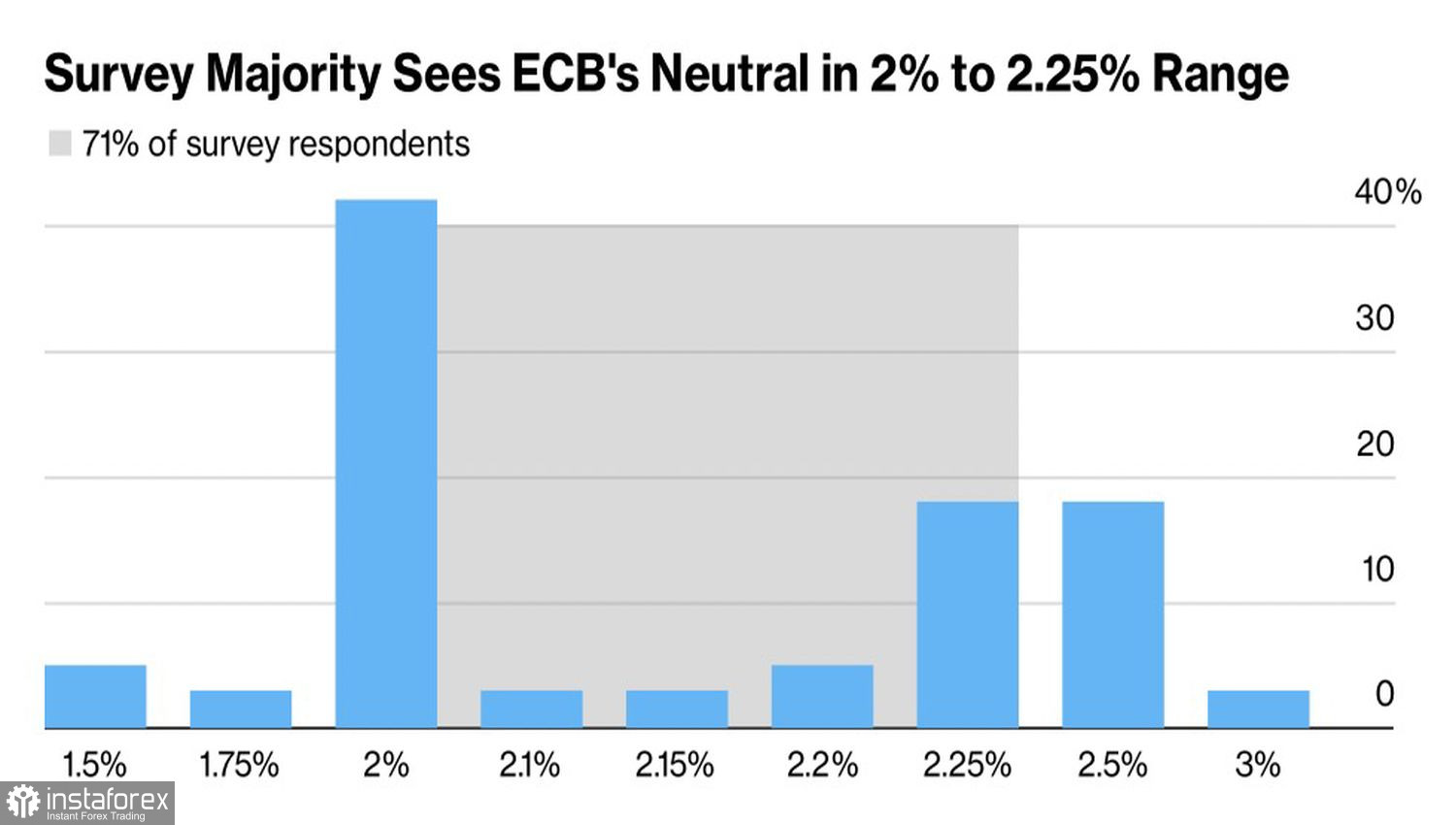

The hawks of the Governing Council, including the influential German member Isabel Schnabel, argue that the ideal range for the deposit rate has recently risen and now falls between 2% and 3%. In contrast, the doves advocate for a rate below 2%. Most experts from Bloomberg lean towards the 2% mark, which aligns with forecasts from the money market. Additionally, derivatives indicate that the ECB may implement three more rate cuts by the end of 2025, reducing borrowing costs from the current 2.75% to 2%.

ECB Neutral Rate Estimates

Chief Economist Philip Lane asserts that the ECB should not postpone its monetary easing cycle. He warns that if rate cuts are implemented too slowly, the eurozone could fall back into deflation, which would necessitate an accelerated approach to monetary expansion—an undesirable outcome. Lane also pointed out that Trump's tariffs are likely to slow eurozone economic growth, although their effect on inflation remains uncertain.

In response to potential new tariffs on EU imports, European businesses are rushing to export goods to the U.S. before the restrictions take effect. This surge in exports has led to a widening U.S. trade deficit and an unexpected increase in German factory orders. Despite the prevailing pessimism about Germany's economy, this positive development has provided some support for the EUR/USD exchange rate.

Germany's Factory Orders Trend

On the other hand, pressure on the U.S. dollar is mounting due to rumors that the revision of U.S. nonfarm payroll growth for 2024 could reach a staggering -818K, the worst figure since 2009. If the U.S. labor market is weaker than currently perceived, the Federal Reserve may end its monetary policy pause earlier, increasing the risk of EUR/USD continuing its correction within the broader downtrend.

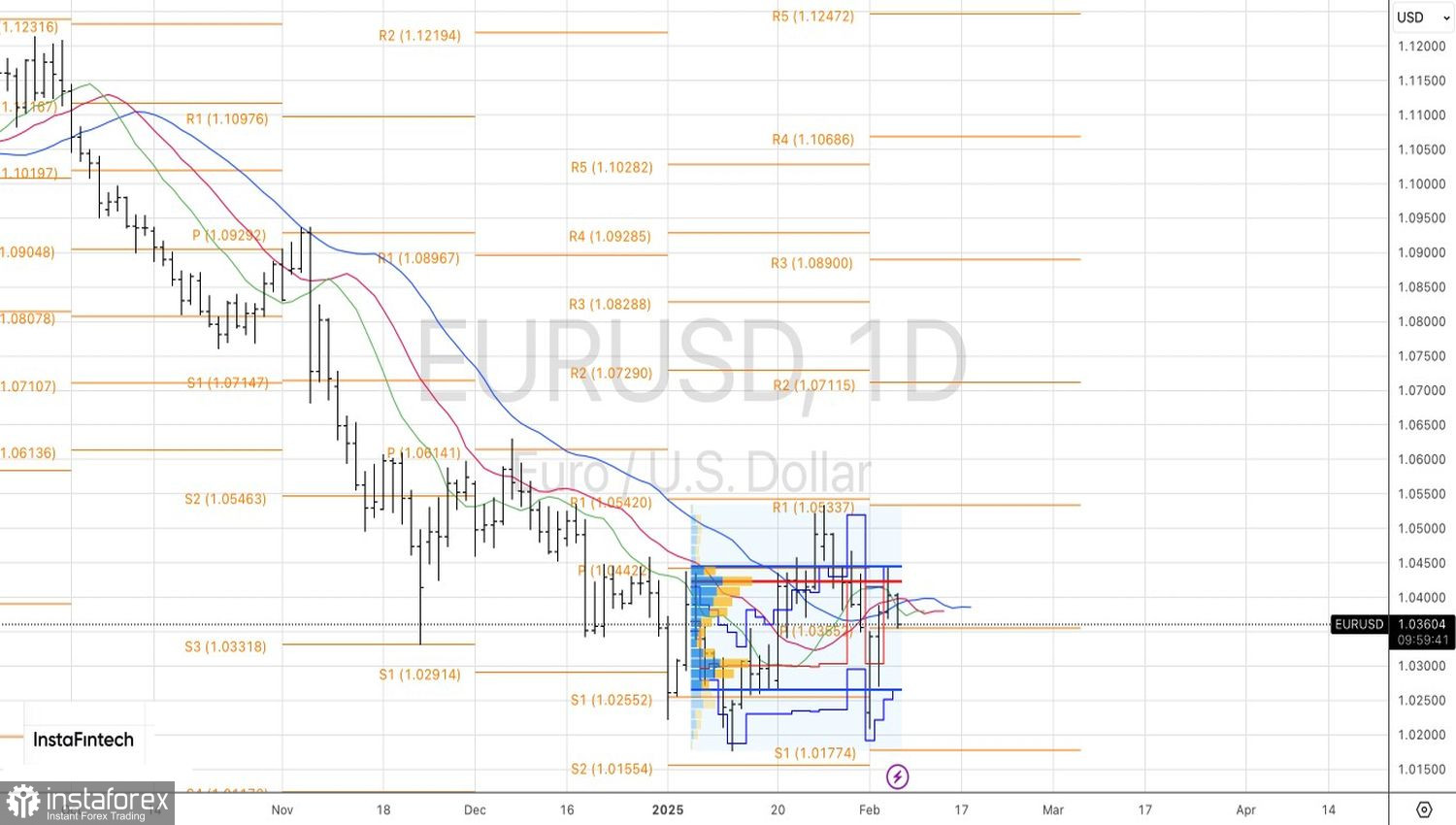

With central bank policy reliant on data and Donald Trump appearing to pause his tariff threats, US employment data may increase volatility in EUR/USD. This situation could lead to increased volatility in the EUR/USD currency pair, particularly in light of U.S. employment data. Currently, the markets anticipate two rate cuts by the Fed in 2025 and three by the ECB. However, labor market data has the potential to significantly alter investor sentiment.

On the daily chart, Euro bulls were unable to break above the upper boundary of the fair value range, which is between 1.0265 and 1.0445. This indicates weakness in the bulls and presents an opportunity to add to short positions on a pullback from 1.0415.