Mixed US labor market data at the end of last week initially favored Bitcoin and other digital assets, but the momentum fizzled out over the weekend. As a result, BTC and ETH remained within their established ranges without showing any decisive moves.

The weak impulse from economic data was likely insufficient to break through key resistance levels. Investors appear to have adopted a wait-and-see approach, assessing risks ahead of the new trading week and potential macroeconomic developments.

Market sentiment in the crypto sector remains cautious, despite ongoing discussions about Bitcoin as a hedge against inflation and fiat currency devaluation. Additionally, the lack of clear direction may be linked to profit-taking after the modest price increase in previous days. Major market players might be staying on the sidelines, waiting for a clearer picture before making moves.

Regulatory developments: US lawmakers propose stablecoin framework

In positive news, the US has launched a project to discuss a regulatory framework for stablecoins. The proposed bill introduces a two-year ban on stablecoins backed solely by self-issued digital assets and requires the US Treasury to conduct a risk assessment.

This legislative move is a major step toward clearer regulations for the US digital asset market. While the two-year restriction on certain stablecoins might seem limiting, it reflects a cautious approach aimed at investor protection and financial stability.

The Treasury's research will provide a comprehensive risk assessment of digital assets and could shape future regulations on stablecoins and cryptocurrencies.

Federal Reserve's take on stablecoins

Last week, Federal Reserve Governor Christopher Waller expressed support for stablecoins but emphasized that they must be backed by US government bonds. Waller also stated that the Fed has no plans to establish a strategic Bitcoin reserve—although, realistically, no one will ask for his opinion on this matter. His stance represents a compromise between innovation and regulatory control.

Backing stablecoins with US government bonds would help maintain their stability while providing investor protection. However, this approach would limit issuers' flexibility in selecting assets for collateral, excluding other potentially lucrative instruments.

Bitcoin reserve legislation & Trump's influence

Legislation for a strategic BTC reserve has already been introduced in 22 US states. A federal crypto reserve bill is also up for a Congressional vote. In theory, Trump could bypass all regulatory hurdles with legal maneuvers.

Bitcoin technical outlook

Resistance levels: Buyers are targeting a return to $97,400, which opens the path to $99,000 and then to $100,200. The ultimate target is $101,200. A breakout above this level would signal a return to a mid-term bullish market.

Support levels: In case of a decline, buyers are expected around $96,000. A drop below this area could send BTC down to $95,900, followed by $94,300. The final bearish target is $92,700.

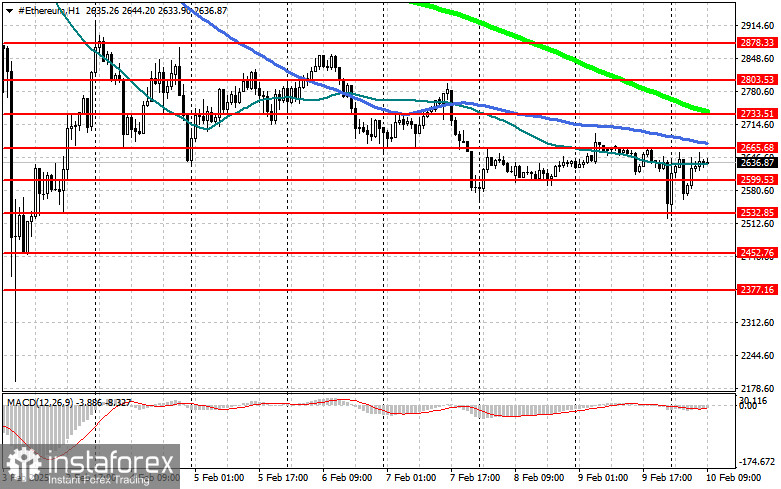

Ethereum technical outlook

Resistance levels: A solid hold above $2,665 paves the way for $2,733, with $2,803 as the next key level. The ultimate target is $2,878. A breakout here would confirm a return to the mid-term bullish market.

Support levels: If ETH corrects lower, buyers are expected at $2,599. A drop below this could send ETH toward $2,532, with the final bearish target at $2,452.