As mentioned earlier, gold, a popular asset during periods of uncertainty, continued its third consecutive session of gains, surpassing $2,940 and setting a new all-time high. Meanwhile, the U.S. dollar index has been rising since Monday.

Investor Sentiment & Market Reactions

These market moves indicate that investors are taking Trump's tariff measures seriously and assessing their potential impact on global trade, corporate earnings, and inflation. While tariffs on China have already taken effect, uncertainty surrounding additional duties has reignited concerns about escalating trade wars. The most optimal approach in this environment appears to be seeking assets that provide protection, which is why gold is seeing strong inflows. In this context, gold serves not just as a safe haven but also as a hedge against systemic risks arising from trade conflicts.

Historically, gold has proven to be a reliable asset during periods of geopolitical instability and economic uncertainty. The current situation is no exception. Investors are looking to diversify their portfolios by increasing gold holdings to mitigate overall volatility and potential losses. The impact of tariffs on corporate earnings and inflation is further fueling demand for gold.

Trump's Tariff Announcement

On Monday, President Donald Trump ordered a 25% tariff on steel and aluminum imports, set to take effect on March 12. According to Trump, this move aims to protect U.S. industries. The tariffs will apply to all countries, including key suppliers Mexico and Canada. However, Trump noted that he would consider an exemption for Australia.

Upcoming Key Market Events

Beyond global trade concerns, investors will also focus on U.S. inflation data scheduled for release this week and Fed Chair Jerome Powell's testimony before Congress.

Expectations for inflation trends over the next year may influence investor positioning, particularly in risk assets such as equities.

For the S&P 500 to break out of its sideways range, it will require the absence of negative surprises and dovish inflation forecasts from the U.S.

The Indian Rupee gained 1% against the U.S. dollar. The Japanese Yen remained stable, while the British Pound weakened.

U.S. Treasury bonds were not traded during Asian hours due to a holiday in Japan. Oil prices rebounded from near year-to-date lows, as Russia's production cuts helped ease concerns about oversupply.

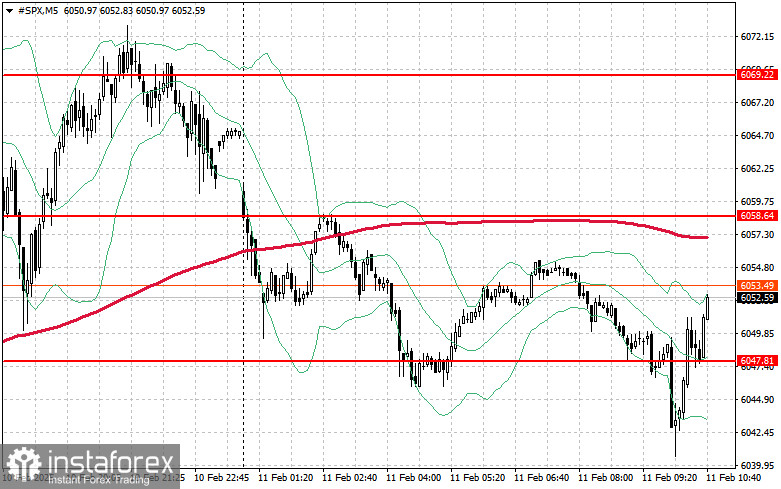

Technical Outlook for the S&P 500

Demand for the index remains high. The key task for buyers today is to break above the nearest resistance level at $6,058. This would allow the uptrend to continue and could lead to a new rally toward $6,069. Bulls will also aim to maintain control above $6,079, further strengthening their position.

In the event of a decline due to lower risk appetite, buyers must defend support at $6,047. A break below this level could push the S&P 500 back to $6,038, with further downside potential toward $6,020.