Bitcoin and Ethereum are currently facing challenges, as both assets approach critical support levels that will test the resilience of investors and traders. For Bitcoin, this support level is set at $90,000, while for Ethereum, it stands at $2,200.

According to the latest data from CryptoQuant, Bitcoin (BTC) reserves on over-the-counter (OTC) desks have declined significantly since the beginning of the year. A substantial portion of BTC trading volume occurs on OTC markets, where large transactions can be made without directly affecting the price. The sharp decrease in BTC reserves suggests that many coins are being transferred to cold wallets for long-term storage. If the supply of Bitcoin continues to decline at this rate, large investors may be compelled to buy BTC directly on exchanges, where liquidity is typically lower. This could potentially trigger another major rally in the cryptocurrency market.

Large institutional investors, hedge funds, and even governments are increasingly viewing Bitcoin as an alternative asset. As a result, many transactions are likely being conducted through OTC markets, which could create a volatile situation.

If demand continues to rise while supply contracts, the likelihood of a significant price surge in Bitcoin in the near future remains very high. Additionally, reports indicate that 69% of the total BTC supply is currently held by retail investors, leading to a supply shortage for institutional players. This further strengthens the possibility of a future supply shock in Bitcoin.

Regarding my intraday strategy in the cryptocurrency market, I will continue to take action, particularly during any significant downturns of Bitcoin and Ethereum. I believe the bull market is still in development over the medium term.

As for short-term trading, the strategy and conditions are outlined below.

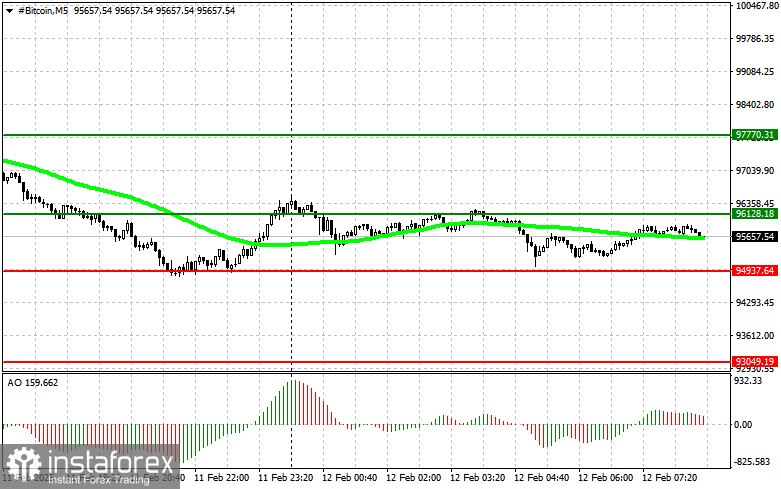

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching the entry point around $96,100, targeting a rise to $97,700. At $97,700, I will exit long positions and immediately sell on a rebound. Before buying on a breakout, confirming that the 50-day moving average is below the current price and the Awesome Oscillator is above the zero line is necessary.

Scenario #2: Bitcoin can also be bought from the lower boundary at $94,900, provided there is no market reaction confirming a breakout in the opposite direction, targeting $96,100 and $97,700.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching the entry point of around $94,900, targeting a decline to $93,000. At $93,000, I will exit short positions and immediately buy on a rebound. Before selling on a breakout, confirming that the 50-day moving average is above the current price and the Awesome Oscillator is below the zero line is necessary.

Scenario #2: Bitcoin can also be sold from the upper boundary at $96,100, provided there is no market reaction confirming a breakout in the opposite direction, targeting $94,900 and $93,000.

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today upon reaching the entry point around $2,627, targeting a rise to $2,697. At $2,697, I will exit long positions and immediately sell on a rebound. Before buying on a breakout, confirming that the 50-day moving average is below the current price and the Awesome Oscillator is above the zero line is necessary.

Scenario #2: Ethereum can also be bought from the lower boundary at $2,582, provided there is no market reaction confirming a breakout in the opposite direction, targeting $2,627 and $2,697.

Sell Scenario

Scenario #1: I will sell Ethereum today upon reaching the entry point around $2,580, targeting a decline to $2,512. At $2,512, I will exit short positions and immediately buy on a rebound. Before selling on a breakout, confirming that the 50-day moving average is above the current price and that the Awesome Oscillator is below the zero line is necessary.

Scenario #2: Ethereum can also be sold from the upper boundary at $2,627, provided there is no market reaction confirming a breakout in the opposite direction, targeting $2,580 and $2,512.