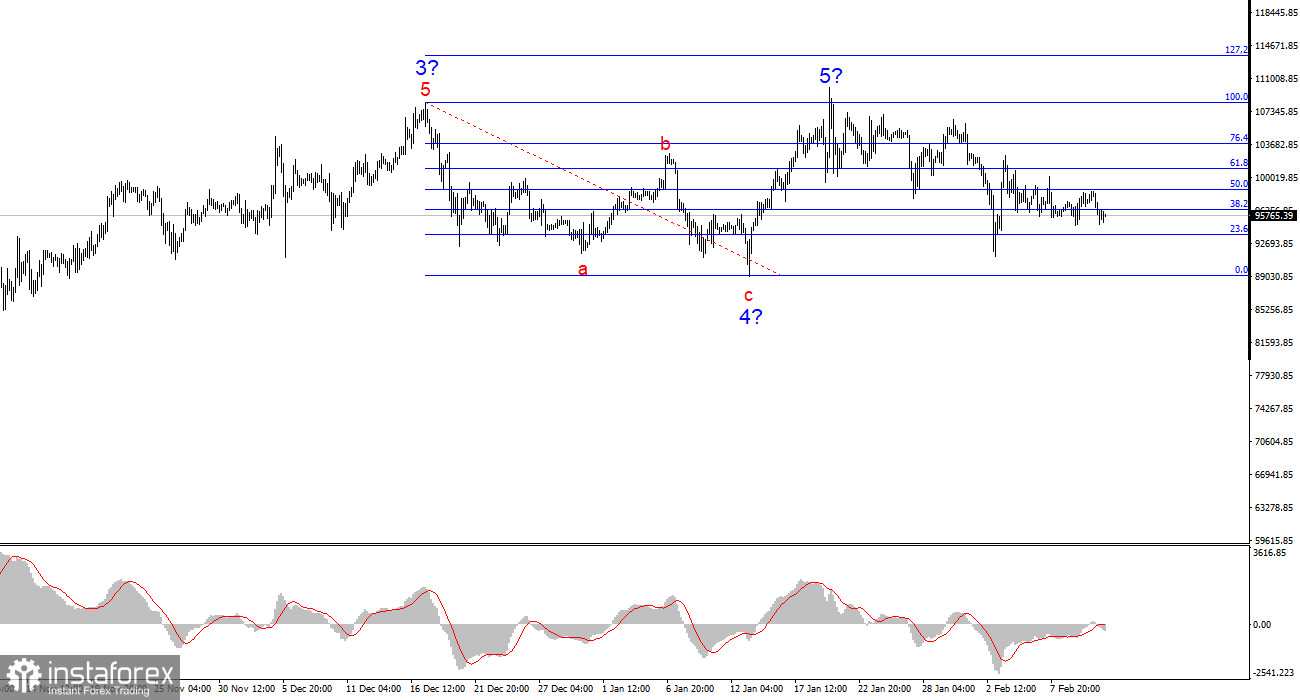

The wave analysis of the 4-hour BTC/USD chart is straightforward. Following a prolonged and complex a-b-c-d-e corrective structure (from March 14 to August 5), a new impulsive wave began forming. This impulse wave has taken a clear five-wave structure. Given the size of Wave 1, Wave 5 may turn out to be truncated.

Bitcoin is unlikely to exceed the $110,000–$115,000 range in the coming months. Wave 4 has a three-wave formation, confirming the correct wave count.

Institutional investors, governments, and pension funds have been increasing their crypto investments. However, Trump's policies could force investors to exit the market. Trends do not stay bullish indefinitely, and current price action suggests a potential shift.

BTC/USD declined by $1,000 on Tuesday, but remains within a broader range. Despite the pullback, Bitcoin continues to trade sideways—which is the most critical factor right now. This sideways range is nearly $20,000 wide, allowing for significant short-term moves, but lacking a clear trend.

The uptrend appears to be completed. The market is either at the start of a prolonged corrective structure or the beginning of a new downtrend. Market activity has sharply declined—a typical characteristic of corrective phases. Buyers have consistently stepped in at $92,000, absorbing available supply. This suggests that most traders do not expect Bitcoin to drop below $92,000. However, no price level is absolute—a break below $92,000 could trigger a wave of sell-offs.

Unlike traditional stocks, crypto investors prioritize short-term gains over capital preservation. Stock market investors seek wealth preservation, whereas crypto traders focus on rapid profit opportunities. This makes the crypto market far more speculative and susceptible to sudden, large price swings. Bitcoin can easily drop by tens of thousands of dollars in a short period.

General conclusions

Based on BTC/USD analysis, the rally appears to be nearing completion. While this may be an unpopular view, Wave 5 is likely truncated. If this assumption holds, Bitcoin is set for either a major decline or a complex correction. Buying Bitcoin at current levels is not advisable. BTC could soon drop below the low of Wave 4. If that happens, it will confirm a transition into a new downtrend.

The higher timeframe shows a completed five-wave uptrend. The market is likely to enter a corrective or bearish phase soon.

Key Principles of My Wave Analysis

- Wave structures should be simple and clear. Complex formations are harder to trade and prone to unexpected changes.

- If market conditions are uncertain, it is best to stay out.

- Absolute certainty in market direction is impossible. Always use Stop Loss orders for effective risk management.

- Wave analysis should be combined with other trading strategies. A multi-method approach improves decision-making accuracy.