Recent news about negotiations between Russia and the U.S. concerning Ukraine has generated significant interest in the information space. The market is still processing this development, but the initial response has been positive. This shift could lead to a reduction in tensions between the U.S. and Russia, which may result in decreased demand for gold as a safe-haven asset. If this trend continues, we could see a notable decline in gold prices in the near future.

Technical Outlook and Trading Idea:

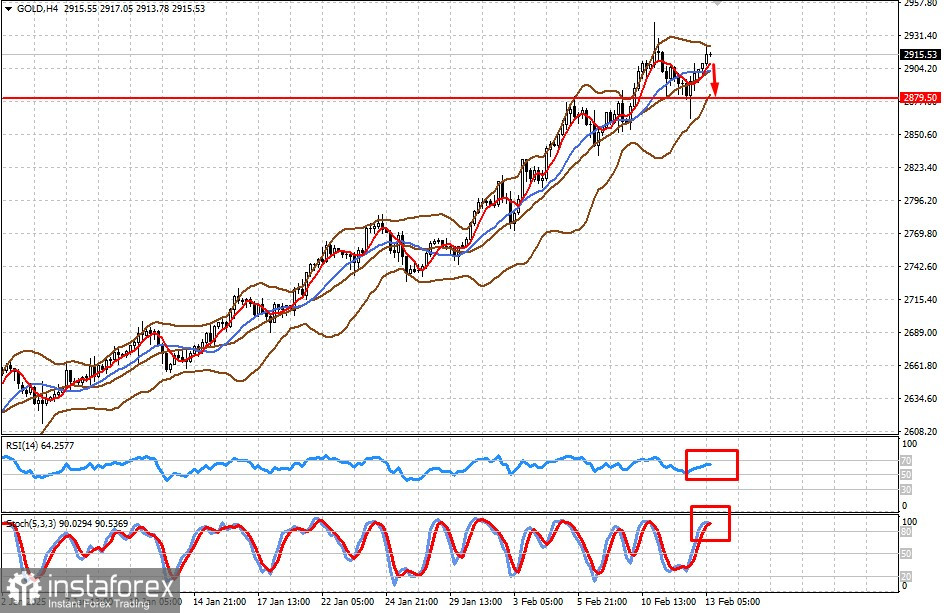

The current price is above the middle line of the Bollinger Bands and is also above both the SMA 5 and SMA 14. The RSI is below the overbought zone, suggesting that bullish momentum is weakening. Additionally, the Stochastic oscillator is crossing within the overbought zone.

As negotiations commence between Moscow and Washington regarding the Ukrainian crisis, there is a high probability of a price drop towards the 2879.50 level.