Investors welcomed indications of a less aggressive trade war, boosting demand for risk-sensitive assets, particularly in sectors highly exposed to global trade, such as automobiles and technology. However, despite positive sentiment, caution is warranted. There are concerns that the rally may be premature, given ongoing uncertainty regarding global economic prospects and the future actions of central banks.

Asian markets performed even stronger: Chinese stocks in Hong Kong surged over 4%, reaching their highest level in three years, fueled by optimism about China's expanding capabilities in artificial intelligence.

Regarding Trump's trade policies, ongoing negotiations over his proposed tariffs could ease the potential economic impact. The U.S. dollar index has dropped about 2.5% from its February peak, as investors scale back bets that Trump will push aggressively for widespread tariff hikes under his "America First" policy. The fact that Trump is adopting a gradual approach, with the possibility of rolling back many tariffs, has helped support market sentiment.

"The process of implementing reciprocal tariffs will be handled separately for each country and will extend until April of this year," said Howard Lutnick, Trump's nominee for Secretary of Commerce, yesterday. His remarks followed news that Trump had instructed his administration to consider reciprocal tariffs for multiple trading partners.

Gold remains near record highs. The precious metal has surged this year, driven by safe-haven demand, setting consecutive records with the potential to test $3,000 per ounce.

Meanwhile, oil prices have stabilized as markets assess the implications of Trump's executive order on potential retaliatory tariffs against U.S. trading partners.

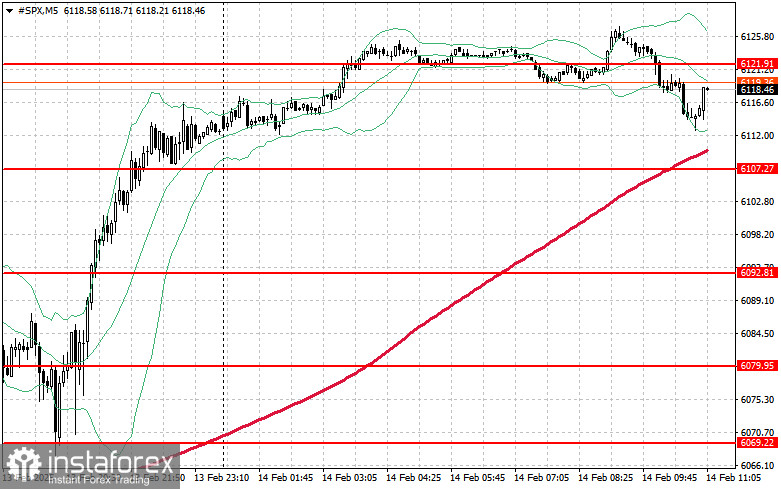

As for the technical picture of the S&P500, demand remains high. The main task of buyers for today will be to overcome the nearest resistance of $ 6,121. This will help to continue the uptrend, as well as open up the possibility of a breakthrough to a new level of $ 6,138. Control over $6,152 will be an equally high priority for the bulls, which will strengthen the position of buyers. In the case of a downward movement against the background of a decrease in demand for risk appetite, then buyers simply have to declare themselves at the level of $ 6107. A breakdown will quickly push the trading instrument back to $6092 and open the way to $6079.