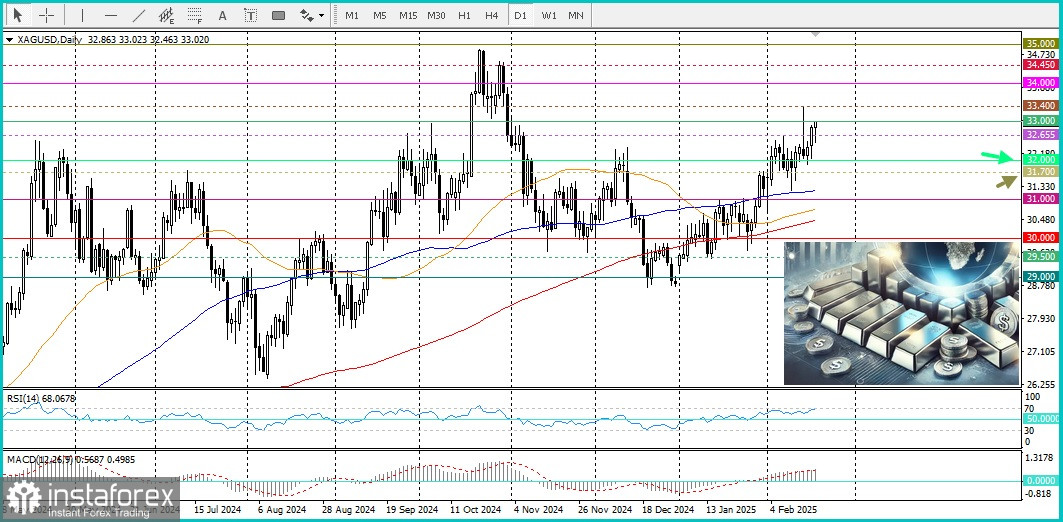

Silver continues its bullish momentum, attracting buyers on pullbacks from the $32.00 psychological level. The metal has now posted gains for three consecutive days, reaching a new weekly high and breaking above the $33.00 mark.

A sustained close above $32.65 has confirmed a breakout from the short-term trading range, favoring bullish traders. Positive oscillators on the daily chart reinforce the uptrend, supporting the potential for further gains. However, some consolidation may occur as indicators near overbought territory.

Silver appears poised to target last Friday's swing high near $33.40 before attempting to reclaim the $34.00 psychological level. If the bullish momentum persists, XAG/USD could challenge intermediate resistance at $34.45, potentially extending the rally toward $35.00 or even multi-year highs last seen in October.

Key Support Levels

Any meaningful pullback is likely to find initial support between $32.00 and $31.90. Further declines could present buying opportunities, with downside likely limited near the horizontal support zone of $31.75–$31.70. A convincing break below this region could shift the short-term bias in favor of bears.

In such a scenario, silver prices could accelerate toward the 100-day SMA, currently around $31.20, before testing the $31.00 psychological level. Continued weakness may drive XAG/USD lower toward support near $30.25, with intermediate levels at the 50-day and 200-day SMAs. A further decline could push prices to $30.00, with strong support around $29.55–$29.50.