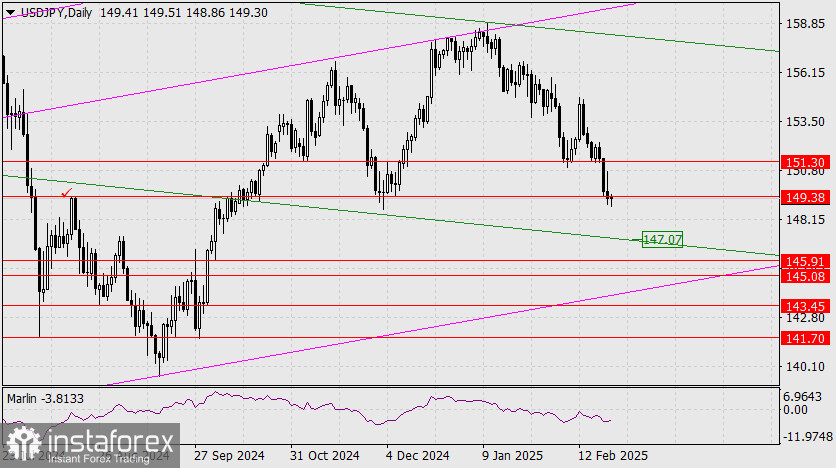

On the compressed daily chart, the price is steadily approaching the green price channel line around the 147.07 mark. If this level is breached, it will open targets at 145.91 and then 145.08. The positive outlook for the yen is driven by expectations of a Bank of Japan rate hike during the upcoming meeting on March 19.

During today's Asian session, the Nikkei 225 has declined by 1.30%, heightening market concerns about the unwinding of carry trades. Currently, the price is testing support at 149.38, which is the high from August 15. A daily close below this level could accelerate further declines.

Today, in the Asian session, Nikkei225 is falling by 1.30%, and this increases market concerns about the curtailment of the carry trade.

On the four-hour chart, the price and the Marlin oscillator have formed a small convergence, indicating a potential consolidation above the reached level. Upon its completion with the price staying below 149.38, the downward movement will likely become more stable.