The euro and the pound have resumed their upward trend against the US dollar. The euro received support from news out of Germany, while the pound increased following reports of the US taking an active role in addressing the Russia-Ukraine conflict.

Last Friday, the euro faced downward pressure throughout the day due to concerns about slowing economic growth in the Eurozone, which has been worsened by the energy crisis and high inflation. Investors are closely monitoring signals from the European Central Bank, especially with the upcoming publication of Eurozone inflation data.

Regarding the core Consumer Price Index, traders will watch for any signs of its sustainability. If the CPI exceeds forecasts, the ECB could pause its monetary easing cycle, potentially boosting the euro. Conversely, a lower-than-expected CPI could ease pressure on the ECB and negatively impact the euro.

Stronger-than-expected IFO data from Germany, also released today, could strengthen confidence in economic recovery, supporting the euro. However, weak data could increase recession fears and pressure the European currency.

As for the pound, apart from speeches by the Bank of England's Deputy Governor for Markets and Banking, Sir David Ramsden, and MPC member Swati Dhingra, there are no other significant data or reasons to expect a correction in the pair at the start of the week.

If the data aligns with economists' expectations, following a Mean Reversion strategy is best. A Momentum strategy is recommended if the data is significantly higher or lower than expected.

Momentum Strategy (on breakout):

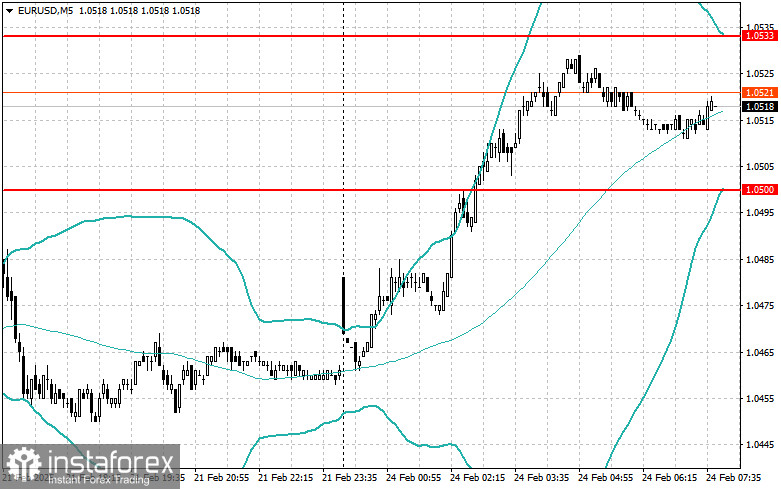

EUR/USD

Buying on a breakout above 1.0525 could push the euro toward 1.0555 and 1.0593.

Selling on a breakout below 1.0500 could lead to a decline toward 1.0470 and 1.0440.

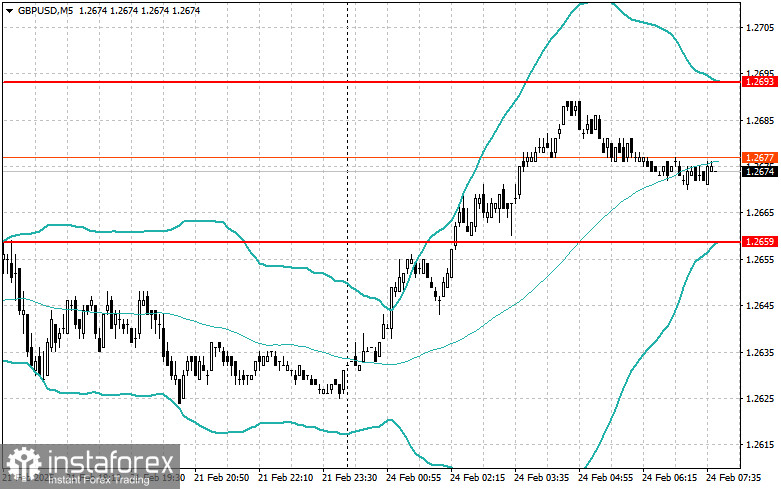

GBP/USD

Buying on a breakout above 1.2685 could push the pound toward 1.2718 and 1.2761.

Selling on a breakout below 1.2655 could lead to a decline toward 1.2630 and 1.2590.

USD/JPY

Buying on a breakout above 149.55 could push the dollar toward 149.85 and 150.20.

Selling on a breakout below 149.30 could lead to a decline toward 148.95 and 148.60.

Mean Reversion Strategy (on pullbacks):

EUR/USD

I will look for selling opportunities after an unsuccessful breakout above 1.0533, once the price returns below this level.

I will look for buying opportunities after an unsuccessful breakout below 1.0500, once the price returns above this level.

GBP/USD

I will look for selling opportunities after an unsuccessful breakout above 1.2693, once the price returns below this level.

I will look for buying opportunities after an unsuccessful breakout below 1.2659, once the price returns above this level.

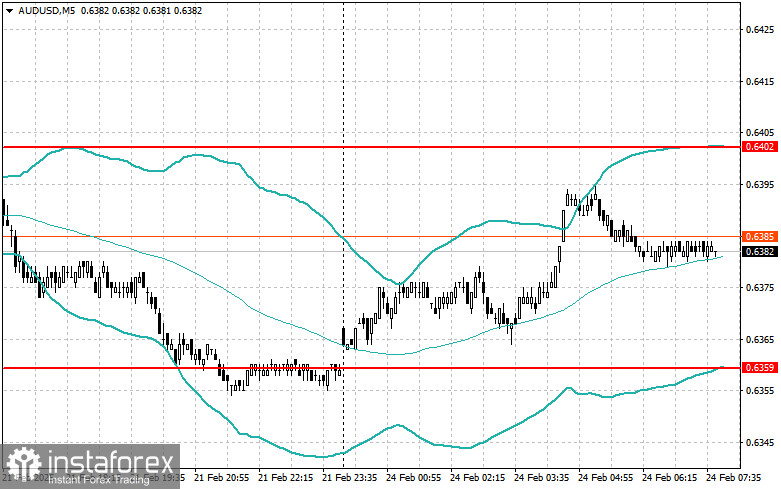

AUD/USD

I will look for selling opportunities after an unsuccessful breakout above 0.6402, once the price returns below this level.

I will look for buying opportunities after an unsuccessful breakout below 0.6359, once the price returns above this level.

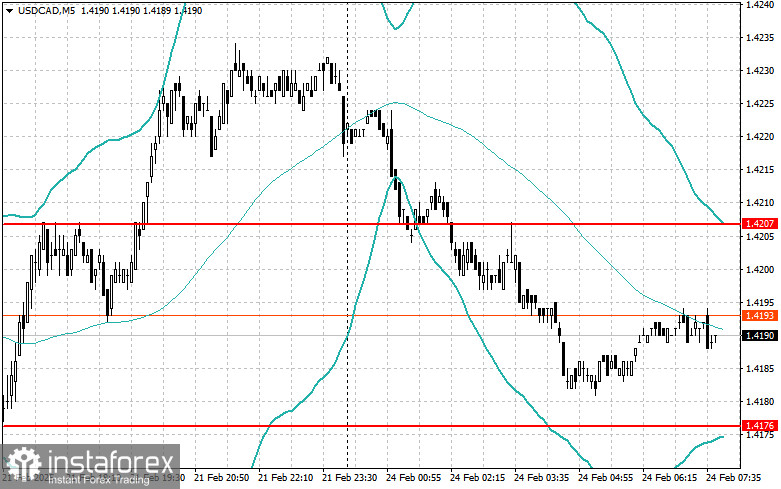

USD/CAD

I will look for selling opportunities after an unsuccessful breakout above 1.4207, once the price returns below this level.

I will look for buying opportunities after an unsuccessful breakout below 1.4176, once the price returns above this level.