Bitcoin faced ongoing pressure throughout the weekend, struggling to break above the $96,000 mark. This could potentially trigger a larger sell-off in the near future. It is important to note that we have not surpassed $100,000 for an extended period, which could indicate a negative trend for any bullish momentum. Meanwhile, Ethereum experienced significant volatility following news of a hack that resulted in the theft of nearly 400,000 ethers from one of the world's largest cryptocurrency exchanges. Despite this setback, buyers managed to withstand the pressure, keeping trading around $2,700.

On a positive note, the global liquidity dynamics of M2 continue to show signs of accelerating growth. Historically, an acceleration in M2 growth is a bullish signal for BTC, cryptocurrencies, and all other risk assets. Previously, some experts pointed out that the dynamics of global M2 liquidity may be following a pattern similar to 2016-2018. If this analogy holds, we could see further rallies in risk asset markets in the coming months. However, it is essential to remember that correlation does not imply causation, and many other factors could influence the price of BTC and other cryptocurrencies.

Potential risks should not be overlooked. The ongoing tight monetary policy of the Federal Reserve, geopolitical instability, and unforeseen regulatory changes could exert pressure on the market. As a result, investors must stay vigilant.

While the increase in global M2 liquidity growth seems to be a positive sign, investment decisions should be guided not only by this data but also by thorough market analysis and an assessment of individual risk tolerance.

Regarding intraday strategies for the cryptocurrency market, I will focus on taking advantage of any significant drops in Bitcoin and Ethereum. My goal is to capitalize on the ongoing development of a bullish market in the medium term, which remains intact.

Below are the outlined strategies and conditions for short-term trading.

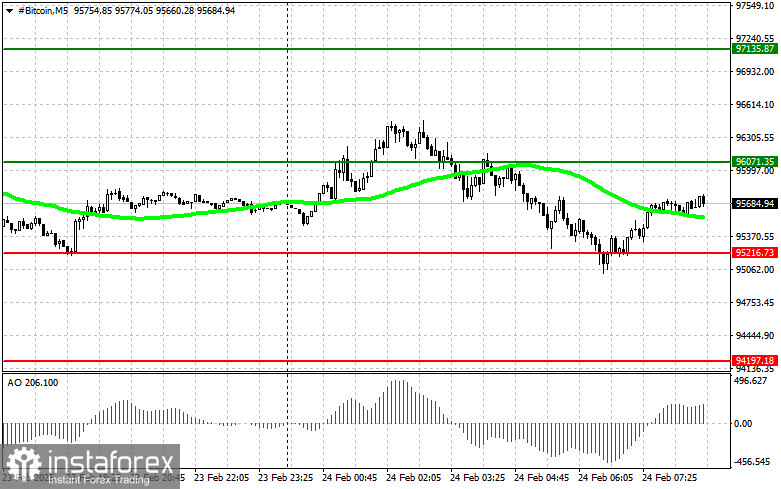

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today if the entry point reaches around $96,000, targeting a rise to $97,100. Around $97,100, I will exit the purchases and sell immediately on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and that the Awesome indicator is in the zone above zero.

Scenario #2: Bitcoin can be bought from the lower boundary of $95,200 if there is no market reaction to its breakout in the opposite direction, aiming for $96,000 and $97,100.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today if the entry point reaches around $95,200, targeting a drop to $94,100. Around $94,100, I will exit the sales and buy immediately on the rebound. Before selling on the breakout, make sure that the 50-day moving average is above the current price and that the Awesome indicator is in the zone below zero.

Scenario #2: Bitcoin can be sold from the upper boundary of $96,000 if there is no market reaction to its breakout in the opposite direction, aiming for levels of $95,200 and $94,100.

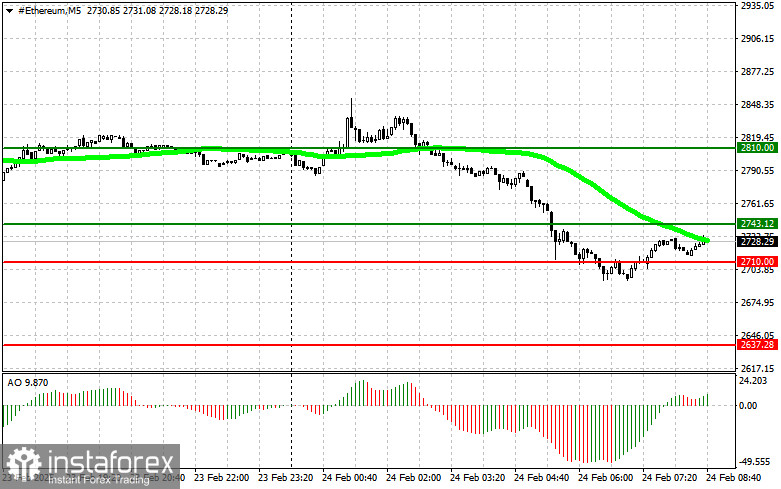

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today if the entry point reaches around $2,743, targeting a rise to $2,810. Around $2,810, I will exit the purchases and sell immediately on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and that the Awesome indicator is in the zone above zero.

Scenario #2: Ethereum can be bought from the lower boundary of $2,710 if there is no market reaction to its breakout in the opposite direction, aiming for $2,743 and $2,810.

Sell Scenario

Scenario #1: I plan to sell Ethereum today if the entry point reaches around $2,710, targeting a drop to $2,637. Around $2,637, I will exit the sales and buy immediately on the rebound. Before selling on the breakout, make sure that the 50-day moving average is above the current price and that the Awesome indicator is in the zone below zero.

Scenario #2: Ethereum can be sold from the upper boundary of $2,743 if there is no market reaction to its breakout in the opposite direction, aiming for levels of $2,710 and $2,637.