Trade Analysis and Recommendations for the Euro

During the first half of the day, the price tested the 1.0494 level at a time when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I refrained from selling the euro.

Inflation data from the eurozone was largely ignored, as it fully met economists' forecasts, meaning the market had already priced it in. As a result, there was no significant reaction. Instead, traders shifted their focus to the IFO data from Germany, which disappointed and ultimately triggered a decline in the euro.

Overall, the financial markets in the eurozone remained relatively stable, with attention on global trends and expectations for further comments from ECB and Federal Reserve officials.

Additionally, with no U.S. economic data scheduled for release in the second half of the day, and no speeches from Fed officials, market volatility is expected to decrease significantly. As a result, the euro is likely to trade within a sideways range for the remainder of the session.

For the intraday strategy, I will primarily rely on the implementation of Scenarios #1 and #2.

Buy Signal

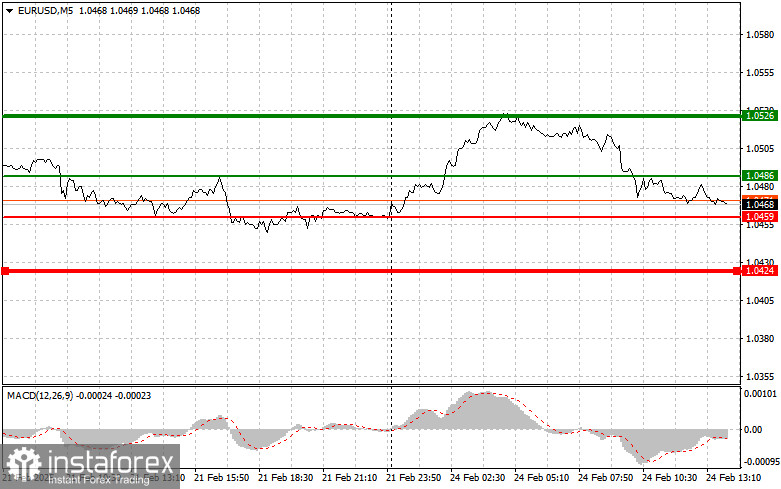

Scenario #1: Buying the euro is possible when the price reaches the 1.0486 level, with an upward target at 1.0526. I plan to exit the market at 1.0526 and consider selling from this level, expecting a 30-35 point retracement. Any upward movement in the euro today is likely to remain within the sideways channel. It is important to confirm that the MACD indicator is above the zero mark and beginning to rise before entering a long position.

Scenario #2: Another opportunity to buy the euro arises if the price tests 1.0459 twice while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward, with an expected rise toward 1.0486 and 1.0526.

Sell Signal

Scenario #1: Selling the euro is viable if the price drops to 1.0459, with a downward target at 1.0424, where I plan to exit short positions and open longs in the opposite direction for a 20-25 point correction. Selling pressure on the pair may persist until the end of the day. Before entering a short position, it is important to confirm that MACD is below the zero mark and beginning to decline.

Scenario #2: Another selling opportunity arises if the price tests 1.0486 twice while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal, with an expected decline toward 1.0459 and 1.0424.

Key Chart Levels

- Thin green line: Entry price for buying the instrument.

- Thick green line: Estimated price for setting Take Profit or manually securing profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the instrument.

- Thick red line: Estimated price for setting Take Profit or manually securing profits, as further decline below this level is unlikely.

The MACD indicator plays a crucial role in trade execution, with traders needing to monitor overbought and oversold conditions before entering positions.

Important Considerations for Beginner Forex Traders

It is essential to be cautious when entering the market, especially before important fundamental reports. The best approach is to stay out of the market during news releases to avoid sharp price fluctuations.

If you choose to trade during high-impact events, always set stop-loss orders to minimize potential losses. Without stop-loss protection, you risk losing your entire deposit quickly, particularly if you trade large volumes without proper risk management.

For successful trading, having a clear and structured trading plan is critical. Following a systematic approach like the one outlined above will help maintain discipline and improve trading results. Making impulsive trading decisions based on the current market situation is generally a losing strategy for intraday traders.