The key factor in market recovery will be investor behavior. Will they resist panic selling and wait for stabilization, or will the sell-off accelerate, driving prices even lower? The answer to this question will shape price dynamics in the coming days. Additionally, macroeconomic factors and the Trump administration's stance on trade wars—which risk asset buyers have largely ignored—should not be overlooked.

Ethereum's Pectra Upgrade Moves Forward

One of the most significant upcoming developments for Ethereum is Pectra, a major network upgrade. The update was activated on the Holesky testnet yesterday, marking an important step in stress-testing before it reaches the Ethereum mainnet.

Holesky is one of Ethereum's test networks, designed to simulate real-world conditions and allow developers to identify and fix potential issues in a controlled environment. However, the Pectra launch on Holesky did not go smoothly. Although the update was deployed as planned, block explorers indicate that the network slot has yet to finalize since activation. Ethereum developers are currently investigating the root cause of the issue.

The next step for Pectra will be its activation on the Sepolia testnet, scheduled for March 5. However, if issues with Holesky persist, developers may delay the Sepolia launch to allow more time for fixes and additional testing.

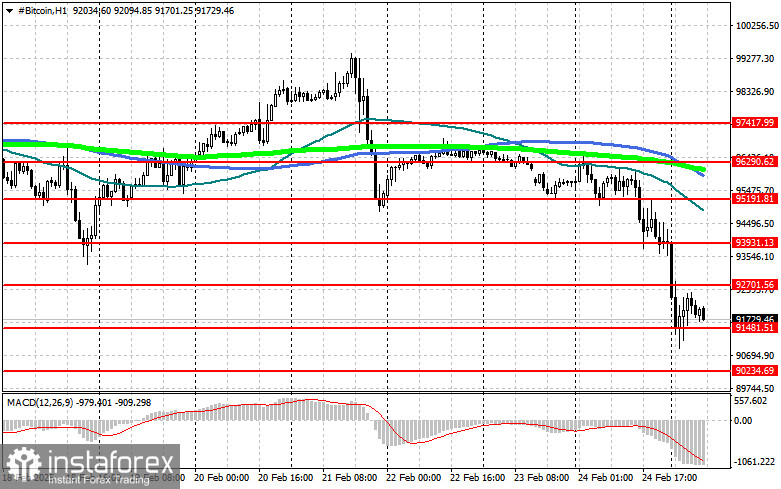

Bitcoin Technical Outlook

Buyers are currently targeting a retest of the $92,700 level, which would pave the way for a move to $93,900, followed closely by $95,200. The ultimate target stands at $96,300, and a breakout above this level would confirm a return to a mid-term bullish trend.

In the event of further downside pressure, buyers are expected to step in at $91,500. A drop below this area could trigger a quick sell-off toward $90,300, with $88,700 as the next key level. The most distant bearish target remains at $86,900.

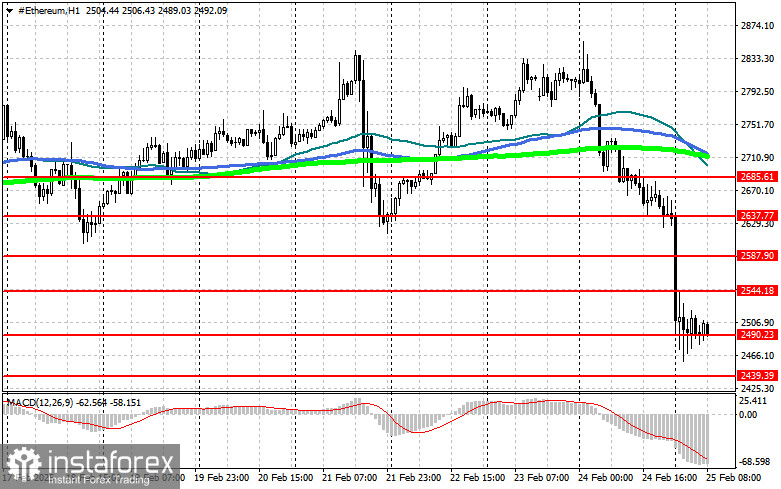

Ethereum Technical Outlook

A clear breakout above the $2,544 level would open the door for a move toward $2,587, with the yearly high at $2,637 serving as the final upside target. A sustained move above this level would signal a return to the mid-term bullish market.

If Ethereum undergoes a correction, buyers are expected at $2,490. A drop below this support could lead to a quick decline toward $2,439, with $2,387 as the final bearish target.