Bitcoin has reached the $86,000 level, but this may not be the end of its movement. There was strong buying activity in Ethereum, which saw a rebound from a low of $2,320 back to the day's opening levels; however, it has not surpassed this point. This indicates that the potential for further growth may be limited in the near future. Additionally, Bitcoin's failure to quickly reclaim the $90,000 level is concerning, as it raises the risk of a significant wave of sell-offs and liquidations upcoming. It's prudent to be cautious and preserve your capital for more attractive buying opportunities.

Short-term Bitcoin holders are experiencing significant losses, but according to Santiment data, there is still room for further declines before reaching record levels. Market volatility continues to put pressure on recent BTC investors.

Santiment highlights that despite the current market pain, historical data suggests profitability for short-term holders could decline further. Various factors, including macroeconomic uncertainty, regulatory news, and overall crypto market trends, may influence this. Many leading analysts believe that for the market to reset before a new wave of growth properly, Bitcoin needs to drop to around $70,000—a view that is hard to disagree with.

In terms of my intraday strategy in the cryptocurrency market, I will continue to take advantage of any significant dips in Bitcoin and Ethereum, as I expect the medium-term bull market to remain intact.

For short-term trading, I have outlined my strategy and conditions below.

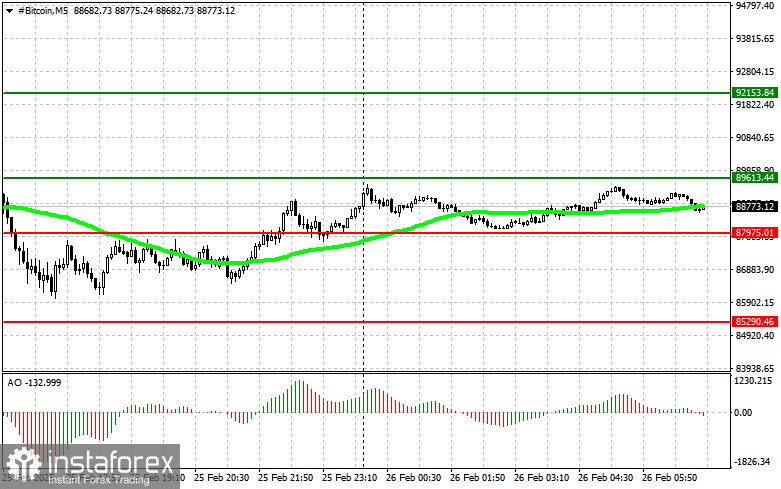

Bitcoin

Buy Scenario

Scenario 1: I plan to buy Bitcoin today at an entry point of around $89,600, targeting growth to $92,100. Around $92,100, I will exit purchases and sell immediately on a pullback. Before buying on a breakout, I will confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario 2: I will also consider buying Bitcoin from the lower boundary at $87,900 if there is no market reaction to a breakout, targeting $89,600 and $92,100.

Sell Scenario

Scenario 1: I plan to sell Bitcoin today at an entry point of around $87,900, targeting a drop to $85,200. Around $85,200, I will exit sales and buy immediately on a pullback. Before selling on a breakout, I will confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario 2: I will also consider selling Bitcoin from the upper boundary at $89,600 if there is no market reaction to a breakout, targeting $87,900 and $85,200.

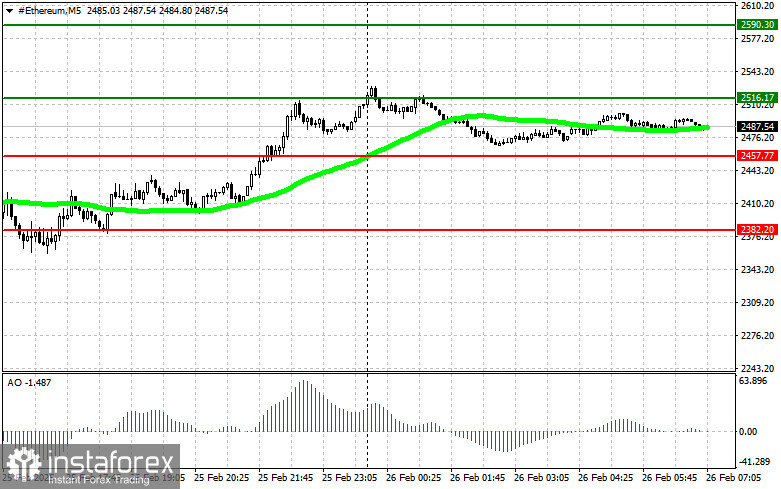

Ethereum

Buy Scenario

Scenario 1: I plan to buy Ethereum today at an entry point of around $2,516, targeting growth to $2,590. Around $2,590, I will exit purchases and sell immediately on a pullback. Before buying on a breakout, I will confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario 2: I will also consider buying Ethereum from the lower boundary at $2,457 if there is no market reaction to a breakout, targeting $2,516 and $2,590.

Sell Scenario

Scenario 1: I plan to sell Ethereum today at an entry point of around $2,457, targeting a drop to $2,382. Around $2,382, I will exit sales and buy immediately on a pullback. Before selling on a breakout, I will confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario 2: I will also consider selling Ethereum from the upper boundary at $2,516 if there is no market reaction to a breakout, targeting $2,457 and $2,382.