Panic-stricken investors are offloading assets, fearing further declines. This fear is exacerbated by news of trade tariffs and stock market declines.

However, such moments often present opportunities for contrarian traders. When fear dominates the market, assets may become undervalued, offering a chance to buy at favorable prices.

Additionally, over the last two days, the net outflow from spot Bitcoin ETFs has reached $1.6 billion, as investors fearing further declines withdraw funds, further intensifying the market's downward pressure. This trend is concerning since ETFs were originally designed to attract institutional investors and stabilize the market. However, as recent events show, even these instruments are not immune to panic-driven sentiment.

From a medium-term perspective, the bullish market structure remains intact, and I will continue to focus on buying major dips in Bitcoin and Ethereum.

For short-term trading, my strategy and conditions are detailed below.

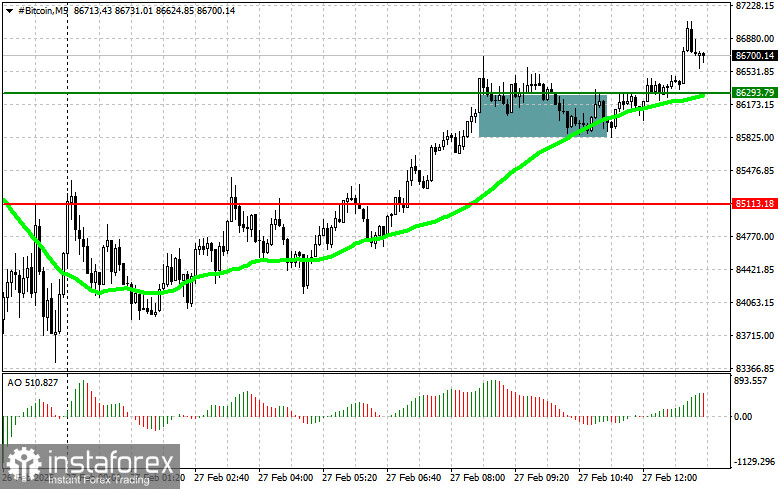

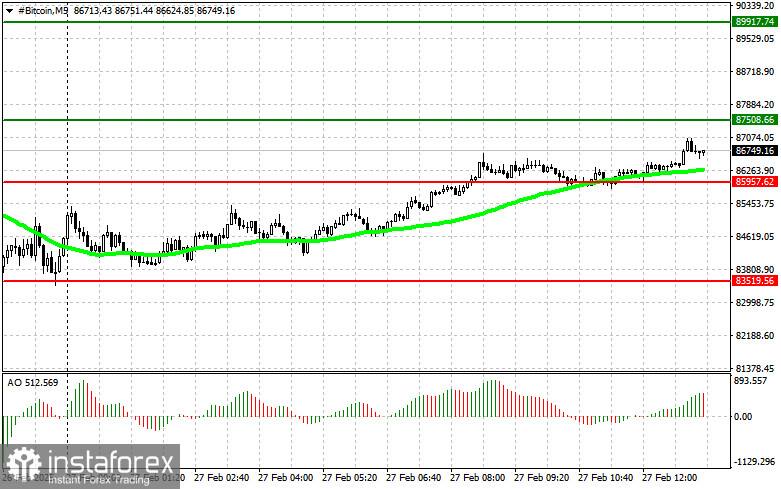

Bitcoin (BTC/USD) Trading Plan

Buy Scenario

Scenario #1: I will buy Bitcoin at $87,500, targeting an increase to $89,900. At $89,900, I will exit long positions and sell on the pullback. Before executing a breakout trade, I will confirm that the 50-day moving average is below the current price and that the Awesome Oscillator (AO) is in positive territory.

Scenario #2: Buying is also possible from the lower boundary at $85,900 if the market fails to break below this level and reverses toward $87,500 and $89,900.

Sell Scenario

Scenario #1: I will sell Bitcoin at $85,900, aiming for a decline to $83,500. At $83,500, I will exit short positions and buy on the rebound. Before executing a breakout trade, I will confirm that the 50-day moving average is above the current price and that the AO is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $87,500 if the market fails to break above this level and reverses toward $85,900 and $83,500.

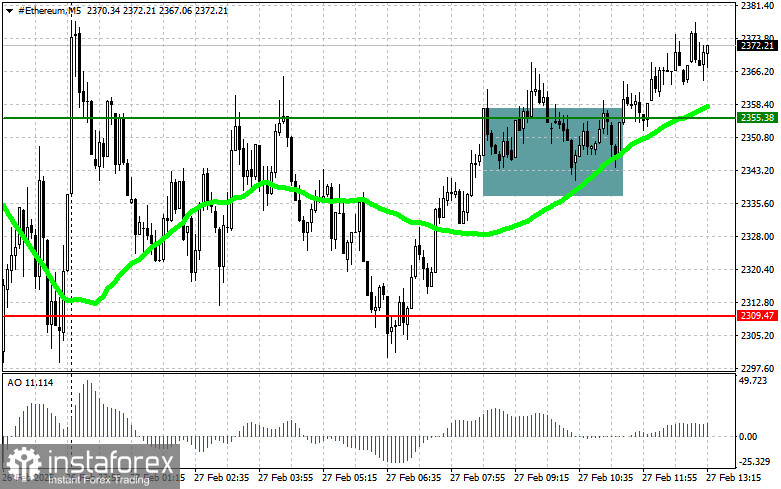

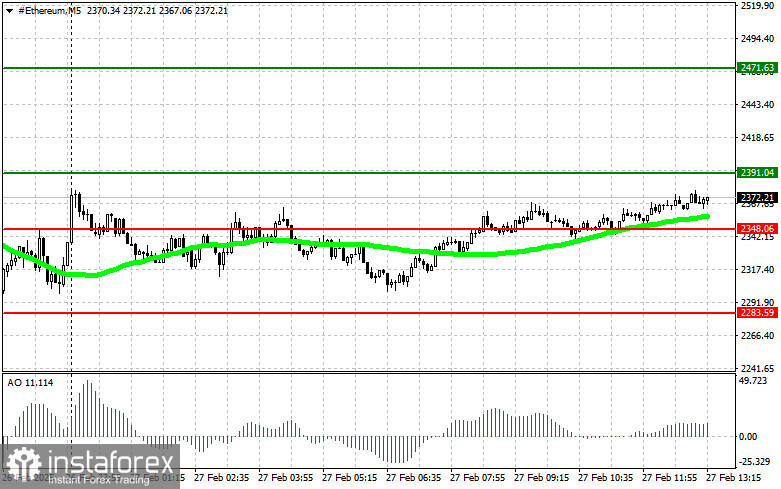

Ethereum (ETH/USD) Trading Plan

Buy Scenario

Scenario #1: I will buy Ethereum at $2,391, targeting an increase to $2,471. At $2,471, I will exit long positions and sell on the pullback. Before executing a breakout trade, I will confirm that the 50-day moving average is below the current price and that the AO is in positive territory.

Scenario #2: Buying is also possible from the lower boundary at $2,348 if the market fails to break below this level and reverses toward $2,391 and $2,471.

Sell Scenario

Scenario #1: I will sell Ethereum at $2,348, aiming for a decline to $2,283. At $2,283, I will exit short positions and buy on the rebound. Before executing a breakout trade, I will confirm that the 50-day moving average is above the current price and that the AO is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $2,391 if the market fails to break above this level and reverses toward $2,348 and $2,283.