The euro and the pound experienced a decline at the end of last week but began to recover as trading opened today. This movement is primarily driven by the geopolitical agenda of the US and the EU.

During today's Asian trading session, the euro opened with an upward gap against the dollar. This increase can be attributed to the EU's support for Ukraine, especially following the US's withdrawal of support. Additionally, there are expectations that the European Central Bank will adopt a more cautious approach after its meeting this Thursday. Economists predict that while the ECB may continue easing its monetary policy, it will also communicate caution regarding any further moves due to renewed inflationary challenges in the region.

Today, focus will be on key manufacturing data and inflation figures in the Eurozone. These indicators are vital for evaluating the effectiveness of the economy and the ECB's monetary policy.

A decline in inflation, particularly in the core index (which excludes the volatile prices of energy and food), could provide the ECB with a reason to adopt a more aggressive approach to interest rate cuts. The market will also keep a close watch on any signals of increasing inflationary pressures. A consistent recovery in the Consumer Price Index (CPI) and core CPI could strengthen the euro, prompting the ECB to reassess its dovish stance and shift back to a more restrictive policy. Therefore, the release of CPI data will be a significant event for financial markets, influencing both short- and medium-term prospects for the European economy and the ECB's policy direction.

If the data aligns with economists' expectations, following a Mean Reversion strategy is best. A Momentum strategy is recommended if the data is significantly higher or lower than expected.

Momentum Strategy (on breakout):

EUR/USD

Buying on a breakout above 1.0425 could push the euro towards 1.0450 and 1.0480

Selling on a breakout below 1.0410 could lead to a decline towards 1.0375 and 1.0350

GBP/USD

Buying on a breakout above 1.2615 could drive the pound towards 1.2650 and 1.2695

Selling on a breakout below 1.2595 could push the pound down towards 1.2560 and 1.2520

USD/JPY

Buying on a breakout above 150.50 could lead to an increase towards 150.75 and 151.05

Selling on a breakout below 150.25 could trigger a decline towards 149.90 and 149.50

Mean Reversion Strategy (on pullbacks):

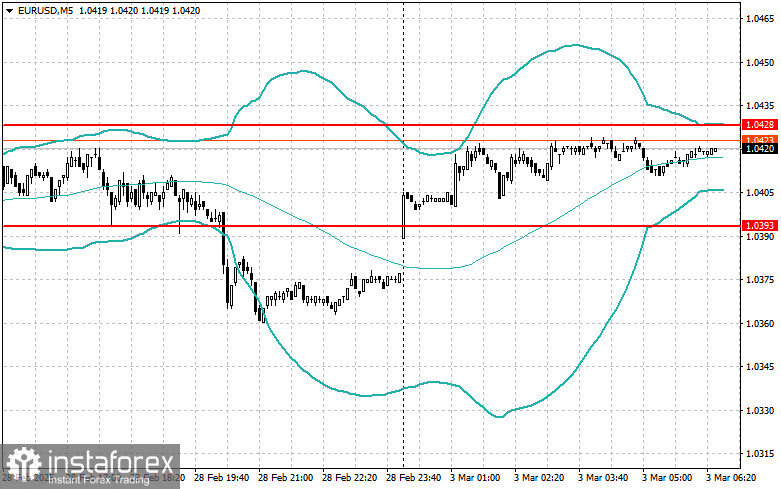

EUR/USD

Look for selling opportunities after a failed breakout above 1.0428, entering short on a return below this level

Look for buying opportunities after a failed breakout below 1.0393, entering long on a return above this level

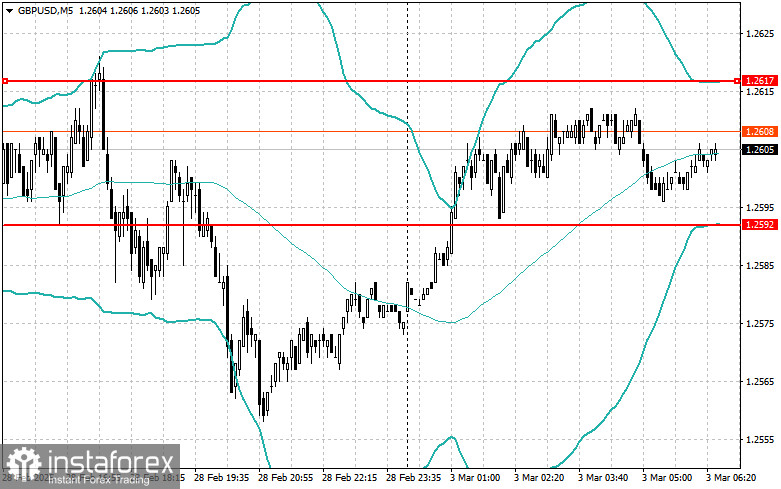

GBP/USD

Look for selling opportunities after a failed breakout above 1.2617, entering short on a return below this level

Look for buying opportunities after a failed breakout below 1.2592, entering long on a return above this level

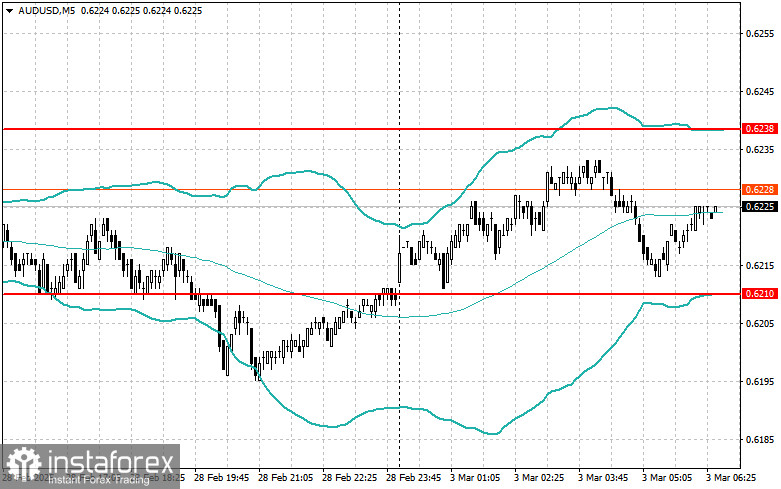

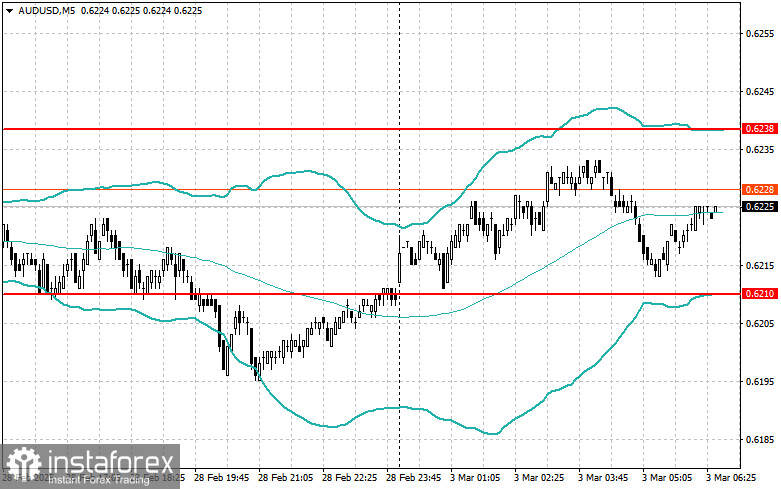

AUD/USD

Look for selling opportunities after a failed breakout above 0.6238, entering short on a return below this level

Look for buying opportunities after a failed breakout below 0.6210, entering long on a return above this level

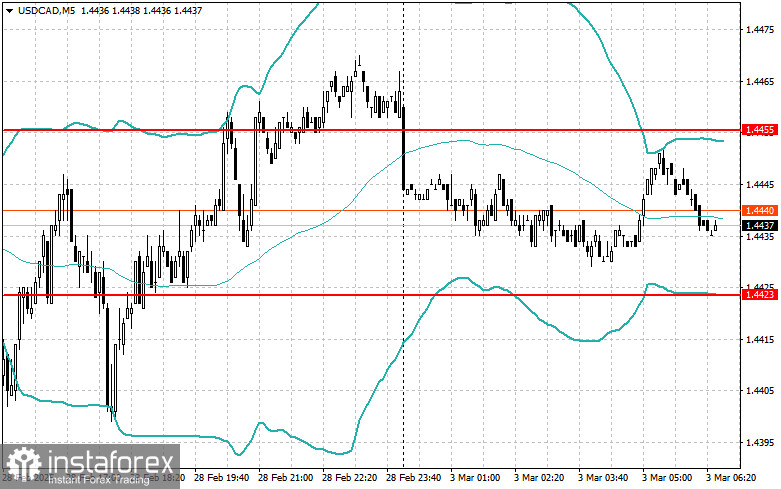

USD/CAD

Look for selling opportunities after a failed breakout above 1.4455, entering short on a return below this level

Look for buying opportunities after a failed breakout below 1.4423, entering long on a return above this level