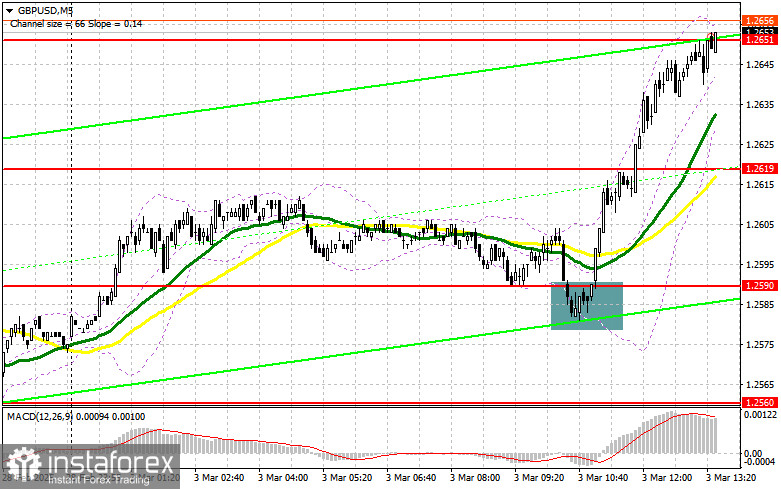

In my morning forecast, I focused on the 1.2590 level and planned to use it as a key reference point for market entry decisions. Let's analyze the 5-minute chart to understand what happened. A decline and false breakout at 1.2590 created an excellent buying opportunity, resulting in a 60-point rise. The technical outlook for the second half of the day has been revised.

To Open Long Positions on GBP/USD:

Moderately strong data from the UK Manufacturing PMI supported the pound in the first half of the day. The decline was less severe than expected, which extended the bullish momentum seen during Asian trading.

During the U.S. session, attention will shift to the ISM Manufacturing PMI and construction spending data. Strong figures could limit the pound's upside, leading to a pullback towards 1.2646, which is currently a key battle zone. Only a false breakout at this level would provide a solid buying opportunity, targeting 1.2683 resistance. A breakout and retest from above would confirm another long entry, with a further push toward 1.2713, reinforcing the bullish trend. The final upward target is 1.2750, where I plan to take profits.

If GBP/USD declines and there is no buying activity at 1.2613, pressure on the pound will increase significantly. In this case, I will only consider buying at a false breakout near the 1.2583 low. I will buy on an immediate rebound from 1.2551, targeting an intraday correction of 30-35 points.

To Open Short Positions on GBP/USD:

Sellers failed to gain control in the first half of the day, despite UK data lacking any clear bullish signals. Currently, 1.2646 resistance is the key level for bears to defend. A false breakout at this level will confirm a short entry, targeting 1.2613, where the moving averages are supporting the bulls.

A break below 1.2613 and a retest from below would trigger stop-loss orders, paving the way for 1.2583. The final downward target is 1.2551, where I plan to take profits. Testing this level would renew selling pressure on the pound.

If demand for the pound remains strong in the second half of the day, and sellers fail to defend 1.2646, the pair will continue its bullish trend. In this case, I will postpone short positions until a test of 1.2683, where I will sell only after a failed consolidation. If there is no downward movement there, I will look for short entries at 1.2713, expecting a 30-35 point pullback.

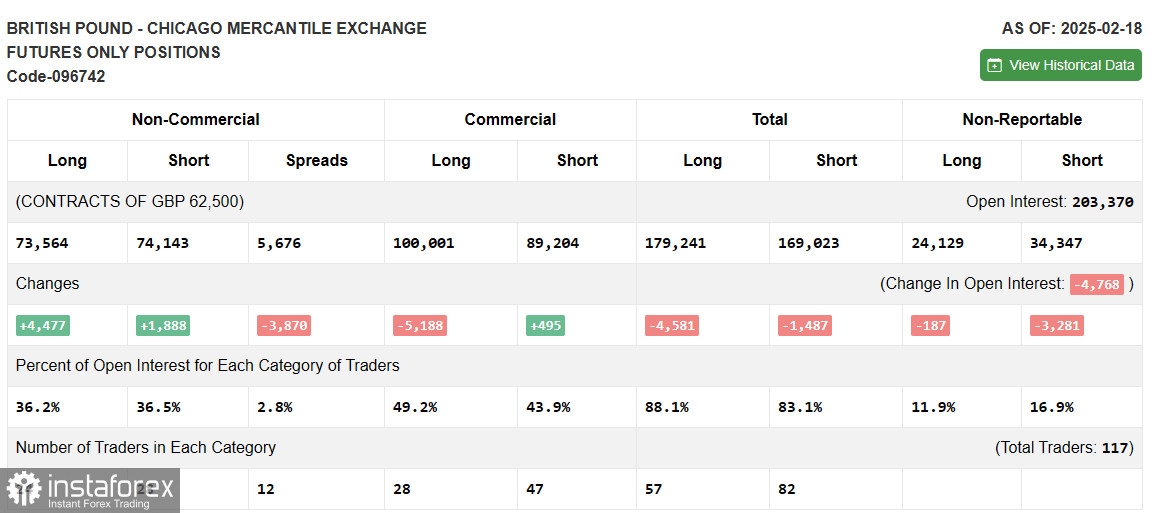

COT (Commitment of Traders) Report Analysis

The COT report from February 18 showed an increase in both long and short positions. However, longs grew more than shorts, indicating a growing willingness to buy the pound. Market conditions are balanced, suggesting a state of equilibrium.

Rising UK inflation data and strong retail sales are expected to push the Consumer Price Index (CPI) higher, which may force the Bank of England to maintain a cautious approach to rate cuts. This could support the pound in the long run.

The COT report revealed that non-commercial long positions increased by 4,477, reaching 73,477, while short positions rose by 1,888, totaling 74,143. As a result, the net short position narrowed by 3,870.

Indicator Signals

Moving Averages

The pair is trading above the 30 and 50-period moving averages, signaling an attempt by pound buyers to regain control.

Note: The moving averages referenced are based on the H1 chart, differing from traditional daily moving averages (D1).

Bollinger Bands

If the pair declines, the lower Bollinger Band at 1.2551 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing volatility and noise.

- 50-period MA (yellow)

- 30-period MA (green)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12-period

- Slow EMA: 26-period

- Signal SMA: 9-period

- Bollinger Bands: Measures price volatility (20-period).

- Non-commercial traders: Large investors (hedge funds, institutions) who use futures markets for speculation.

- Long Non-Commercial Positions: The total number of long speculative contracts.

- Short Non-Commercial Positions: The total number of short speculative contracts.

- Net Non-Commercial Position: The difference between long and short positions among speculative traders.