Analysis of Macroeconomic Reports:

On Wednesday, several important macroeconomic events are scheduled, primarily in the service sector with PMI indices being released for the UK, the U.S., and the Eurozone. These reports are particularly noteworthy, especially the ISM index from the U.S. Additionally, the U.S. will issue the ADP employment report, which reflects changes in the labor market. However, this report is often seen as the "younger sibling" of the Non-Farm Payrolls report, the primary indicator for market participants. Regardless, macroeconomic data is not currently a priority for traders, who are mainly reacting emotionally to speeches made by Donald Trump.

Analysis of Fundamental Events:

Among the key fundamental events on Wednesday are speeches by Bank of England Governor Andrew Bailey and Chief Economist Huw Pill. Both officials are expected to discuss monetary policy and U.S. tariff policies, and may also comment on recent inflation and GDP reports from the UK. Their statements will be significant for the market; however, at this moment, the market is experiencing panic-selling of the U.S. dollar and U.S. stocks. The more Trump speaks, the further the dollar could decline.

General Conclusions:

On the third trading day of the week, both currency pairs may experience considerable fluctuations, as trading is currently driven by emotions with Trump being the main influence. For the euro, the pound, and the dollar, it is less about the actual decisions made by the U.S. president and more about how the market interprets those decisions. Right now, the market is interpreting them negatively.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

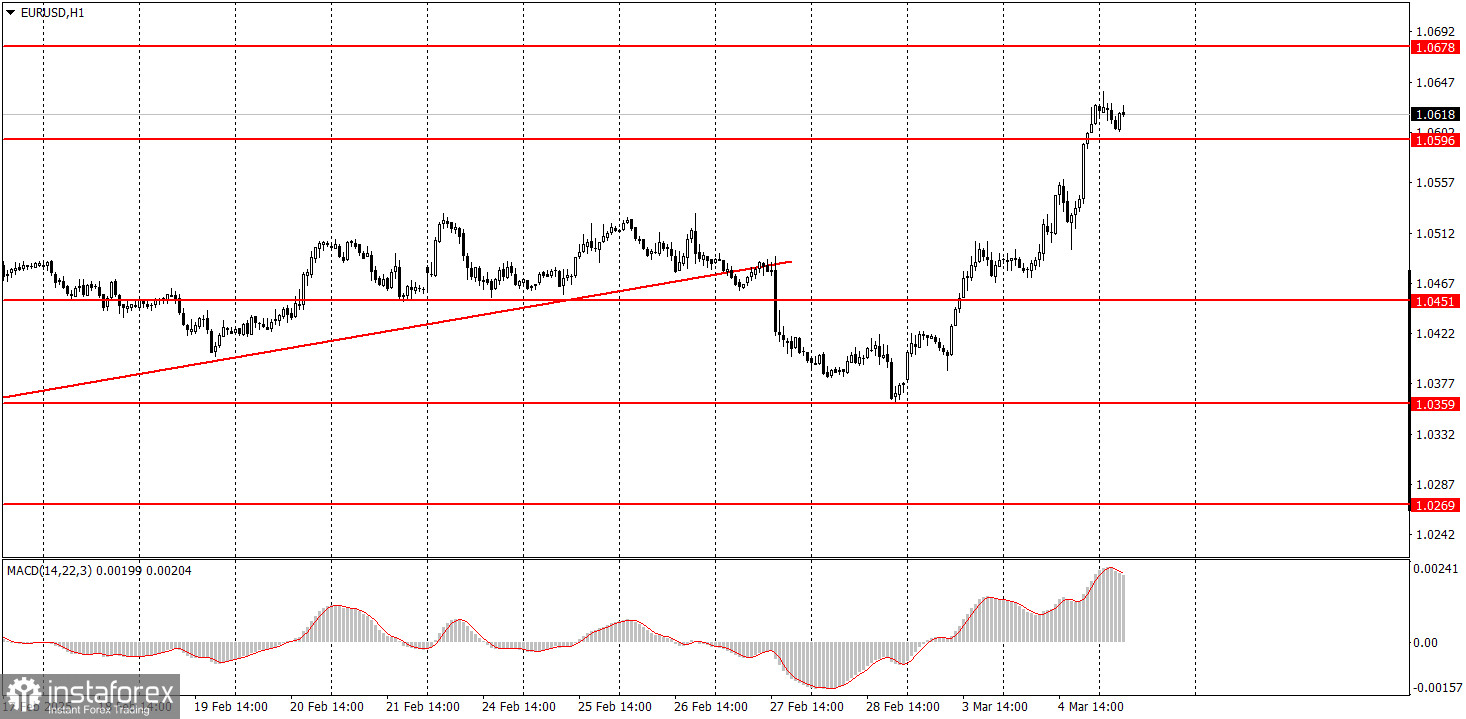

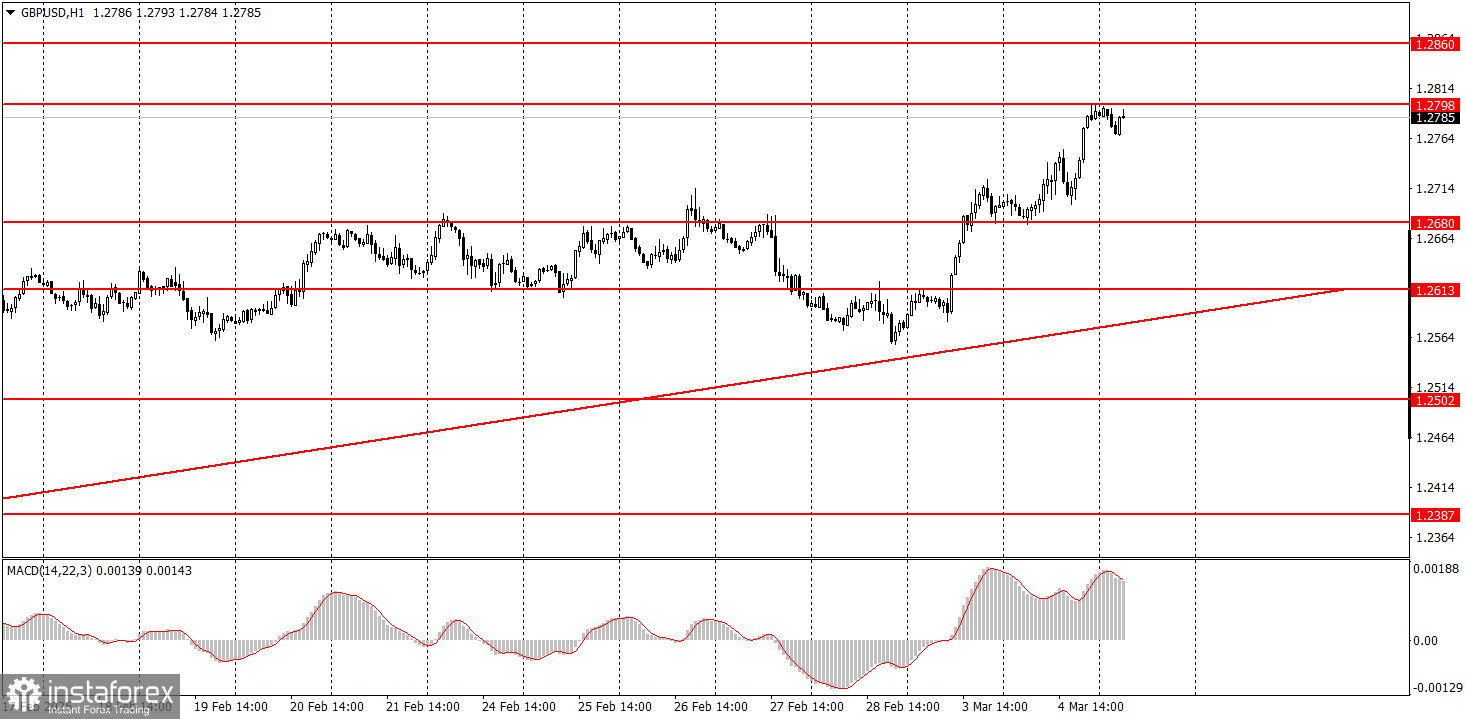

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.