Trade Analysis and Recommendations for the British Pound

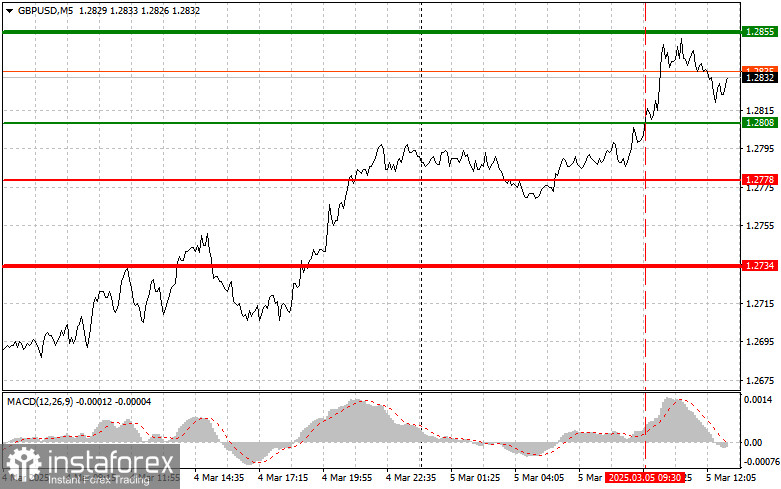

A test of 1.2808 occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I refrained from buying the pound.

The slowdown in the U.K. services sector cooled the enthusiasm of GBP buyers, who had maintained high activity levels despite the currency reaching its peak values. This triggered a partial correction in GBP/USD. The market's initial reaction to the services sector data was relatively subdued, but upon closer examination, it became evident that the slower growth rate could be a precursor to more serious economic challenges in the U.K. In the short term, GBP/USD dynamics will depend on new macroeconomic data and the rhetoric of central bank officials.

In the second half of the day, buyers may face additional challenges from strong ADP employment data and the ISM Services PMI. A rise in employment and increased services sector activity in the U.S. could significantly influence expectations regarding the Federal Reserve's monetary policy stance. If these indicators exceed expectations, the Fed may take a more aggressive approach, leading to a stronger dollar and reduced demand for risk assets, including the pound. Conversely, weak data could undermine support for the Fed's current monetary policy, increasing the likelihood of further rate cuts, which could weaken the dollar and boost interest in GBP and other risk assets.

For today's intraday trading strategy, I will primarily rely on Scenario #1 and Scenario #2.

Buy Signal

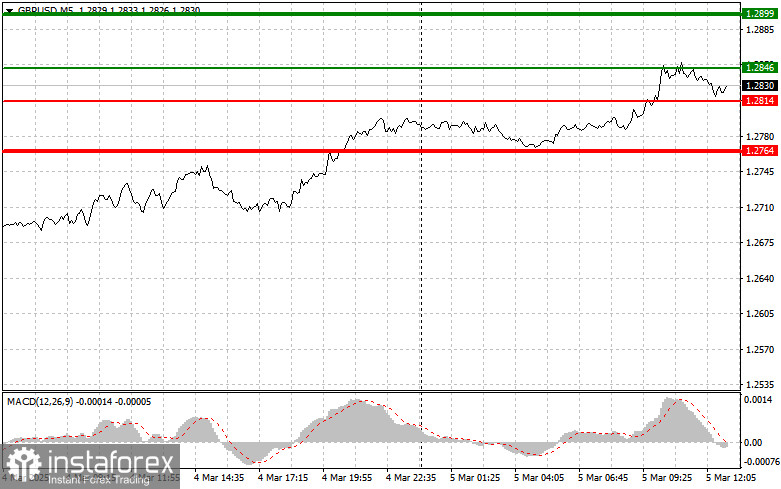

Scenario #1:

Buying the pound is advisable if the price reaches 1.2848, targeting an upward move toward 1.2899. At this level, I plan to exit long positions and initiate short trades in the opposite direction, expecting a 30-35 point correction. A bullish continuation today is only likely if U.S. economic data is weak. Important: Before entering long positions, confirm that the MACD indicator is above the zero mark and beginning its upward movement.

Scenario #2:

Another buying opportunity will arise if the price tests 1.2814 twice, while the MACD indicator is in oversold territory. This would limit the pair's downward potential and trigger a bullish reversal. The anticipated targets for this scenario are 1.2846 and 1.2899.

Sell Signal

Scenario #1:

Selling the pound is an option once the price drops below 1.2814, with a downward target of 1.2764, where I plan to exit short positions and buy the pound again for a 20-25 point retracement. Bearish pressure could intensify following strong U.S. data. Important: Before selling, confirm that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2:

Another selling opportunity will emerge if the price tests 1.2846 twice, while the MACD indicator is in overbought territory. This would limit the pair's upward potential and trigger a bearish reversal, with a downward move expected toward 1.2814 and 1.2764.

What's on the chart:

- Thin green line – Entry price for long positions.

- Thick green line – Suggested Take Profit level or an area where profit-taking is advisable, as further growth beyond this level is unlikely.

- Thin red line – Entry price for short positions.

- Thick red line – Suggested Take Profit level or an area where profit-taking is advisable, as further decline beyond this level is unlikely.

- MACD Indicator – Essential for determining overbought and oversold zones before entering the market.

Important Trading Considerations

For beginner traders in the Forex market, making careful entry decisions is crucial. It is advisable to stay out of the market before major economic reports to avoid sharp price swings. If you choose to trade during high-impact news releases, always use stop-loss orders to minimize potential losses. Failing to set stop-losses can result in rapid account depletion, especially when trading large volumes without proper risk management.

Lastly, a well-defined trading plan is essential for successful trading, as demonstrated in the strategy outlined above. Making impulsive trading decisions based on real-time market fluctuations is a losing approach for intraday traders.