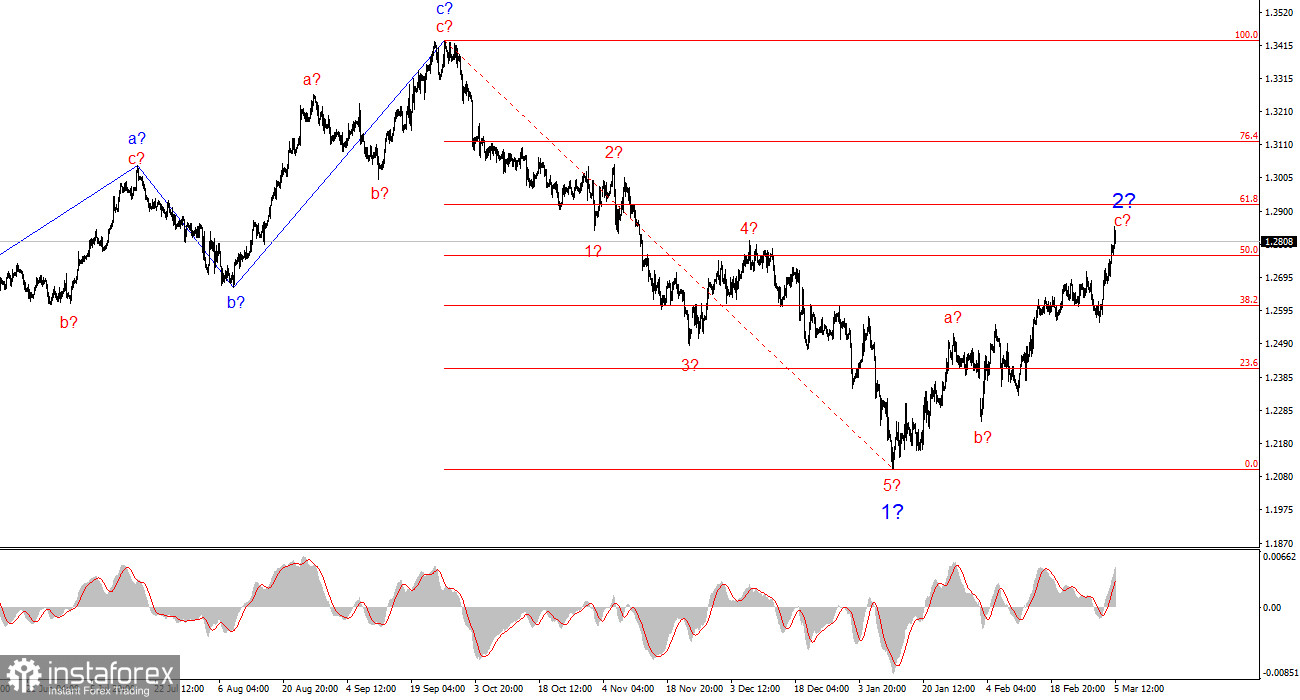

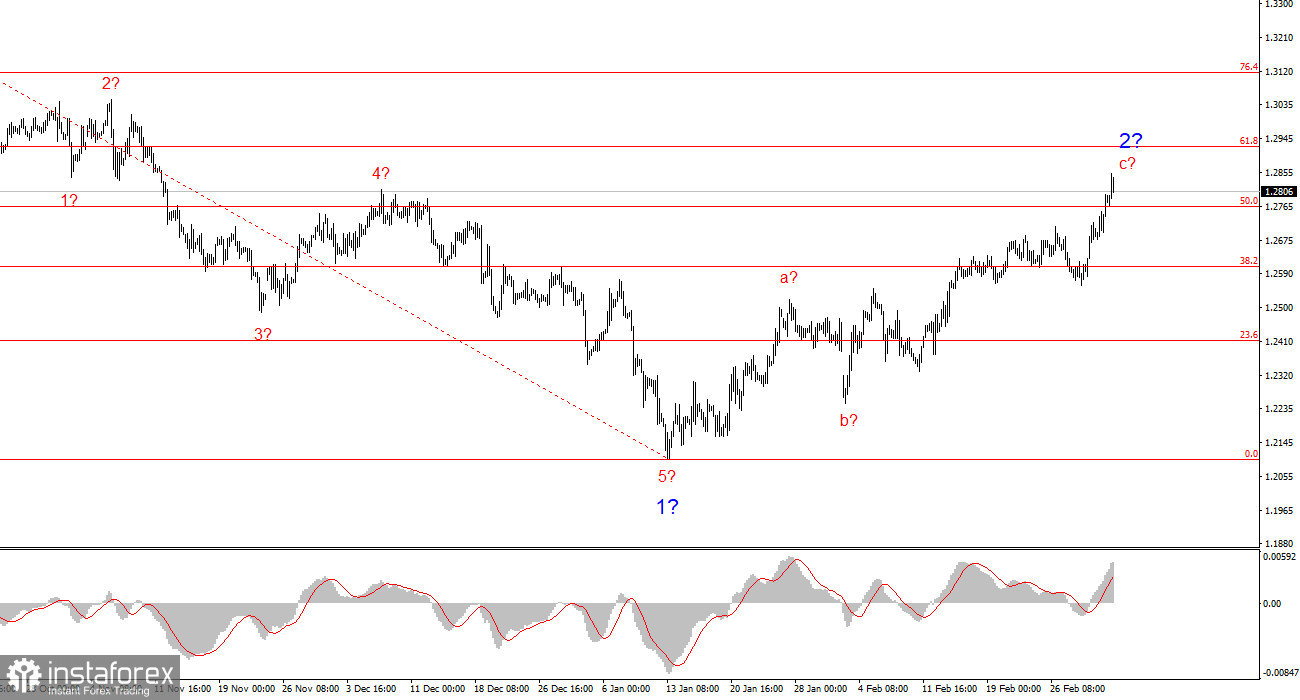

The wave structure for GBP/USD remains somewhat ambiguous but still largely understandable. Currently, the likelihood of forming a long-term downward trend remains high. Wave 5 has taken a convincing shape, leading me to consider wave 1 as completed. If this assumption holds, then wave 2 is currently unfolding, with targets around the 26th and 28th figures. The first two sub-waves within wave 2 appear to be complete, while the third one may conclude at any moment.

Trump's Factor Continues to Support the Pound

The demand for the British pound continues to rise due to the "Trump factor", which has unexpectedly turned into an ally for sterling. However, from a longer-term perspective, the pound lacks fundamental reasons for sustained growth. A crucial factor is that the Bank of England is preparing for four rate cuts in 2025, while the Federal Reserve plans no more than a 50-basis-point reduction. The UK economy has consistently disappointed market participants with weak data, while the current strength of the U.S. economy makes the dollar an attractive asset. These factors should discourage market participants from building a new long-term uptrend for GBP/USD.

The Pound Rises While It Can

The GBP/USD rate climbed 120 basis points on Monday, 90 on Tuesday, and another 30 on Wednesday. At this stage, waves (c) in 2 for both the euro and the pound appear to be fully formed. If this wave count remains valid and is not significantly altered by fundamental factors, then the next phase will likely be the formation of wave 3, implying a resumption of dollar strength.

However, believing in this scenario at the moment is quite difficult. The market is not just selling the dollar but doing so aggressively, causing the U.S. currency to plummet at an extraordinary pace. Who would want to go against such a strong move? Still, I want to emphasize that no matter how one-sided a price movement appears, the possibility of a reversal should never be ruled out.

What we are witnessing is essentially a flight from the U.S. dollar. However, it seems that the market is not just fleeing the dollar—which remains the world's number one reserve currency—but rather, it is running away from Trump himself. The U.S. president continues to damage relations with Canada, Mexico, China, and the European Union, adding geopolitical uncertainty to an already fragile economic environment.

From my perspective, the dollar's decline is entirely logical. However, the further depreciation of the greenback contradicts the current wave pattern. The market could continue reducing demand for the U.S. currency, and instead of a downward wave 3, we might see a complete transformation of the wave count. Unfortunately, this scenario cannot be ruled out. There are still two days left before the week's close, but I have doubts that even strong U.S. labor market reports will instantly reverse the situation.

Key Takeaways

The wave pattern for GBP/USD suggests that the formation of a bearish trend is still in progress, with wave 1 already completed. At this stage, traders should be looking for new short opportunities. The minimum targets for the corrective wave structure around the 26th figure have been reached, while the maximum targets around the 28th figure have also been achieved. The current wave count still favors the continuation of a bearish trend, which started last fall, but how the "Trump factor" will influence the market sentiment going forward remains uncertain.

On the higher timeframes, the wave structure has transformed. Now, we can anticipate the formation of another bearish trend, as the previous three-wave upward correction appears to be completed. If this assumption is correct, the market should expect a corrective wave 2 or b, followed by an impulse wave 3 or c.

Core Principles of My Analysis

- Wave structures should be simple and understandable. Complex patterns are hard to trade and are often subject to frequent revisions.

- If there is no confidence in the market's direction, it is better to stay out.

- No movement is ever 100% predictable. Always use Stop Loss orders to protect against unexpected reversals.

- Wave analysis can be combined with other methods and trading strategies for a more comprehensive approach to the market.