Analysis of Wednesday's Trades

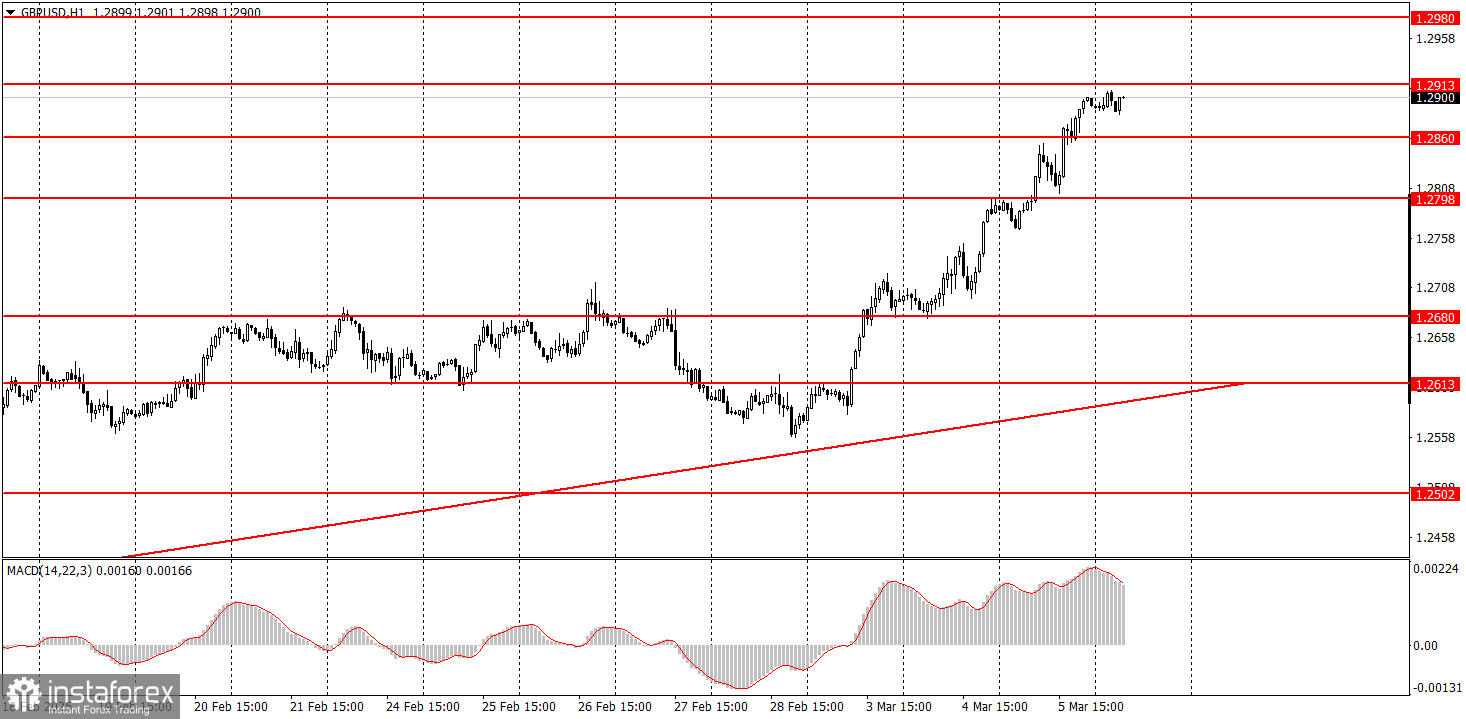

1H Chart of GBP/USD

The GBP/USD pair continued to rise significantly on Wednesday. While the European currency had no reason to strengthen at the beginning of the week, the pound sterling had even less justification for its growth. Both currencies have been rising primarily due to statements made by Donald Trump, which, despite his constant calls for peace, goodwill, and unity, are often counterproductive. The notion of "peace" can vary greatly; Trump aims to end the war in Ukraine, but insists on terms that neither Kyiv nor Moscow currently accept. Meanwhile, he is intensifying trade tensions with China, Canada, Mexico, India, and the European Union, effectively damaging relationships with countries that have been long-time partners of the U.S. Given these circumstances, it's understandable how the market might respond to the U.S. dollar.

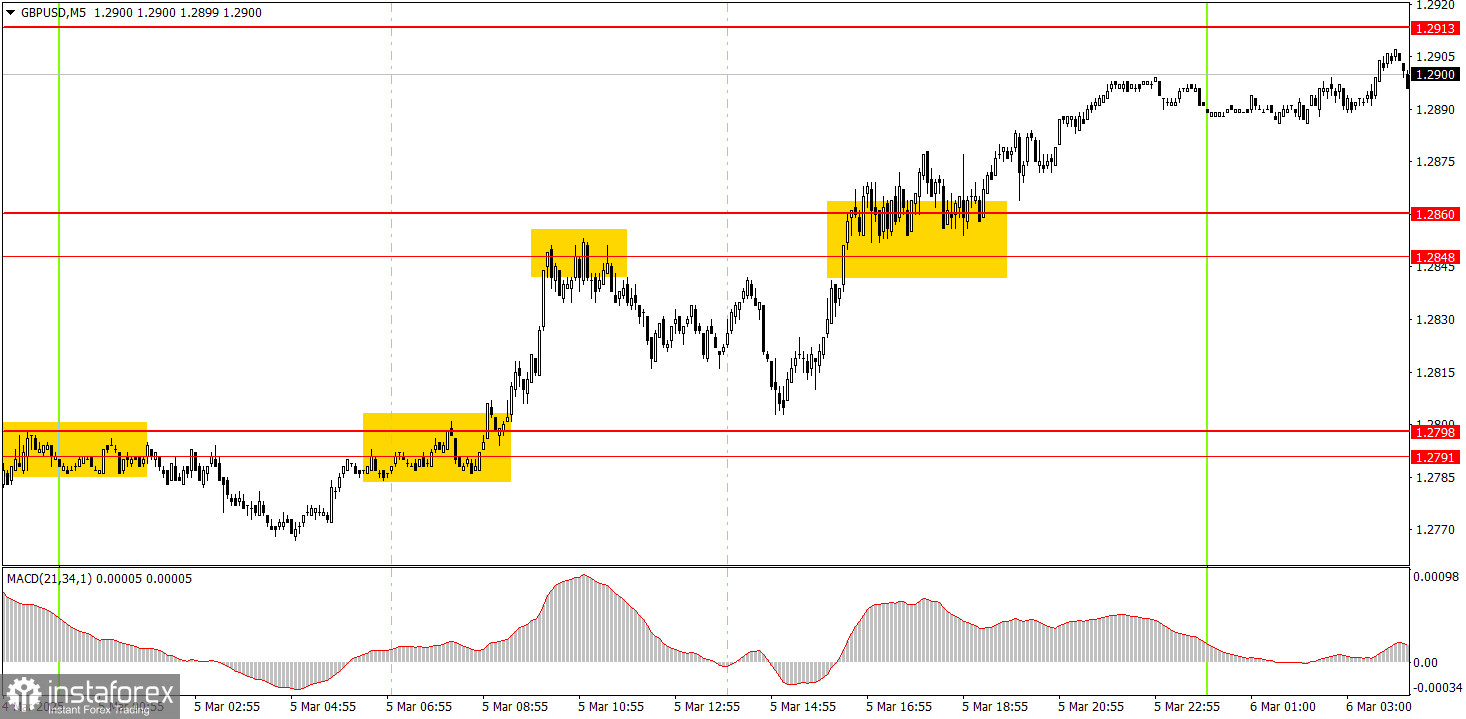

5M Chart of GBP/USD

On Wednesday, three trading signals emerged on the 5-minute timeframe. The first buy signal occurred when the price broke through the 1.2791-1.2798 range, reaching the nearest target. The second signal was a sell signal from a rebound in the 1.2848-1.2860 range, which nearly met the target. The third buy signal appeared when the pair broke through the 1.2848-1.2860 range, leading to another profitable trade, although the target of 1.2913 has yet to be reached. Fortunately, none of these trades resulted in losses.

Trading Strategy for Thursday:

On the hourly timeframe, GBP/USD could begin a short-term downtrend, but Trump is doing everything possible to prevent that. We still expect the pound to fall toward 1.1800 in the medium term, as this seems like the most logical outcome. However, we now need to wait for the daily timeframe's upward correction to end and for the price to consolidate below the trendline on the hourly chart. Preferably, we should also wait until Trump stops imposing sanctions on everyone.

On Thursday, GBP/USD could continue to rise if Donald Trump continues to sow chaos and dictate his terms to the world. Trading can be done based on key levels, but they are frequently ignored.

On the 5-minute timeframe, relevant trading levels include 1.2164-1.2170, 1.2241-1.2270, 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798. No major economic events are scheduled in the UK or the U.S. on Thursday, but they are not necessary at this point. Even if Trump does not introduce new sanctions or tariffs today, the dollar may continue to weaken due to his previous decisions.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.