Japan's 10-year bond yield climbed to 1.5% for the first time since June 2009, as the country grapples with rising inflation and higher borrowing costs. Meanwhile, U.S. Treasury yields continued to rise for the third consecutive day, with the 10-year yield hovering around 4.3%. European stock futures edged higher, posting gains between 0.5% and 0.7%.

Daily volatility underscores the impact of geopolitical instability in recent weeks, particularly the weakening U.S. support for Ukraine and ongoing trade tensions, which continue to shape trader and investor sentiment.

The euro posted its best three-day rally since 2015, ahead of today's European Central Bank (ECB) meeting. Analysts overwhelmingly predict a 25-basis-point rate cut, but this decision appears to have been already priced into the market. Key U.S. economic data set for release on Thursday includes weekly jobless claims, ahead of the highly anticipated non-farm payrolls report on Friday.

As noted earlier, German government bonds extended their decline on Wednesday, as markets increasingly expect the ECB to continue cutting rates to stimulate economic growth and support increased fiscal spending.

Asian Markets and China's Economic Ambitions

Stock indices in Japan, South Korea, and Hong Kong posted gains. The Hang Seng China Enterprises Index surged by 3.3%, reflecting rising investor expectations for additional stimulus measures. These could be announced later today during a joint press conference by China's government ministries in Beijing.

On Wednesday, Chinese officials at their annual parliamentary session reaffirmed a growth target of around 5% by 2025, marking the first time in over a decade that Beijing has maintained the same target for three consecutive years. President Xi Jinping signaled China's commitment to pushing forward with its ambitious growth agenda this year, despite mounting trade tensions.

U.S. stock futures remain stable, despite pressure on technology stocks. Shares of Marvell Technology Inc. dropped in after-hours trading in New York, following a disappointing revenue forecast, which dampened investor expectations for a stronger return from the AI boom. Meanwhile, Broadcom Inc., another AI-linked chipmaker, fell by 3.5% in premarket trading on Thursday, ahead of its earnings report.

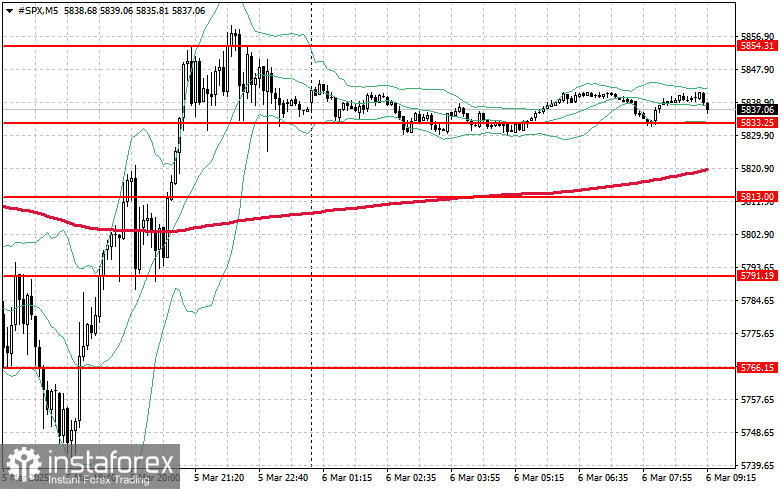

Technical Outlook for S&P 500

The S&P 500 continues its decline, with the main objective for buyers being to break through the nearest resistance level at $5,854. A successful move above this level could extend the rally and open the door for a push toward $5,877.

Another key priority for bulls will be maintaining control above $5,897, which would further reinforce buying momentum.

If risk appetite wanes, buyers must defend the $5,833 support level. A break below this threshold could accelerate selling pressure, pushing the index down to $5,813, with further downward potential toward $5,787.