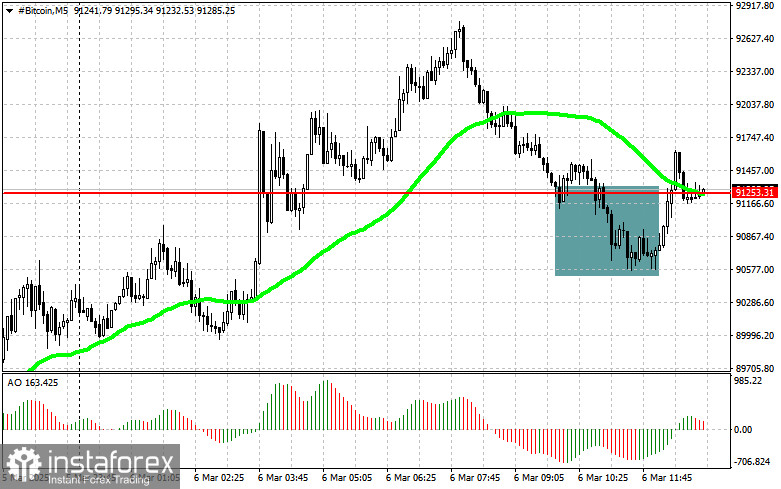

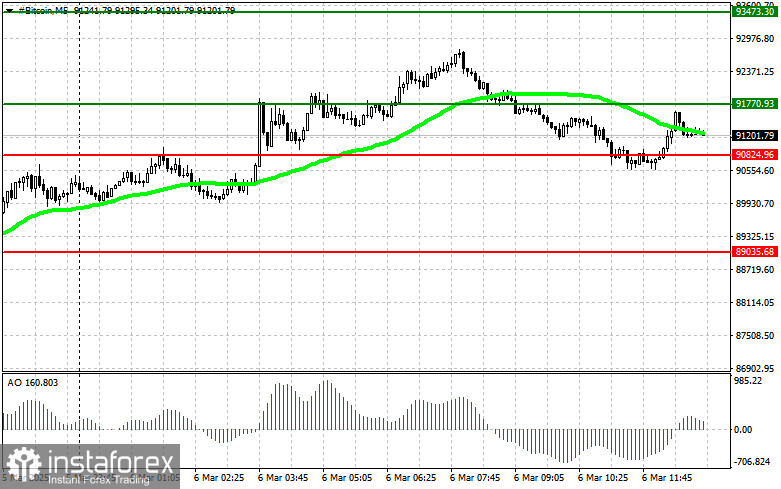

Bitcoin managed to correct after the Asian session's rally, allowing for a short position at $91,200. While a major decline didn't materialize, the price did manage to update the $90,500 level, which is already a decent result.

The obvious drop in volatility and the lack of new sellers directly relate to Trump's speech tomorrow at the cryptocurrency conference, where the US president is expected to shed light on the details of the US reserve crypto fund.

The speech is expected to cover a strategy for stabilizing the crypto market and strengthening the dollar's position in the digital economy. Experts predict Bitcoin's growth if Trump's statements are positive but caution against excessive euphoria, reminding investors of the unpredictability of political decisions.

At the same time, Federal Reserve officials are avoiding comments, emphasizing the need for a detailed analysis of the potential impact of a crypto reserve fund on monetary policy. Experts disagree on whether such a move is justified, with concerns that it could increase government control over decentralized assets.

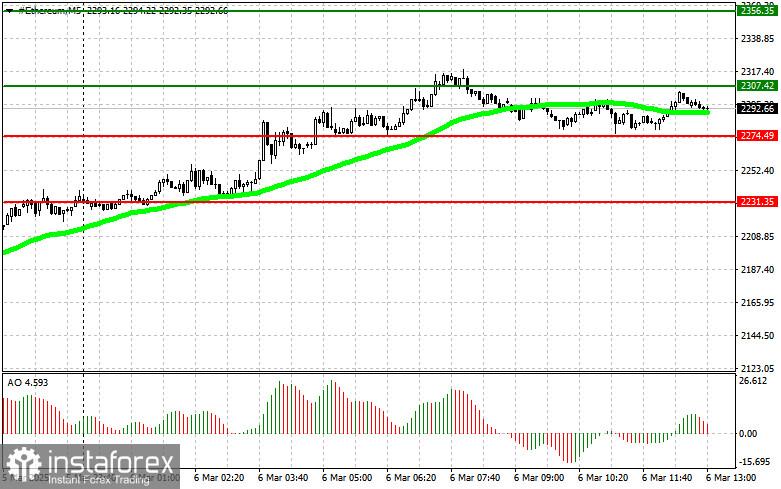

Ethereum gets stuck in trading range

Ethereum is not showing much momentum, continuing to trade within a range, which is positive for its long-term bullish prospects. However, the market lacks fresh catalysts, which everyone is eagerly awaiting tomorrow. Until then, the market is unlikely to see significant moves.

Medium- and short-term trading strategy

For intraday trading, I will continue to focus on major pullbacks in Bitcoin and Ethereum, betting on the bullish trend to continue in the medium term.

Bitcoin

Buy scenario

Scenario #1: I will buy Bitcoin today if it reaches the entry point at $91,700, targeting a rise to $93,400. At $93,400, I will exit long positions and go short on a rebound. Before buying on a breakout, I need to confirm that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Bitcoin can also be bought from the lower border at $90,800 if there is no reaction to its breakdown, aiming for $91,700 and $93,400.

Sell scenario

Scenario #1: I will sell Bitcoin today if it reaches the entry point at $90,800, targeting a decline to $89,000. At $89,000, I will exit short positions and buy on a dip. Before selling on a breakout, I need to check that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Bitcoin can also be sold from the upper border at $91,700 if there is no reaction to its breakout, aiming for $90,800 and $89,000.

Ethereum

Buy scenario

Scenario #1: I will buy Ethereum today if the price reaches the entry point at $2,307, targeting a rise to $2,356. At $2,356, I will exit long positions and open short ones on a rebound. Before buying on a breakout, I need to confirm that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Ethereum can also be bought from the lower border at $2,274 if there is no reaction to its breakdown, aiming for $2,307 and $2,356.

Sell scenario

Scenario #1: I will sell Ethereum today if it reaches the entry point at $2,274, targeting a decline to $2,231. At $2,231, I will exit short positions and buy on a dip. Before selling on a breakout, I need to verify that the 50-day moving average is above the current price, and the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper border at $2,307 if there is no reaction to its breakout, aiming for $2,274 and $2,231.