Analysis of Thursday's Trades

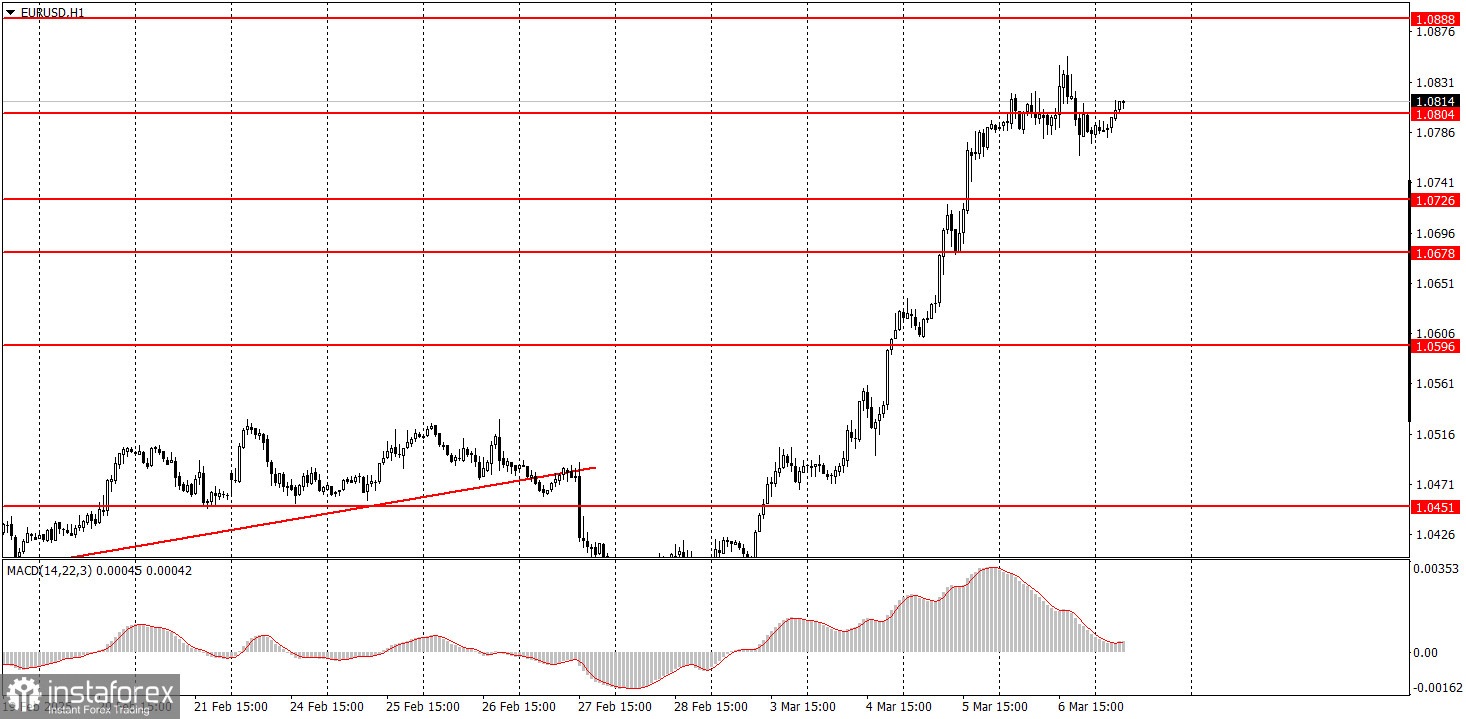

EUR/USD 1H Chart:

The EUR/USD pair essentially paused on Thursday after three days of rapid growth. Despite the presence of significant events that could have strengthened the U.S. dollar, the market stopped trading, further highlighting the recent lack of logical movement in the pair. The ECB's decision to ease monetary policy once again should have caused the euro to decline, but we saw no such movement as the market remains focused solely on Donald Trump's policies. Despite the dollar's sharp decline this week, a strong rebound may begin today or next week. However, at the moment, market sentiment lacks clear logic. Everything depends on how traders interpret the fundamental background. Additionally, there is no clear trendline on the hourly time frame to indicate the completion of the uptrend.

EUR/USD 5M Chart:

On the five-minute chart, the pair ignored all key levels on Thursday. The European session was marked by a complete lack of movement, while during the American session, volatility slightly increased but without any major impact. It became evident early on that traders were disregarding the 1.0797–1.0804 range, meaning that the only viable signal was a rebound from the 1.0845–1.0851 area.

How to Trade on Friday?

On the hourly time frame, EUR/USD remains within a medium-term downtrend. Given that the fundamental and macroeconomic background continues to favor the U.S. dollar more than the euro, we expect a decline in the pair. However, multiple short-term trends may emerge before the primary downward movement resumes. Currently, the market is not witnessing euro strength but rather a decline in the dollar due to Donald Trump's policies.

On Friday, the euro could trade in any direction as macroeconomic and fundamental factors no longer exert a consistent influence on price movements. However, given today's high-impact events, volatility is likely to be elevated.

On the five-minute chart, key levels to consider include 1.0334–1.0359, 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0845–1.0851, 1.0888–1.0896, and 1.0940–1.0952. In the U.S., labor market reports, unemployment data, and wage growth figures will be released, while in the EU, the final Q4 GDP report is expected. Additionally, ECB President Christine Lagarde and Fed Chair Jerome Powell will deliver speeches. Given these developments, the market is unlikely to remain stagnant today.

Key Trading System Rules

- The strength of a signal is determined by how quickly it forms (a bounce or a breakout). The faster it appears, the stronger the signal.

- If two or more false signals occur around the same level, subsequent signals from that level should be ignored.

- In flat market conditions, the pair may generate many false signals or none at all. If the market shows signs of stagnation, it is better to pause trading.

- Trades should be executed between the start of the European session and the middle of the U.S. session. After that, all open trades should be closed manually.

- On the hourly chart, MACD signals should be used only in conditions of good volatility and a trend confirmed by a trendline or channel.

- If two levels are too close (5 to 20 pips apart), they should be treated as a support or resistance zone rather than individual levels.

- If the price moves 15 pips in the correct direction, it is advisable to set Stop Loss to breakeven.

Chart Explanation

- Support and resistance levels – these act as targets for buy or sell trades. Take Profit levels can be placed near these points.

- Red lines – trendlines and trend channels that indicate the current market direction and preferred trading strategy.

- MACD Indicator (14,22,3) – histogram and signal line serve as auxiliary tools for generating additional trade signals.

Important News and Reports

High-impact news releases (always available in the economic calendar) can have a significant effect on price movements. During major events, it is advisable to trade with caution or stay out of the market to avoid sudden price reversals.

Traders new to Forex should remember that not every trade will be profitable. The key to long-term success lies in developing a structured trading strategy and practicing proper risk management.