Yesterday, U.S. stock indices resumed their decline, hitting new weekly lows. The S&P 500 dropped by 1.78%, while the tech-heavy NASDAQ plunged by 2.61%.

Asian stocks also followed the downward trend, as President Donald Trump's ever-changing stance on trade tariffs for key partners exacerbated market uncertainty and weakened confidence in economic prospects.

Australian and Japanese stocks fell by more than 1.5%, while European futures declined even before the start of the regular trading session. The U.S. dollar index also slid, marking its longest losing streak in nearly a year.

Traders point to uncertainty surrounding Trump's tariffs. Even after Trump delayed tariffs on Mexican and Canadian goods under the North American trade agreement, U.S. stocks failed to recover—highlighting the fragile risk appetite among investors.

For the entire week, markets have been falling as investors grapple with geopolitical uncertainty and conflicting signals from the U.S. on tariffs. The overall sentiment remains clouded by confusion surrounding Trump's policy agenda. While there are few signs of outright panic, the stock market continues to lose ground due to declining demand for risk assets.

Wall Street strategists are debating whether the recent stock market losses could influence Trump's tariff decisions. Some believe Trump may reconsider his policies if the stock market, which he often touts as a measure of his administration's success, continues to decline and scare investors away.

So far, Trump has given no indication that he will alter his course. In his latest speech, he downplayed the market reaction, stating, "I don't even look at the market." This follows his earlier comments to Congress this week, where he acknowledged that tariffs might cause some market turbulence but insisted that his administration is prepared to handle it.

Market Trends & Key Developments

As mentioned earlier, European stock futures fell by 0.9% during Asian trading. However, S&P 500 futures rose by 0.3% after an optimistic earnings forecast from U.S. semiconductor giant Broadcom Inc. boosted investor sentiment. The company's strong AI-related revenue outlook pushed its stock up by 13% in after-hours trading.

U.S. Treasury bonds edged higher on Friday after a lackluster Thursday session. The Mexican peso and Canadian dollar strengthened following news of a potential delay in tariffs.

Meanwhile, Bitcoin dropped as much as 5.7% before recovering some losses. Although Trump fulfilled his campaign promise to create a Bitcoin-specific reserve, the details fell short of industry expectations.

Upcoming Economic Data & Market Outlook

The U.S. Nonfarm Payrolls report due today could help traders assess the future direction of interest rates. The Bureau of Labor Statistics' jobs report will provide new insights into labor market trends, which had been a key pillar of support for the stock market until January.

Commodities Update

- Oil recorded its biggest weekly drop since October

- Gold continued to rise as traders sought safe-haven assets

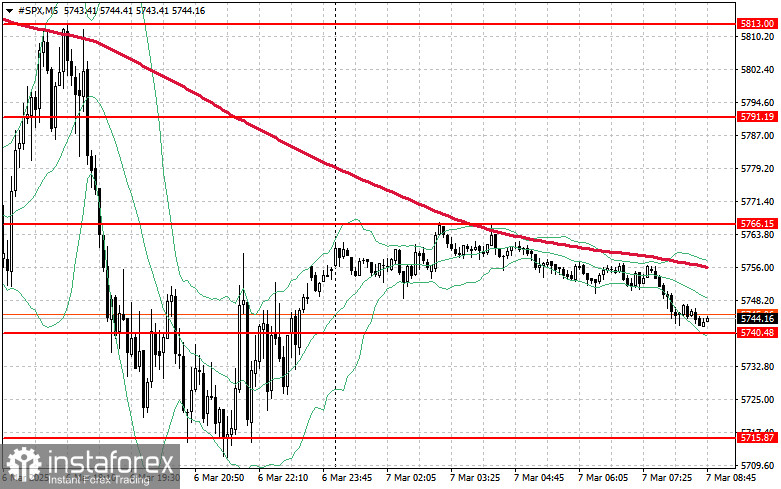

Technical Outlook for S&P 500

The downtrend remains intact. The primary task for buyers today will be to break through resistance at $5,766, which would sustain the recovery and open the door for a move toward $5,791. Bulls will also aim to establish control above $5,813, further strengthening their position.

However, if risk appetite continues to fade, buyers must defend the $5,740 level. A break below this level would accelerate the decline toward $5,715, with further downward potential to $5,687.