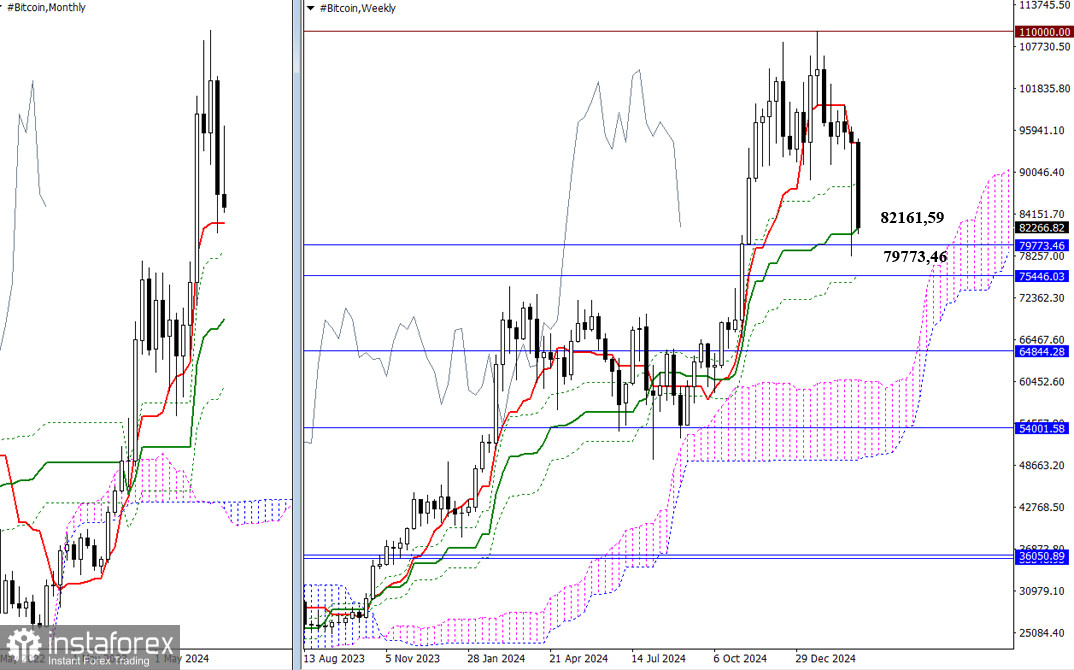

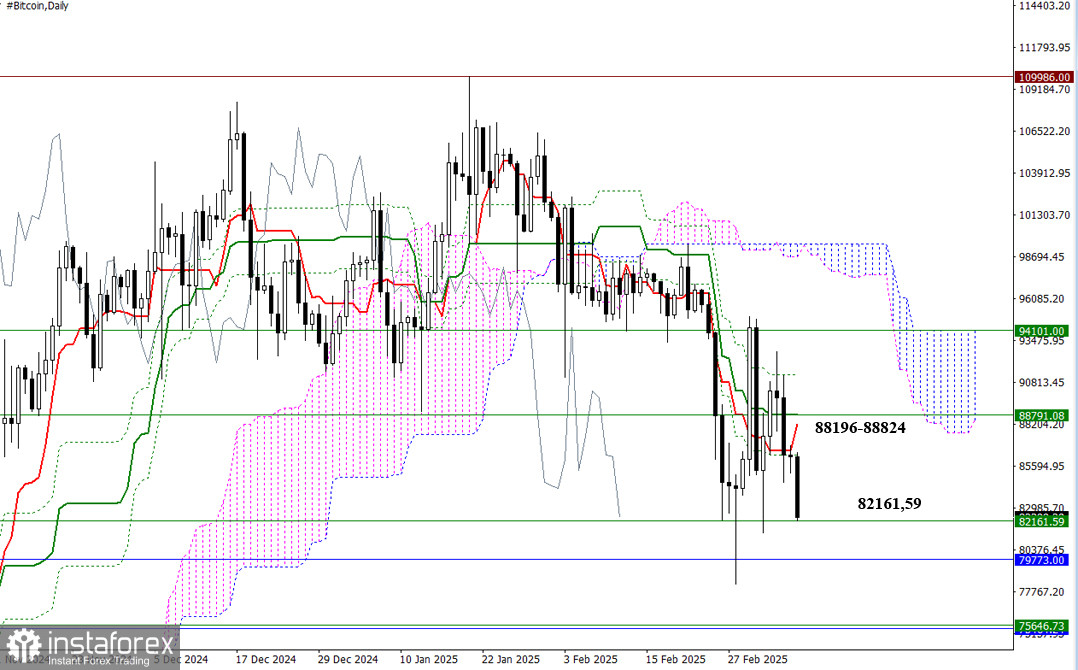

Despite last week bringing the market back to its previous consolidation zone, sellers remain active. They are currently retesting the support level of the weekly medium-term trend at 82,161.59, with the next key level at 79,773.46, which represents the monthly short-term trend. If these levels are breached, it will create new opportunities for the bears. Their primary goal will be to break through the weekly Ichimoku cross, with the final level currently at 75,595.09, further supported by monthly support at 75,446.03.

However, if sellers fail to break through the support levels at 82,161.59 and 79,773.46, control could shift back to the bulls. Buyers will aim to regain momentum by testing and surpassing the daily dead cross levels at 88,196.42, 88,824.37, and 91,327.91, in addition to facing resistance at the weekly level of 88,791.08.

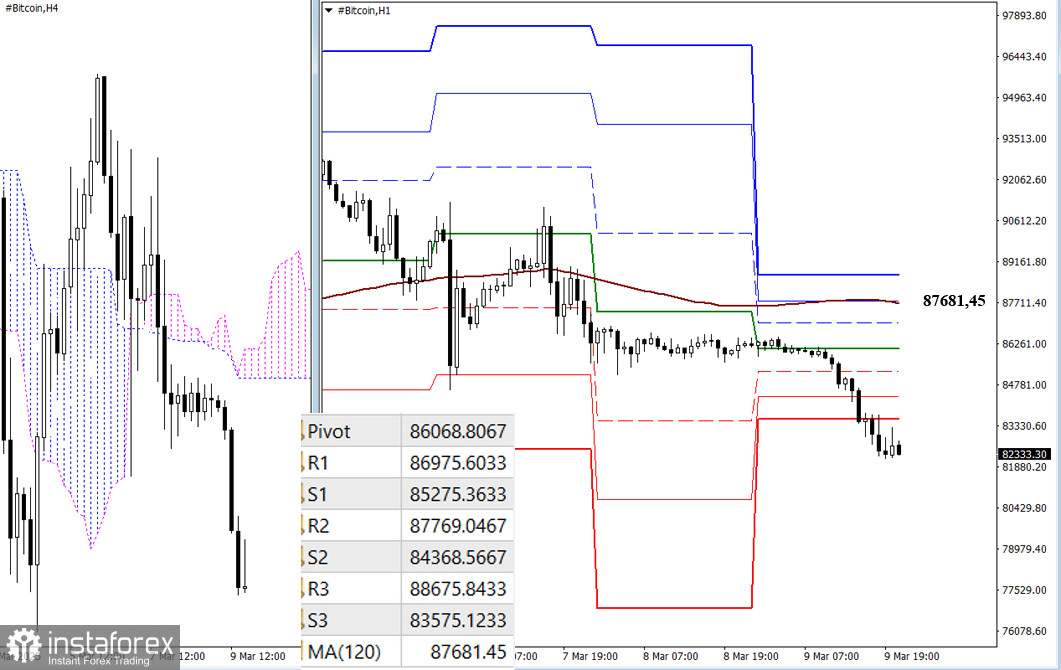

On lower timeframes, sellers currently hold the upper hand, maintaining a downward trend. Throughout today's session, all classic pivot level supports have been tested. As a new trading day begins, updated pivot levels will be introduced. For the bears, these new classic pivot supports will be of particular interest. Meanwhile, buyers will aim to regain control by testing the key level of the weekly long-term trend at 87,681.45. Holding this level would provide a significant advantage on lower timeframes. Trading above this trend favors bullish momentum, while remaining below it keeps bearish sentiment in play.

***

Technical Analysis Components:

- Higher Timeframes: Ichimoku Kinko Hyo (9.26.52) and Fibonacci Kijun levels

- H1: Classic Pivot Points and 120-period Moving Average (weekly long-term trend)