The euro and the pound are currently experiencing low demand, and despite mixed economic data from the U.S. last Friday, their growth has slowed. Many traders have adopted a more cautious approach as they did not receive the anticipated statements from the Federal Reserve regarding economic stimulus measures.

An unexpected rise in U.S. unemployment, which surpassed analysts' expectations, caused a decline in the dollar. However, this decline did not lead to a significant strengthening of the EUR/USD pair, indicating a lack of confidence among euro buyers in the continuation of the uptrend.

The unexpected increase in unemployment prompted traders to reevaluate their expectations for the Fed's future policy. The market has begun to factor in a higher likelihood of further interest rate cuts, putting additional pressure on the dollar. However, the euro has not been able to fully take advantage of this situation. One reason for the muted reaction in EUR/USD is the ongoing concerns regarding the outlook for the European economy. Moreover, investors remain cautious about the potential consequences of geopolitical tensions arising from U.S. trade wars.

Today, key data releases include Germany's industrial production figures, trade balance, and the Eurozone Sentix investor confidence index. Strong industrial data could boost demand for the euro. Otherwise, the correction in EUR/USD, which began after the recent European Central Bank rate cut, will likely continue.

Expectations for German industry remain subdued as the energy crisis and weak demand continue to weigh on the manufacturing sector. If the figures come below forecasts, the euro may face another wave of selling. The trade balance data will also be closely scrutinized—declining exports or rising imports could signal weakness in the German economy and reinforce negative sentiment toward the euro.

Although the Sentix index is a leading indicator, it carries less weight in the current situation compared to actual industrial production and trade data. However, a strong increase in the index could support the euro by easing selling pressure.

If the data aligns with economists' expectations, following a Mean Reversion strategy is best. A Momentum strategy is recommended if the data is significantly higher or lower than expected.

Momentum Strategy (on breakout):

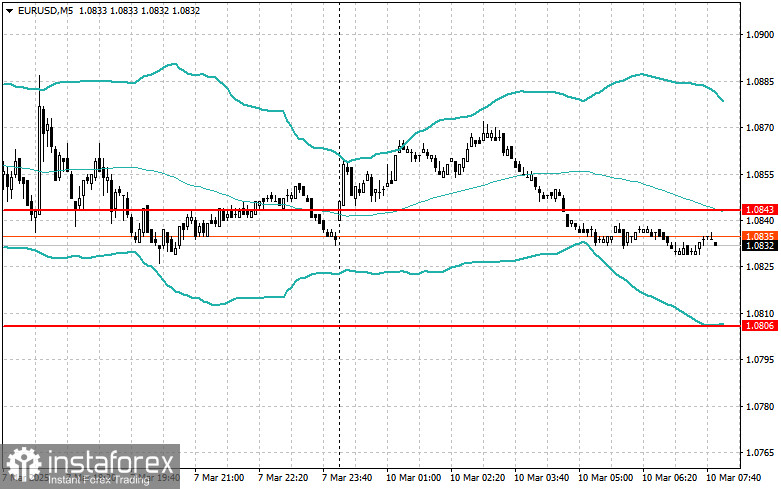

EUR/USD

Buying above 1.0869 could lead to a rise toward 1.0901 and 1.0935.

Selling below 1.0827 could push the euro down to 1.0782 and 1.0749.

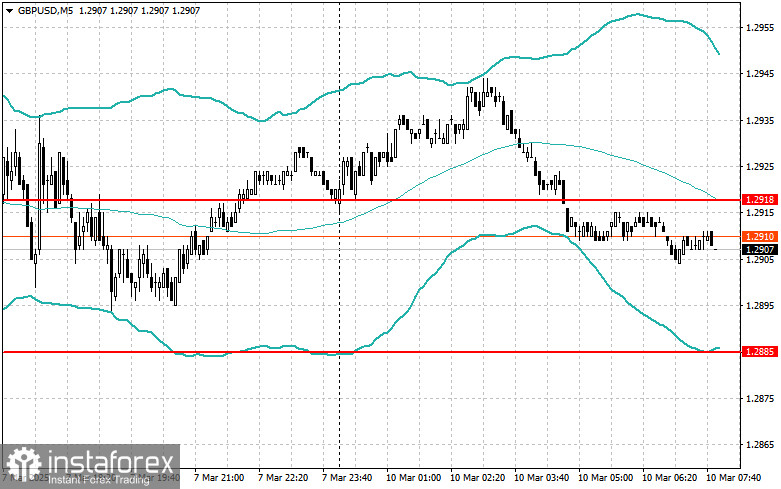

GBP/USD

Buying above 1.2940 could lead to a rise toward 1.2972 and 1.3006.

Selling below 1.2881 could push the pound down to 1.2846 and 1.2808.

USD/JPY

Buying above 147.85 could lead to a rise toward 148.20 and 148.50.

Selling below 147.50 could trigger a decline toward 147.20 and 146.70.

Mean Reversion Strategy (on pullbacks):

EUR/USD

Looking to sell after an unsuccessful breakout above 1.0843 when the price returns below this level.

Looking to buy after an unsuccessful breakout below 1.0806 when the price returns above this level.

GBP/USD

Looking to sell after an unsuccessful breakout above 1.2918 when the price returns below this level.

Looking to buy after an unsuccessful breakout below 1.2885 when the price returns above this level.

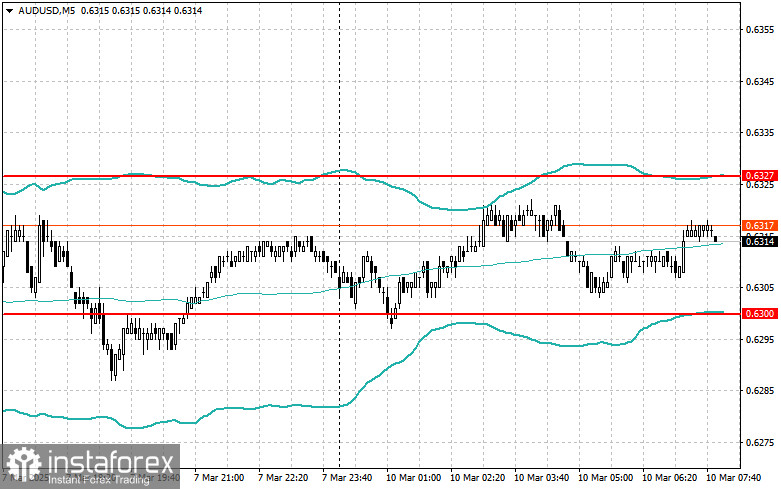

AUD/USD

Looking to sell after an unsuccessful breakout above 0.6327 when the price returns below this level.

Looking to buy after an unsuccessful breakout below 0.6300 when the price returns above this level.

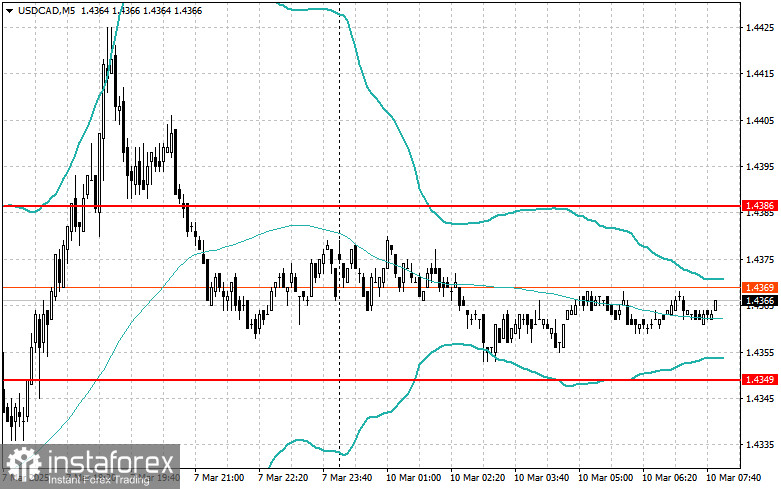

USD/CAD

Looking to sell after an unsuccessful breakout above 1.4386 when the price returns below this level.

Looking to buy after an unsuccessful breakout below 1.4349 when the price returns above this level.