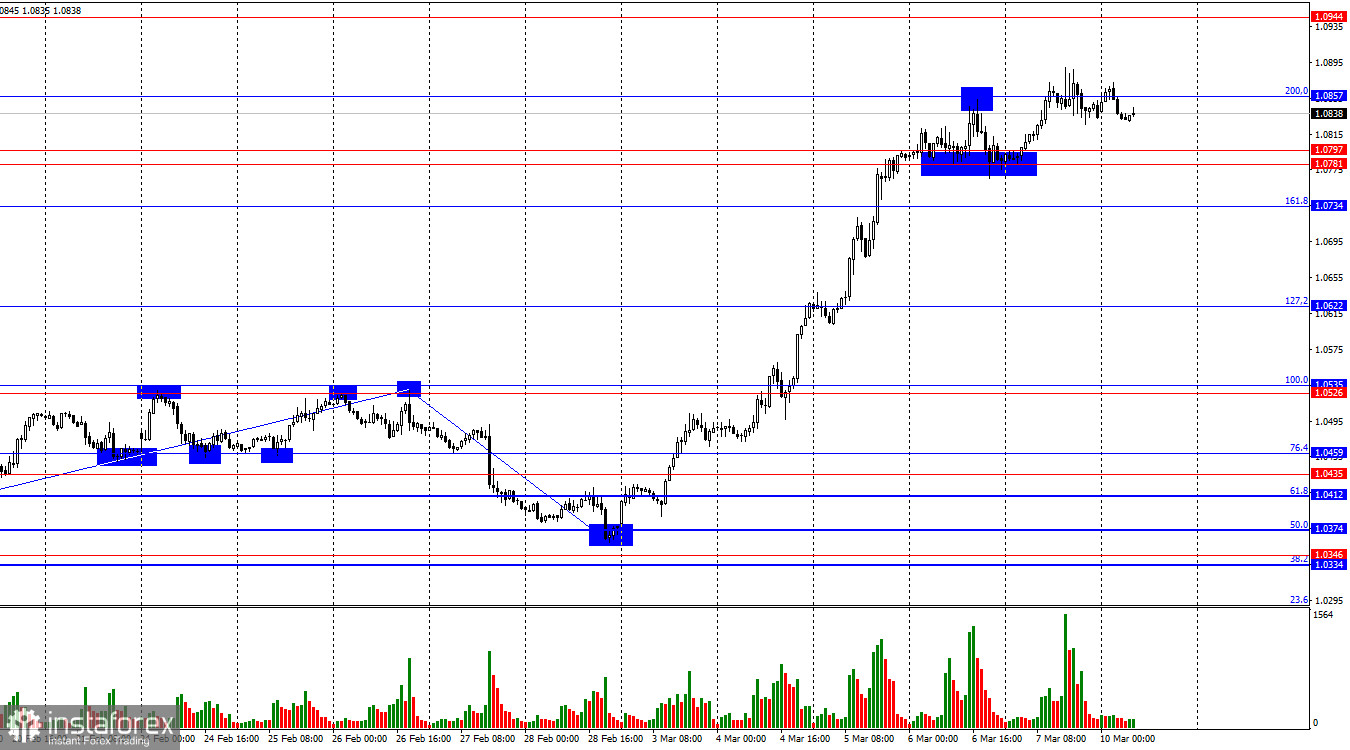

On Friday, EUR/USD attempted to extend its upward movement and consolidate above the 200.0% Fibonacci retracement level at 1.0857, but bulls lacked the momentum to sustain the breakout. However, a successful close above this level would strengthen the case for further growth toward 1.0944. If the pair rebounds from 1.0857, it could favor the U.S. dollar and trigger a mild and short-lived pullback.

The wave structure on the hourly chart has shifted. The last completed downward wave broke the previous low, while the new upward wave broke the previous high. This indicates that the market is no longer in a sideways trend but rather in a bullish phase. However, the current growth appears impulsive, with buyers aggressively pushing higher due to concerns over a potential U.S. economic slowdown driven by Donald Trump's policies. This fear-driven sentiment remains the primary reason for the dollar's decline last week.

On Friday, the market's bias continued to support buyers, although it would be misleading to say that the sentiment had been consistently bullish throughout the week. For example, on Thursday, the ECB announced another round of monetary easing, which initially supported bearish traders. However, by Friday, the U.S. unemployment rate had risen, and the Nonfarm Payrolls (NFP) report fell short of market expectations. Still, as I mentioned earlier, bulls seemed to have exhausted their strength.

Under these conditions, a corrective wave would be logical, but I lack confidence that dollar buyers are present in the market right now. Last week, Trump's policies sent shockwaves through the markets, leading many traders to anticipate economic deterioration rather than improvement. Additionally, market participants now expect the Fed to cut rates at least twice by year-end. Even Jerome Powell's speech on Friday failed to change the sentiment.

The FOMC Chair stated that there is currently no reason to alter the Fed's monetary policy stance, but he acknowledged that economic risks have increased. While the U.S. dollar enjoyed a strong end to 2024 and the beginning of 2025, its outlook is now increasingly uncertain.

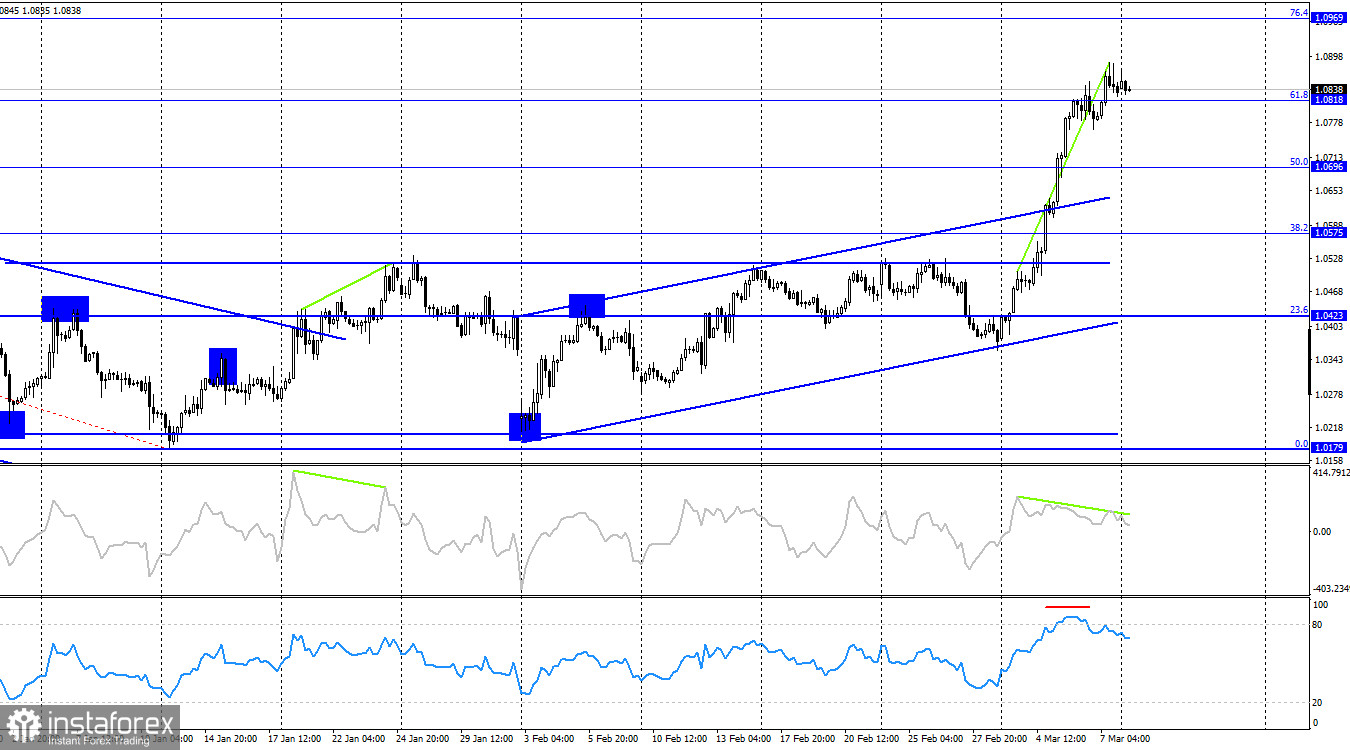

On the 4-hour chart, EUR/USD continues its bullish trend after breaking out of a horizontal channel. The upward trend channel confirms the uptrend, while the break above the 61.8% Fibonacci level at 1.0818 suggests further upside potential toward 76.4% at 1.0969.

However, the CCI indicator has formed a bearish divergence, and the RSI is signaling overbought conditions, indicating that the pair may be preparing for a pullback. If EUR/USD closes below 1.0818, a decline toward the 50.0% Fibonacci retracement at 1.0696 could follow.

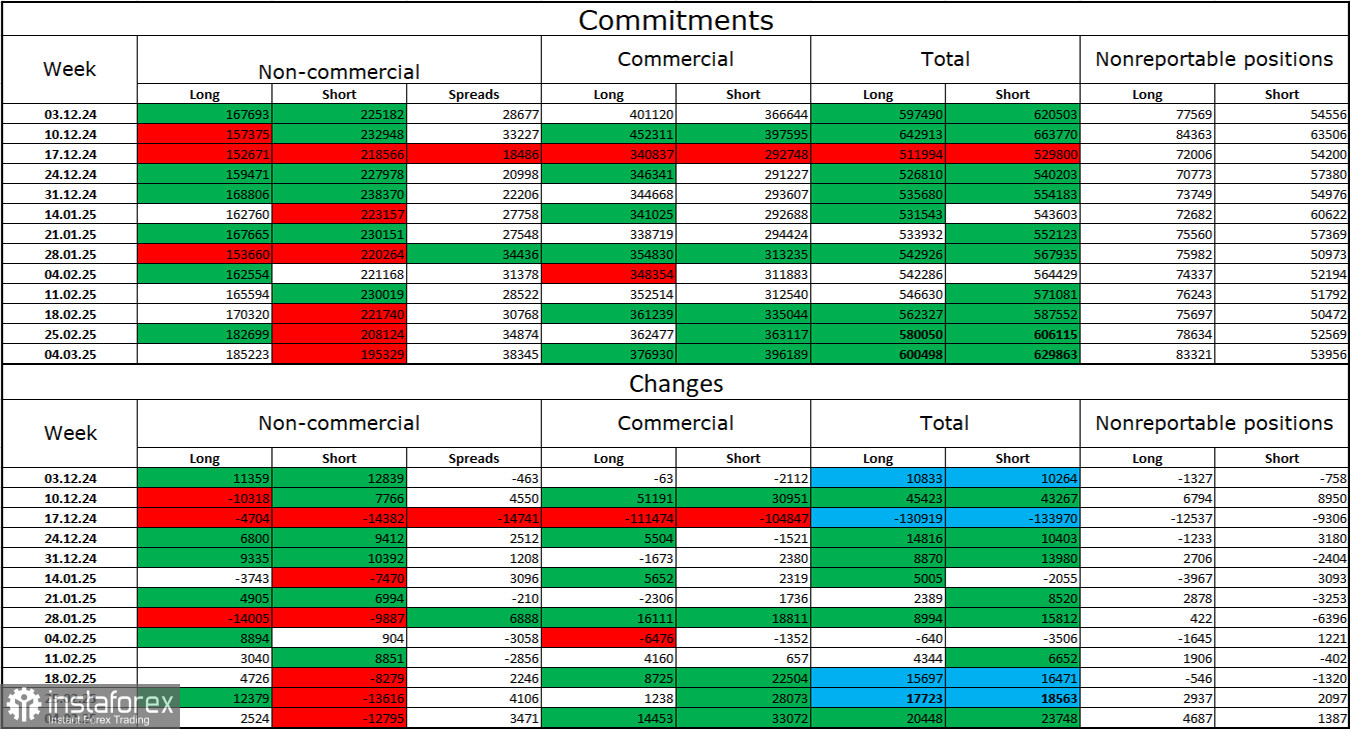

Commitments of Traders (COT) Report

During the latest reporting week, institutional traders opened 2,524 new long positions and closed 12,795 short positions. Although the Non-commercial group remains bearish, their stance has softened in recent weeks. Total long positions now stand at 185,000 and total short positions stand at 195,000.

For 20 consecutive weeks, institutional traders have been reducing their euro holdings, reinforcing the prevailing bearish trend. The monetary policy divergence between the ECB and the Fed still favors the U.S. dollar, despite recent adjustments.

However, bearish dominance is weakening, and the number of long positions has increased for five straight weeks—a period that coincides with Donald Trump's presidency. This shift raises questions about whether market sentiment toward the euro is truly changing.

Economic Calendar for the U.S. and Eurozone

- Eurozone – German Industrial Production Change (07:00 UTC).

On March 10, only one minor economic release is scheduled, meaning the impact of fundamental factors on market sentiment will be minimal.

EUR/USD Forecast and Trading Recommendations

Selling opportunities arise if the pair closes below the 1.0781–1.0797 range on the hourly chart, with downward targets at 1.0734 and 1.0622. Another selling opportunity could emerge if the pair rebounds from 1.0857. Buying opportunities exist, but the pair's strong and uninterrupted rally raises concerns about a potential sharp reversal.

Fibonacci retracement levels:

- Hourly chart: Based on the 1.0529–1.0213 range.

- 4-hour chart: Based on the 1.1214–1.0179 range.