Analysis of Trades and Trading Tips for the Euro

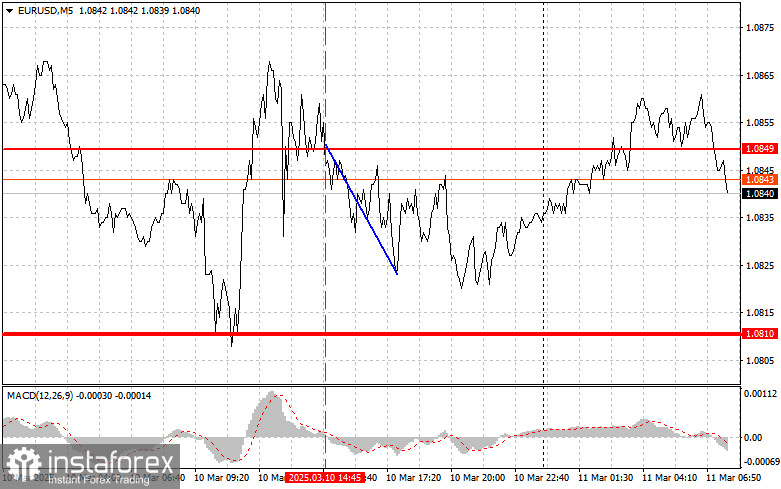

The price test at 1.0849 occurred when the MACD indicator had just begun to decline from the zero mark, confirming a favorable entry point for selling the euro. This led to a 25-pip drop in the pair, after which the pressure on the euro eased.

Currently, EUR/USD is moving sideways within a narrow channel while waiting for new catalysts. Market participants are focused on macroeconomic indicators, which, unfortunately, are lacking today. The European Central Bank is likely to continue its stance toward monetary policy easing, which will limit the pair's upward potential. Therefore, it is important to pay attention to speeches from representatives of the ECB.

Today, a meeting of EU finance ministers is scheduled to take place, and no other significant events are anticipated. This makes it unlikely for the EUR/USD to break out of its current range. Traders should exercise caution and consider multiple scenarios, as the existing overbought conditions could eventually lead to a substantial downward correction.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

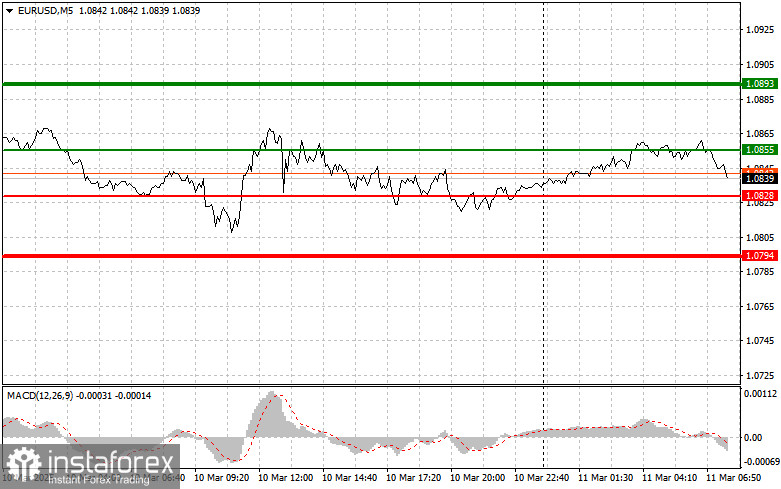

Scenario #1: Today, I plan to buy the euro if the price reaches the 1.0855 area (green line on the chart), aiming for a rise to 1.0893. At 1.0893, I will exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. Euro growth in the first half of the day can be expected to continue the upward trend. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.0828 twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposite levels of 1.0855 and 1.0893 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.0828 level (red line on the chart). The target will be 1.0794, where I will exit the market and immediately buy in the opposite direction, expecting a movement of 20-25 pips in the opposite direction from the level. Pressure on the pair will return today if an attempt to rise above the daily high fails. Important! Before selling, make sure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.0855 twice a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.0828 and 1.0794 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.