Trade Analysis and Recommendations for the British Pound

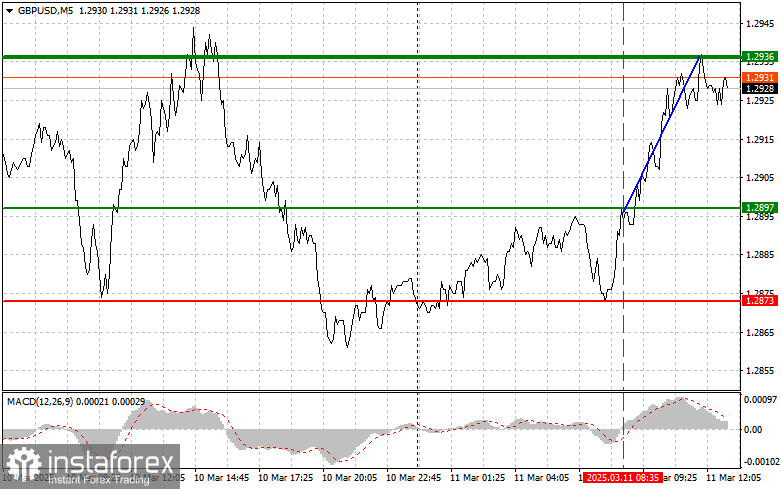

The test of the 1.2897 price level occurred when the MACD indicator was just starting to rise from the zero mark, confirming a valid entry point for buying the pound in line with the trend. This resulted in a 40-point increase in the pair.

The absence of UK economic data was enough to support the bullish market for the pound. However, it is essential to remember that such resilience can be misleading. The British pound, like any other currency, is influenced by multiple factors, including geopolitical developments, changes in the Bank of England's monetary policy, and UK economic indicators. Additionally, traders should closely monitor the actions of the Federal Reserve. If the Fed hints at further rate cuts, demand for the pound will likely increase.

In the second half of the day, even seemingly minor U.S. data releases could impact the market. The NFIB Small Business Optimism Index, for instance, reflects sentiment among small businesses, which are a crucial component of the U.S. economy. An improvement in this indicator may signal growing confidence among entrepreneurs, which, in turn, can boost investment and job creation.

As for the JOLTS report, it provides insights into job openings, layoffs, and hiring trends. A high number of job openings may indicate labor shortages and potential upward pressure on wages, which could fuel inflation.

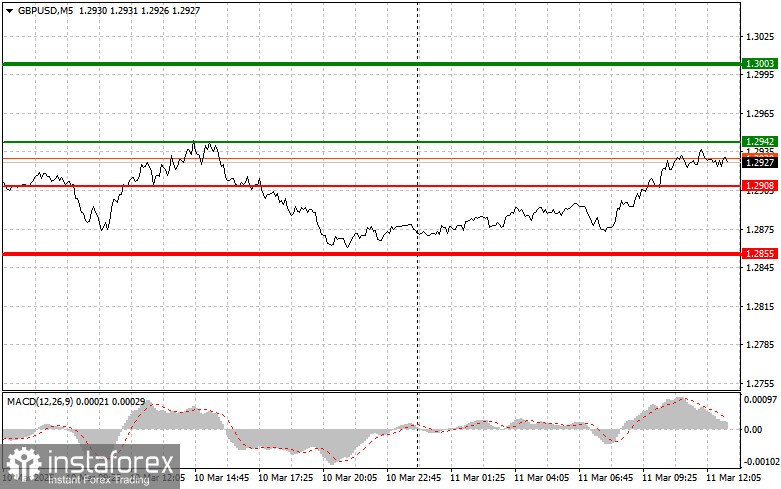

Regarding the intraday strategy, I will focus on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the price reaches 1.2942 (green line on the chart), with a target of 1.3003 (thicker green line). Around 1.3003, I will exit buy positions and open a sell position in the opposite direction, expecting a 30-35 point pullback. The pound is expected to continue rising within the uptrend. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound if the 1.2908 level is tested twice in a row, with the MACD indicator in the oversold zone. This will limit the pair's downward potential and trigger a reversal to the upside. A subsequent rise to 1.2942 and 1.3003 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after it breaks below 1.2908 (red line on the chart), which could lead to a rapid decline. The key target for sellers will be 1.2855, where I will exit sell positions and immediately buy in the opposite direction, expecting a 20-25 point rebound. Sellers will become more active if the daily high is retested. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I will also sell the pound if the 1.2942 level is tested twice in a row, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and trigger a downward market reversal. A subsequent decline to 1.2908 and 1.2855 can be expected.

Chart Key:

- Thin green line – Entry price for buying the instrument

- Thick green line – Expected target price for placing Take Profit or manually securing profits, as further growth beyond this level is unlikely

- Thin red line – Entry price for selling the instrument

- Thick red line – Expected target price for placing Take Profit or manually securing profits, as further decline beyond this level is unlikely

- MACD Indicator – When entering the market, it is essential to consider overbought and oversold zones.

Important Notes for Beginner Forex Traders:

Making trading decisions requires extreme caution. Avoid entering the market ahead of key fundamental reports, as sudden price swings may lead to losses. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly deplete your entire deposit, especially when using high leverage and large trade volumes.

For successful trading, you must have a clear trading plan, like the one outlined above. Making impulsive decisions based on short-term market fluctuations is a losing strategy for intraday traders.