Yesterday evening, the euro reached the target level of 1.0949, which is the peak from July 2024, and there are currently no signs of a reversal on the daily chart. A breakout above this resistance level would set the next target at 1.1027, the low from September 3.

Today, U.S. inflation data for February is set to be released. The forecast anticipates a decline in the overall Consumer Price Index (CPI) from 3.0% year-over-year (YoY) to 2.9% YoY, while core CPI is expected to decrease from 3.3% YoY to 3.2% YoY. These figures could bolster the euro's upward movement.

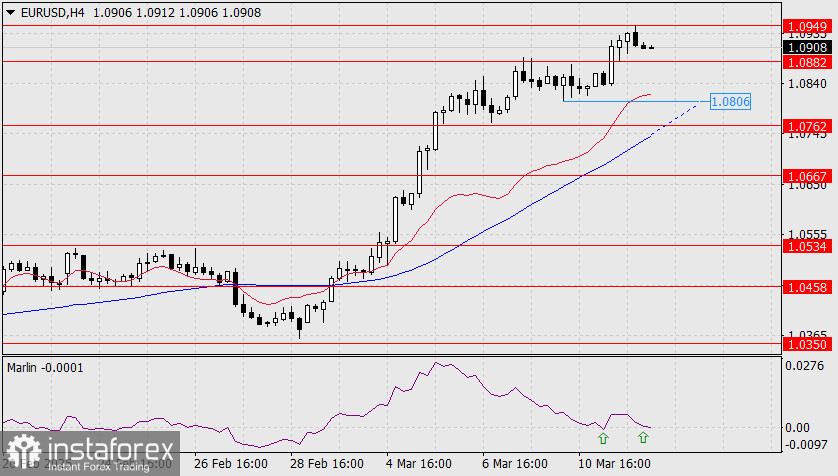

On the four-hour chart, the signal line of the Marlin oscillator is making a second attempt to reverse from the zero line. There is a high probability of forming a second bottom on the oscillator. However, if the price consolidates below 1.0882, the Marlin oscillator could also move into negative territory. In that case, the risk of a deeper correction down to the MACD line (approximately 1.0806) would increase.