Bitcoin and Ethereum are locked within new channels. On the positive side, the intense selling pressure observed at the beginning of the week has subsided. However, there are concerns about Bitcoin's potential for further growth, as there has been a lack of active buying above $84,000. This suggests that another significant price drop may be necessary.

After reaching a low of around $80,500, Bitcoin is currently trading at $83,000. Ethereum dipped to approximately $1,828 but was quickly bought up, leading to a recovery toward $1,861.

A positive sign comes from a Santiment report, which highlights a sharp increase in network activity for Tether, including a rise in new wallets and transaction volumes. Such activity is typically observed near local market extremes. Given the recent decline in the market, this surge in activity could indicate that traders are preparing to invest in the crypto market.

However, it's important to note that the correlation between Tether activity and subsequent market growth is not always direct. Other factors, such as macroeconomic conditions, regulatory developments, and overall trends in the crypto market, must also be taken into account.

Nonetheless, increased activity in the Tether network may serve as one indicator of a potential reversal of the bearish correction. Traders should pay attention to this signal and conduct their own research before making any decisions. While this could be an early sign of market recovery, it is risky to rely solely on one indicator.

As for the intraday trading strategy, I will focus on significant dips in Bitcoin and Ethereum, anticipating continuing the bullish trend in the medium term.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today if it reaches the entry point around $83,600, targeting a rise to $86,000. Around $86,000, I will exit my buy positions and immediately sell on the rebound. Before buying on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory.

Scenario #2: Bitcoin can also be bought from the lower boundary of $82,200 if there is no market reaction to its breakout, with an expected rise toward $83,600 and $86,000.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today if it reaches the entry point around $82,200, targeting a decline to $80,200. Around $80,200, I will exit my sell positions and immediately buy on the rebound. Before selling on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory.

Scenario #2: Bitcoin can also be sold from the upper boundary of $83,600 if there is no market reaction to its breakout, with an expected decline toward $82,200 and $80,200.

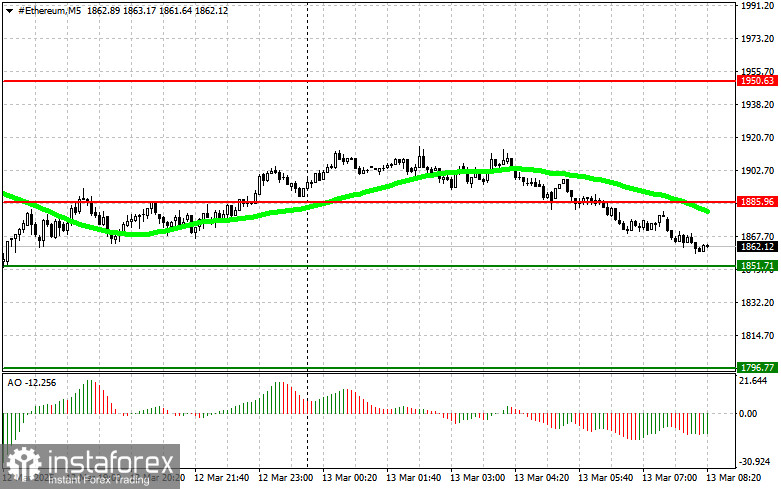

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today if it reaches the entry point around $1,885, targeting a rise to $1,950. Around $1,950, I will exit my buy positions and immediately sell on the rebound. Before buying on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory.

Scenario #2: Ethereum can also be bought from the lower boundary of $1,851 if there is no market reaction to its breakout, with an expected rise toward $1,885 and $1,950.

Sell Scenario

Scenario #1: I plan to sell Ethereum today if it reaches the entry point around $1,851, targeting a decline to $1,796. Around $1,796, I will exit my sell positions and immediately buy on the rebound. Before selling on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory.

Scenario #2: Ethereum can also be sold from the upper boundary of $1,885 if there is no market reaction to its breakout, with an expected decline toward $1,851 and $1,796.