Trade Review and Tips for Trading the British Pound

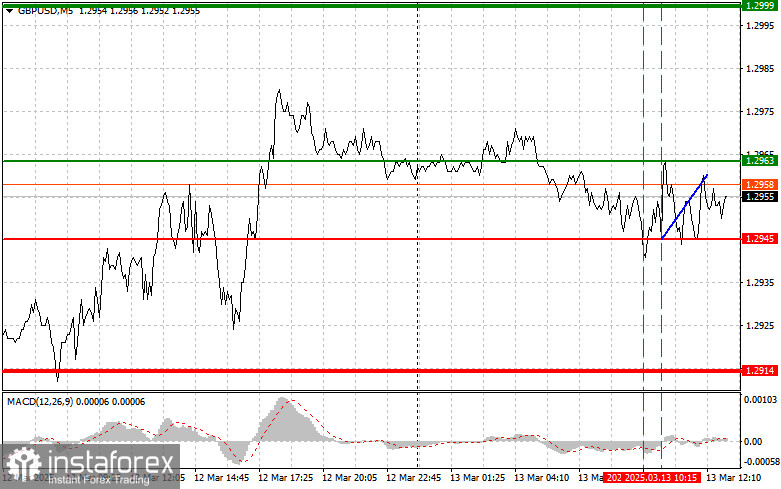

The price test at 1.2945 occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downward potential. For this reason, I did not sell the pound. A second test of 1.2945 after a short period allowed Scenario #2 for buying to play out within the ongoing uptrend, leading to only a 15-point increase in the pair.

The lack of UK economic data is no longer helping the British pound rise, making it the right time to shift focus to U.S. indicators. In the afternoon, attention will turn to key U.S. data releases: the Producer Price Index (PPI) and its core version, which excludes volatile food and energy prices for February. An acceleration in inflation could be a decisive factor for the Federal Reserve's monetary policy, likely supporting the dollar. Conversely, slower inflation would give the Fed more room for maneuver and a softer policy stance, which many investors are hoping for, especially after the latest Consumer Price Index (CPI) data.

For intraday strategy, I will focus more on implementing Scenarios #1 and #2

Buy Signal

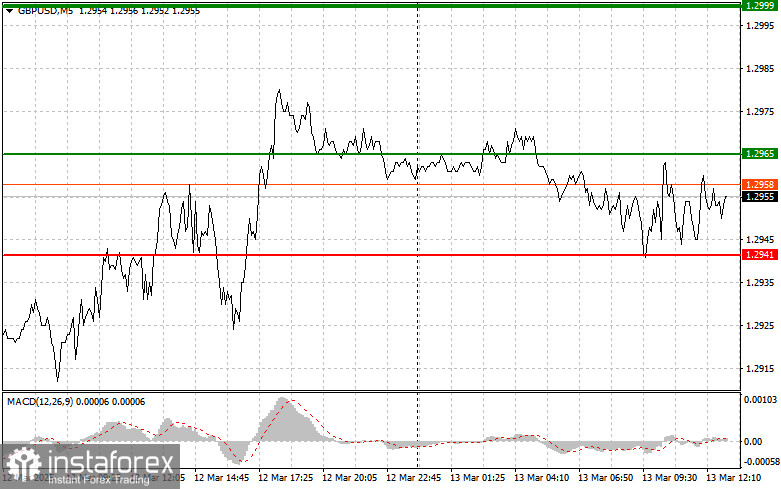

Scenario #1: Today, I plan to buy the pound at 1.2965 (green line on the chart), targeting a rise to 1.3000 (thicker green line on the chart). Around 1.3000, I will exit buy positions and open sell positions in the opposite direction, aiming for a 30-35 point downward move from that level. Further pound growth today would align with the prevailing uptrend. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.2941 twice in a row, while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. A rise can be expected toward 1.2965 and 1.3000.

Sell Signal

Scenario #1: Today, I plan to sell the pound after breaking below 1.2941 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.2910, where I plan to exit short positions and immediately buy in the opposite direction, targeting a 20-25 point rebound from this level. Selling pressure may increase if U.S. inflation data comes in higher than expected. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the pound today if the price tests 1.2965 twice in a row, while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward 1.2941 and 1.2910.

Chart Explanation

- Thin green line – Entry price for buying the trading instrument.

- Thick green line – Expected price level where Take Profit orders can be placed or profits can be manually secured, as further growth above this level is unlikely.

- Thin red line – Entry price for selling the trading instrument.

- Thick red line – Expected price level where Take Profit orders can be placed or profits can be manually secured, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, it is essential to consider overbought and oversold zones.

Important Notice for Beginner Traders

Beginner traders in the Forex market should exercise extreme caution when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news events, always set stop-loss orders to minimize losses. Without stop-loss protection, you could quickly lose your entire deposit, especially if you trade large volumes without proper risk management.

Finally, successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are a losing strategy for intraday traders.