Despite sellers of risk assets' desperate attempts to achieve a meaningful correction, nothing has worked. The euro and the pound continue to trade within sideways channels, maintaining good prospects for further upward trends.

News that the U.S. Senate, following the House of Representatives, passed a bill to extend government funding until September 30 went largely unnoticed by the market, as hardly anyone doubted this outcome. Traders had already priced in this decision, which prevents an imminent "shutdown" and gives lawmakers time for more thorough budget discussions for the next fiscal year. The focus will shift to the upcoming Federal Reserve meeting and macroeconomic indicators. Geopolitical risks and global economic growth prospects also influence trader sentiment, limiting the upside potential of risk assets.

The Bundesbank Monthly Report will be published in the first half of today. Despite its seemingly routine nature, this document often contains valuable insights into the current state and outlook of the German economy. Economists closely analyze the Bundesbank's comments on inflation, interest rates, consumer spending, and industrial activity.

Given Germany's dominant role in the eurozone, the report may shed light on the possible future direction of the European Central Bank's monetary policy. Any signals of slowing economic growth or rising inflationary pressures could significantly impact currency markets and stock indices.

Despite not-so-optimistic GDP and industrial sector data for the UK, the British currency is showing resilience against the U.S. dollar, keeping the prospects for an ongoing upward trend intact.

If the data aligns with economists' expectations, it is advisable to use a Mean Reversion strategy. In contrast, if the data greatly exceeds or falls short of expectations, the Momentum strategy is recommended.

Momentum Strategy (on breakout):

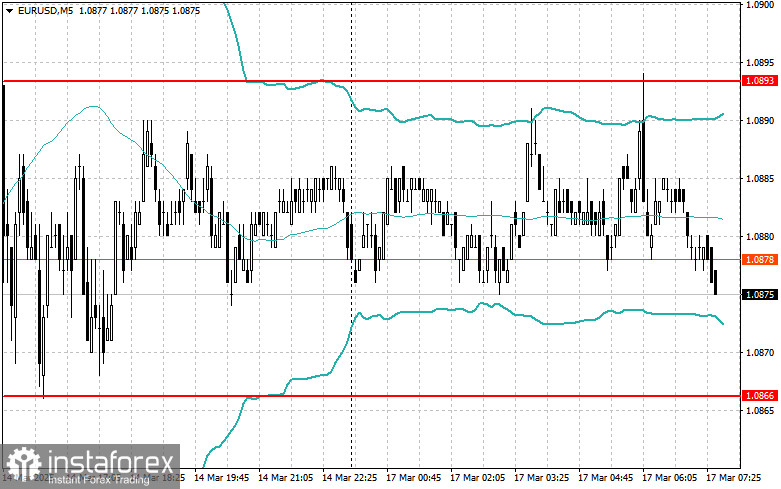

EUR/USD

Buying on a breakout above 1.0906 could lead to euro growth towards 1.0945 and 1.0997.

Selling on a breakout below 1.0866 could lead to a decline towards 1.0827 and 1.0770.

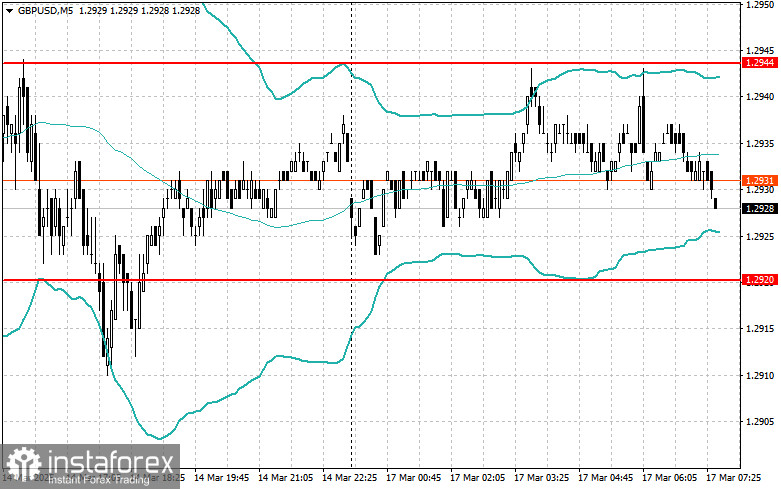

GBP/USD

Buying on a breakout above 1.2950 could lead to pound growth towards 1.2985 and 1.3028.

Selling on a breakout below 1.2930 could lead to a decline towards 1.2910 and 1.2875.

USD/JPY

Buying on a breakout above 149.15 could push the dollar towards 149.40 and 149.70.

Selling on a breakout below 148.90 could trigger a decline towards 148.50 and 148.20.

Mean Reversion Strategy (on pullbacks):

EUR/USD

Looking to sell after a failed breakout above 1.0893 if the price returns below this level.

Looking to buy after a failed breakout below 1.0866 if the price returns above this level.

GBP/USD

Looking to sell after a failed breakout above 1.2944 if the price returns below this level.

Looking to buy after a failed breakout below 1.2920 if the price returns above this level.

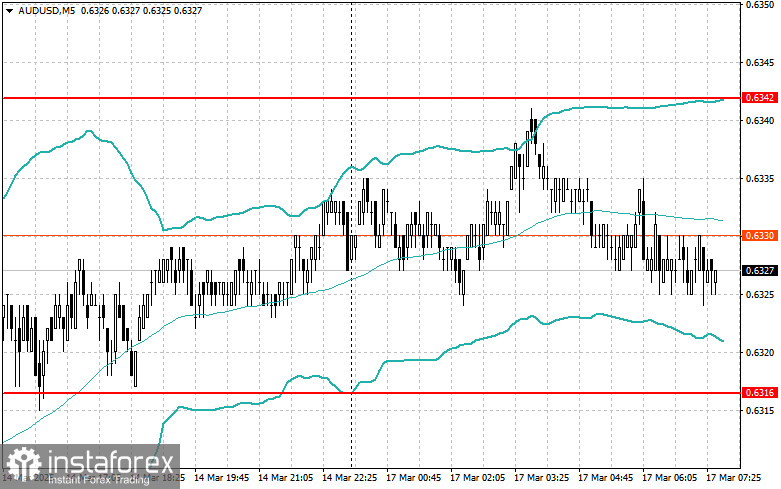

AUD/USD

Looking to sell after a failed breakout above 0.6342 if the price returns below this level.

Looking to buy after a failed breakout below 0.6316 if the price returns above this level.

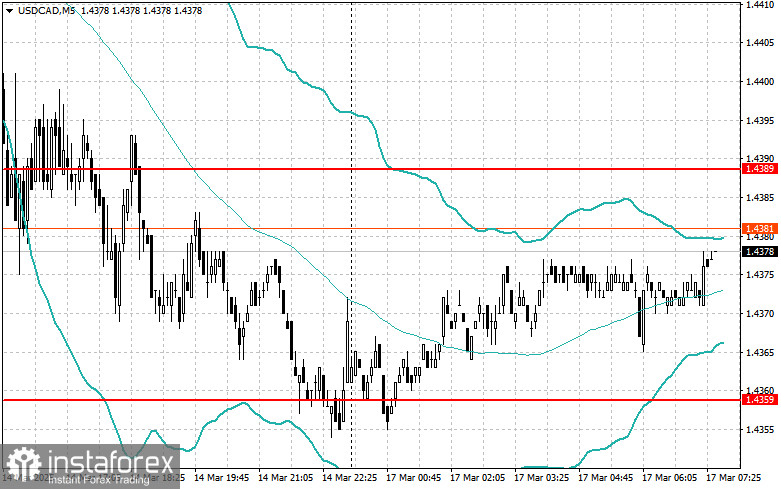

USD/CAD

Looking to sell after a failed breakout above 1.4389 if the price returns below this level.

Looking to buy after a failed breakout below 1.4359 if the price returns above this level.