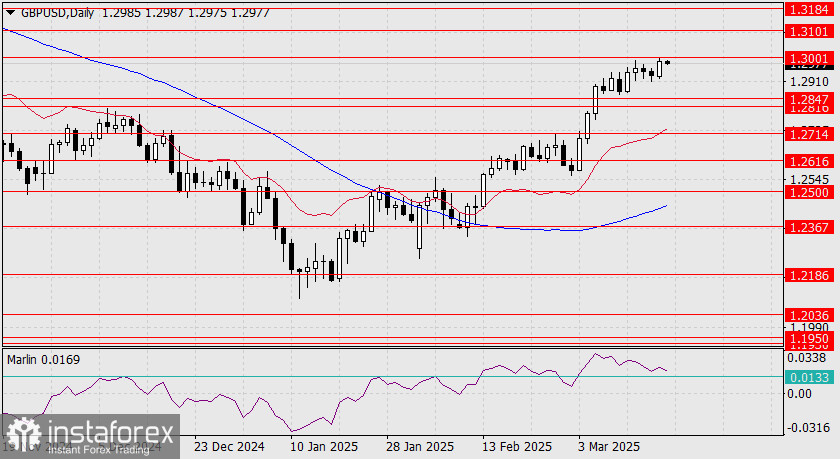

On Monday, the pound rose by 53 pips and is now testing the resistance level at 1.3001. A breakout above this level would propel the pound's growth toward 1.3101. However, the pound must navigate the Federal Reserve's monetary policy decision tomorrow and the Bank of England meeting the following day.

From a technical standpoint, the price could fall to the support range of 1.2816 to 1.2847 due to speculative movements, but for now, the overall trend remains upward.

On the four-hour chart, the Marlin oscillator has broken out of its range to the upside, providing some optimism for the bulls. However, the consolidation range for the next day and a half (until the Fed's announcement) is rather narrow, limited by the MACD line at 1.2953 (a span of just 44 pips). The price may not be able to sustain this compression and could break out of the range prematurely, resulting in a false move. If the price consolidates above 1.3001, it would pave the way for growth toward 1.3101 and possibly up to 1.3184. From a purely technical perspective, the trend remains bullish and is not yet in an overbought condition.