EUR/USD

Analysis:

The euro's primary pair continues the upward trend that began in early February. Quotes remain within a broad potential reversal zone. Over the past three weeks, the price has been forming a flat corrective pattern. Support is located along the lower edge of the reversal zone.

Forecast:

Expect the general sideways tone to persist over the week, with a higher probability of a downward move in the first days, followed by a potential shift and resumption of price growth toward calculated resistance.

Potential Reversal Zones Resistance: 1.0960 / 1.1010 Support: 1.0740 / 1.0690

Recommendations:

- Selling: Can be applied with reduced volume size within specific sessions.

- Buying: Risky and potentially loss-making until reversal signals appear near the support zone.

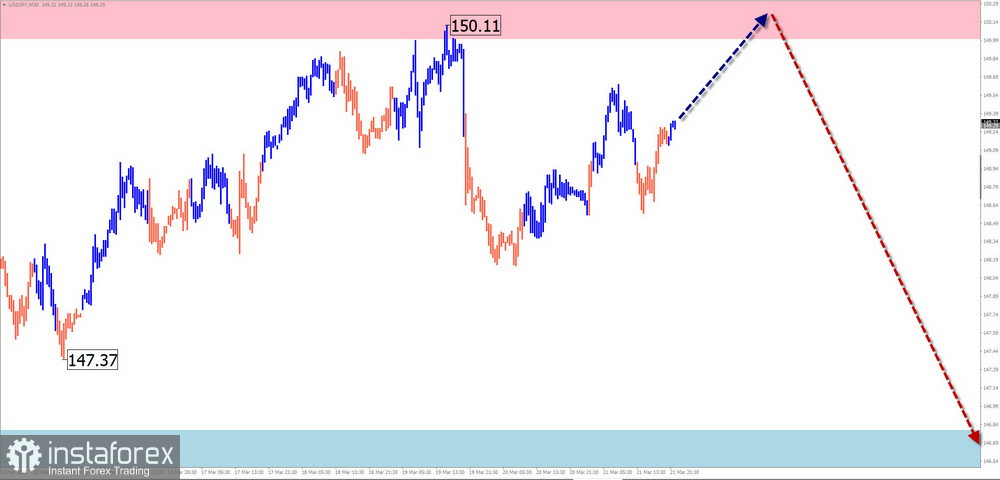

USD/JPY

Analysis:

The short-term trend aligns with the global bullish trend. Since August last year, a bullish wave pattern has defined the direction. A corrective segment began in December and remains incomplete. Over the last three weeks, price has been moving sideways.

Forecast:

Expect a rise toward the resistance zone within 1–2 days. A reversal may form afterward. A trend shift is likely amid increased volatility closer to the weekend. A downward movement is expected no further than the support zone.

Potential Reversal Zones Resistance: 150.00 / 150.50 Support: 146.80 / 146.30

Recommendations:

- Buying: Possible intraday with small volume size, targeting no higher than resistance.

- Selling: Consider small-volume trades only after confirmed reversal signals appear.

GBP/JPY

Analysis:

Since December, GBP/JPY has followed a short-term bearish wave pattern. For the past two months, it has been forming wave (B), the middle section of a zigzag structure, which appears close to completion. The pair is now at the lower edge of a strong reversal zone.

Forecast:

A sideways move is expected at the start of the week, with a potential rise toward resistance. Increased volatility, reversal, and a return to the downward trend are more likely toward the weekend. Support defines the lower weekly range.

Potential Reversal Zones Resistance: 193.70 / 194.20 Support: 191.00 / 190.50

Recommendations:

- Buying: Limited potential; close positions at the first sign of a reversal.

- Selling: Use confirmed reversal signals from your trading system to enter positions.

USD/CAD

Analysis:

The unfinished wave pattern remains bearish since February. The current segment represents corrective wave (B), still in progress. The price is trapped within a sideways corridor between reversal zones on different timeframes.

Forecast:

After a likely consolidation, a renewed decline toward the support zone remains possible. Toward the end of the week, expect bullish sentiment to resume, possibly reaching calculated resistance.

Potential Reversal Zones Resistance: 1.4480 / 1.4530 Support: 1.4280 / 1.4230

Recommendations:

- Buying: Premature without confirmed reversal signals from your trading system near support.

- Selling: High risk; reduce volume size and exit at first signs of reversal.

#Bitcoin

Analysis:

Bitcoin continues to move downward within an ongoing bearish wave structure that began in July last year. The final segment (C) is currently forming. Price has broken through a strong support zone, which has now turned into resistance.

Forecast:

Expect continued decline throughout the week from the resistance zone toward the calculated support. Temporary pressure on the upper boundary of resistance is possible in the near term.

Potential Reversal Zones Resistance: 87,500 / 88,500 Support: 73,500 / 72,500

Recommendations:

- Buying: Not recommended; potential is lacking and may lead to losses.

- Selling: Valid only after confirmed reversal signals near the resistance zone from your trading strategy.

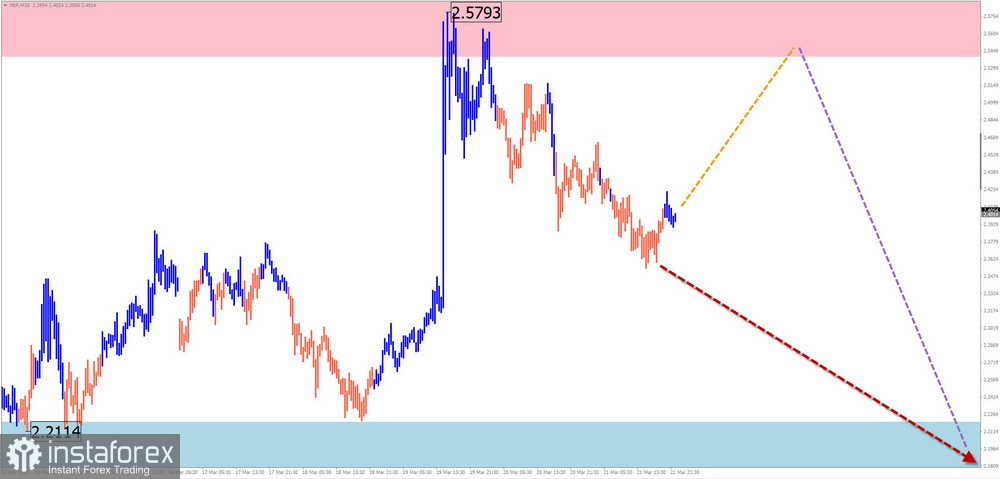

#Ripple

Analysis:

Ripple quotes are in a cluster of strong reversal levels across multiple chart scales. The prevailing downward wave (B) that began this month is still unfolding. Once complete, the short-term bearish trend is expected to continue.

Forecast:

This week, expect the upward movement to end, followed by a reversal in the resistance zone and a renewed downward move. Support marks the lower boundary of the week's range.

Potential Reversal Zones Resistance: 2.5400 / 2.5900 Support: 2.2200 / 2.1700

Recommendations:

- Buying: May be used with reduced volume size in isolated sessions. Potential limited to resistance.

- Selling: Valid after confirmed reversal signals near the resistance zone.

Notes: In Simplified Wave Analysis (SWA), all waves consist of 3 parts (A-B-C). Only the most recent unfinished wave is analyzed on each timeframe. Dotted lines indicate projected movements.

Warning: The wave algorithm does not account for the duration of price movements over time.