Analysis of Macroeconomic Reports:

Very few macroeconomic events are scheduled for Tuesday, and none are of significant importance. At best, the German business climate report and U.S. new home sales data can be mentioned, though even these reports are unlikely to impact currency pair movements or trader sentiment today. Technical factors and Donald Trump will remain the primary drivers for the forex market.

Analysis of Fundamental Events:

Among Tuesday's fundamental events, the speeches by Federal Reserve officials Adriana Kugler and John Williams can be noted. However, the last Fed meeting occurred just last week, and Jerome Powell clearly outlined the central bank's stance for the coming months. It is unlikely that Kugler or Williams will add anything new. In any case, the Fed's monetary policy currently holds little weight for traders, who continue to focus solely on Trump and his trade policy.

General Conclusions:

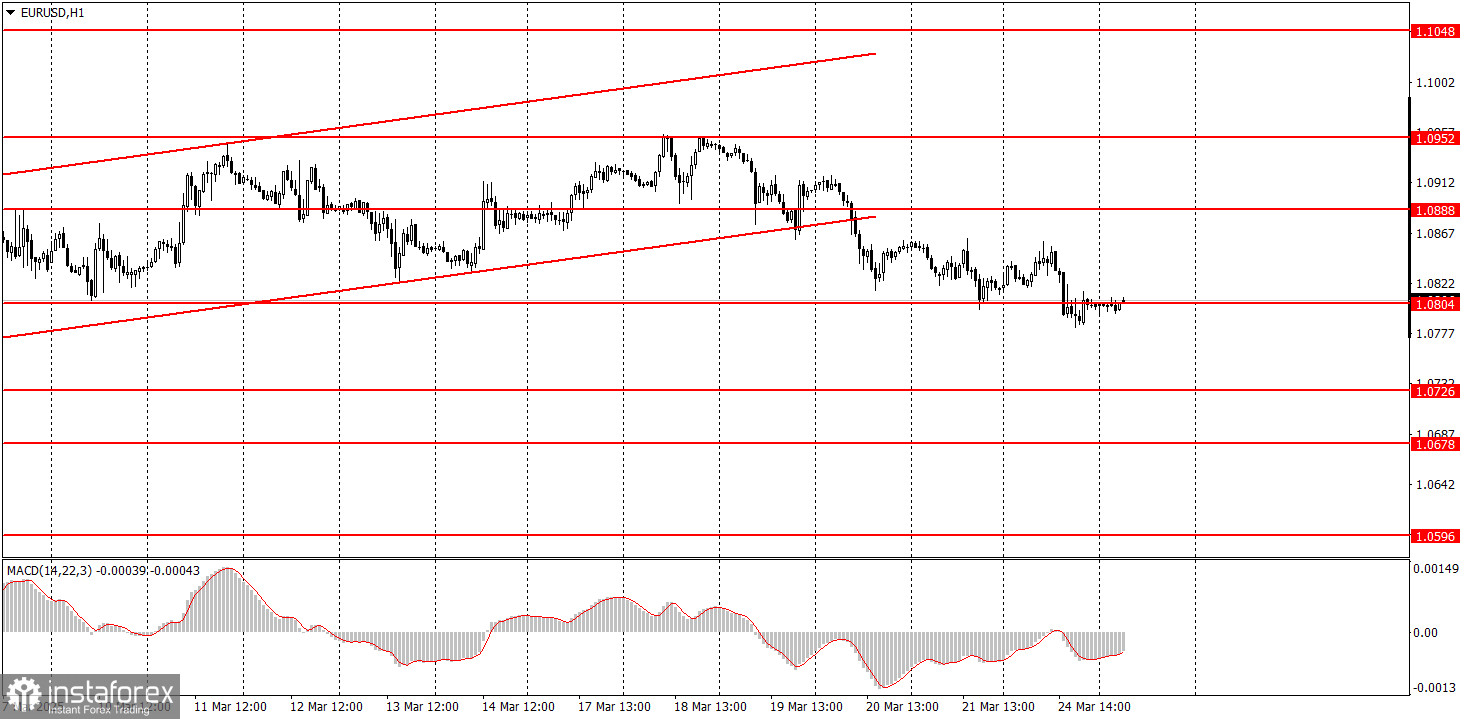

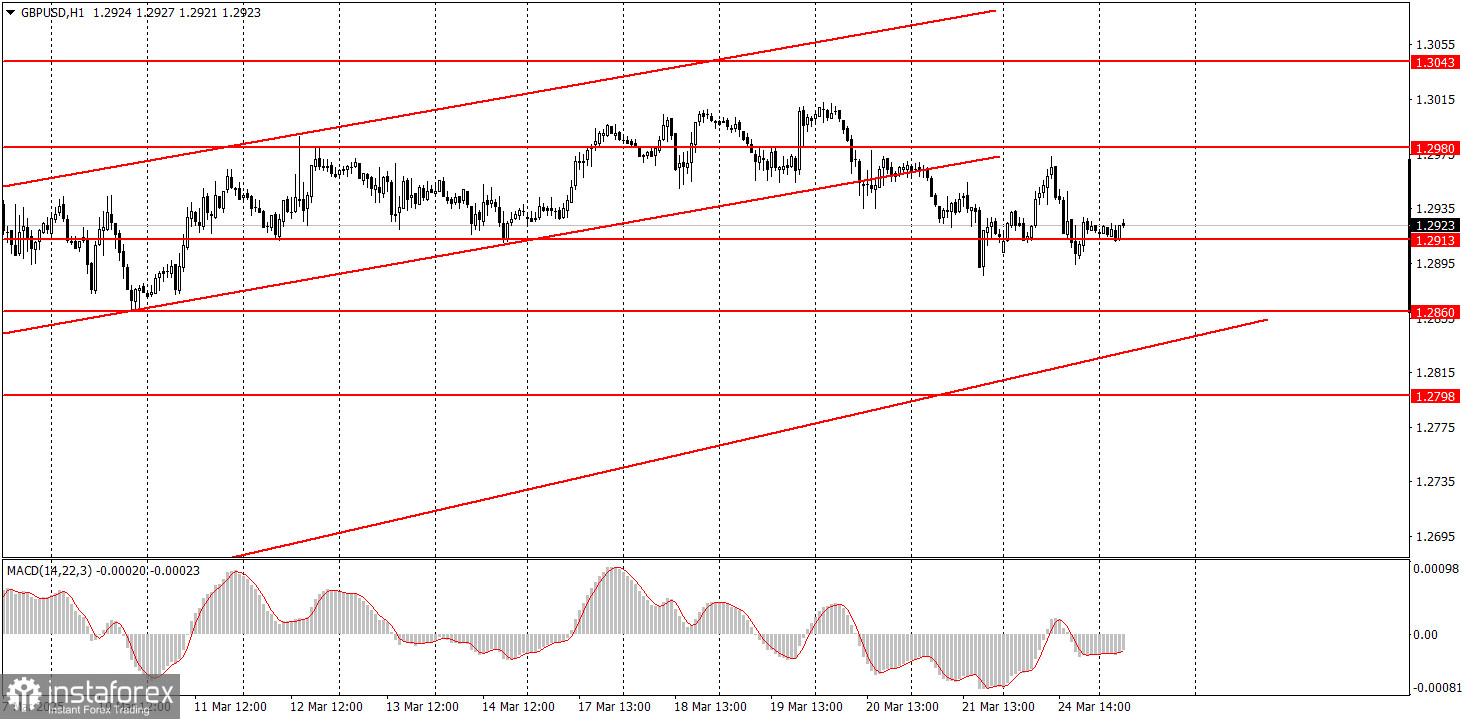

During the second trading day of the week, both currency pairs may continue the decline that has been building in recent weeks. Both pairs have fallen below their ascending channels, and the Fed's current stance allows the dollar to reclaim some of the ground it had unfairly lost. Of course, no one knows when Trump will announce new trade tariffs or what form they will take, but this factor also cannot drive the dollar lower indefinitely.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.