Bitcoin and Ethereum have reached significant levels but failed to hold them.

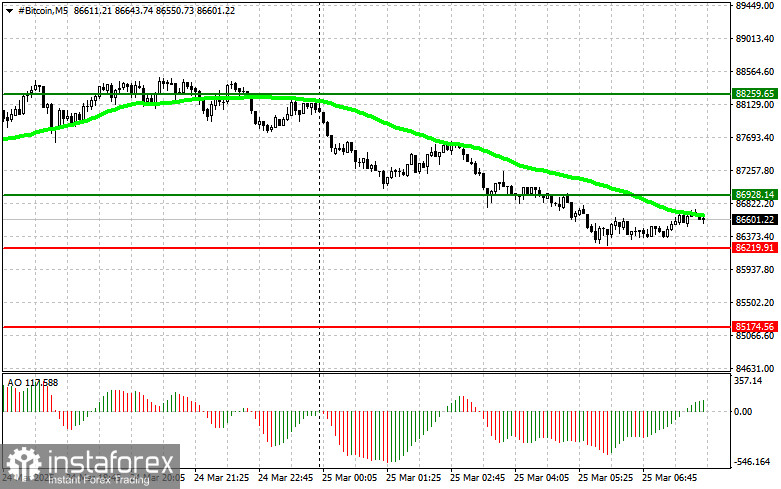

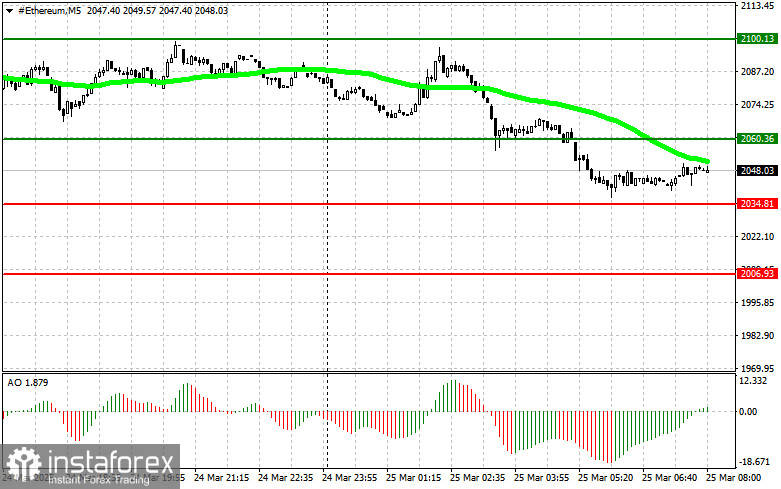

Bitcoin climbed to $88,600 before pulling back and now trades around $86,600. Ethereum also corrected after another failed attempt to break above $2,100 during today's Asian session, falling to the $2,045 area.

Meanwhile, ETFs continue to buy significantly more BTC than miners produce. This indicates that the growth potential for the world's first cryptocurrency remains intact despite the recent pullbacks. Last week, U.S. spot BTC-ETFs purchased nearly three times more BTC than miners produced over the same period. This also highlights the growing institutional appetite for crypto assets and their confidence in Bitcoin's long-term potential.

The increased demand from ETFs has a noticeable impact on market dynamics, reflected in the recent price growth. The reduction in available BTC supply due to aggressive ETF buying contributes to price appreciation. This creates a favorable environment for further investment inflows and reinforces Bitcoin's position as a key asset. Despite playing a crucial role in maintaining the network, Miners cannot keep up with the growing demand. This emphasizes the need to explore new scaling solutions and increase network throughput — but that's a topic for another time.

As for intraday strategy in the crypto market, I will continue to rely on sharp pullbacks in Bitcoin and Ethereum, expecting the medium-term bull market to remain intact.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy Scenario

Scenario 1: I plan to buy Bitcoin today upon reaching the entry point around $86,900, targeting a rise to $88,200. I'll exit longs near $88,200 and sell on a pullback. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: Buying Bitcoin is also possible from the lower boundary at $86,200 if there is no market reaction to a breakout below this level, with a reversal back toward $86,900 and $88,200.

Sell Scenario

Scenario 1: I plan to sell Bitcoin today upon reaching the entry point around $86,200, targeting a drop to $85,100. I'll exit shorts near $85,100 and buy immediately on a bounce. Before selling a breakout, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory.

Scenario 2: Selling Bitcoin is also possible from the upper boundary at $86,900 if there is no market reaction to a breakout above this level, with a reversal back toward $86,200 and $85,100.

Ethereum

Buy Scenario

Scenario 1: I plan to buy Ethereum today at the entry point around $2,060, targeting a rise to $2,100. I'll exit longs near $2,100 and sell immediately on a pullback. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: Buying Ethereum is also possible from the lower boundary at $2,034 if there is no market reaction to a breakout below this level, with a reversal back toward $2,060 and $2,100.

Sell Scenario

Scenario 1: I plan to sell Ethereum today at the entry point around $2,034, targeting a drop to $2,006. I'll exit shorts at around $2,006 and buy immediately on a bounce. Before selling a breakout, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory.

Scenario 2: Selling Ethereum is also possible from the upper boundary at $2,060 if there is no market reaction to a breakout above this level, with a reversal back toward $2,034 and $2,006.