The euro continued to decline, while the pound showed resilience, indicating that there are still buyers willing to enter the market even at current price levels.

The release of the U.S. Consumer Confidence Index did not exert significant pressure on the dollar despite the indicator dropping sharply and coming below economists' forecasts. Trump's actions and policies are affecting consumer sentiment. However, contrary to expectations, this did not weaken the dollar's position. Traders likely interpreted the drop as a temporary phenomenon rather than a signal of underlying problems in the U.S. economy. Support for the dollar came from speeches by Federal Reserve officials.

No economic reports are scheduled for the eurozone today, so all attention will turn to UK data. The cycle of UK economic news will begin with the release of February's Consumer Price Index (CPI) and core inflation data. It will conclude with the publication of the Producer Price Index (PPI) and Retail Price Index (RPI), with the highlight being the presentation of the country's annual budget. The influence of these indicators on the British pound and the overall economic outlook cannot be overstated. CPI directly impacts consumer purchasing power and influences the Bank of England's interest rate decisions. A rise in CPI could prompt tighter monetary policy, leading to pound appreciation.

The Producer Price Index reflects changes in the cost of production for goods and services. Rapid growth in PPI may signal upcoming consumer inflation. While the Retail Price Index is less commonly used than CPI, it still plays a role in adjusting contracts and wages, making its trend relevant for assessing overall inflation.

The Mean Reversion strategy is recommended if the data aligns with economists' expectations. If the figures deviate significantly (higher or lower) from expectations, the Momentum strategy is preferred.

Momentum Strategy (on breakout):

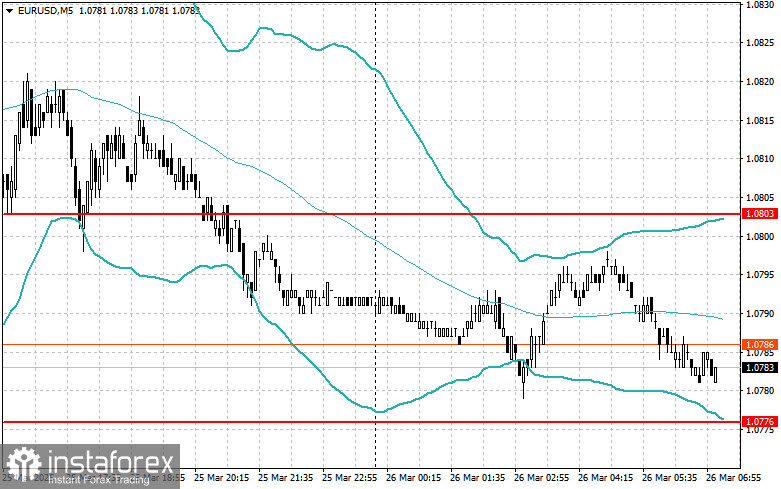

EUR/USD

Buy on a breakout above 1.0795. Target: 1.0836 and 1.0852

Sell on a breakout below 1.0780. Target: 1.0746 and 1.0715

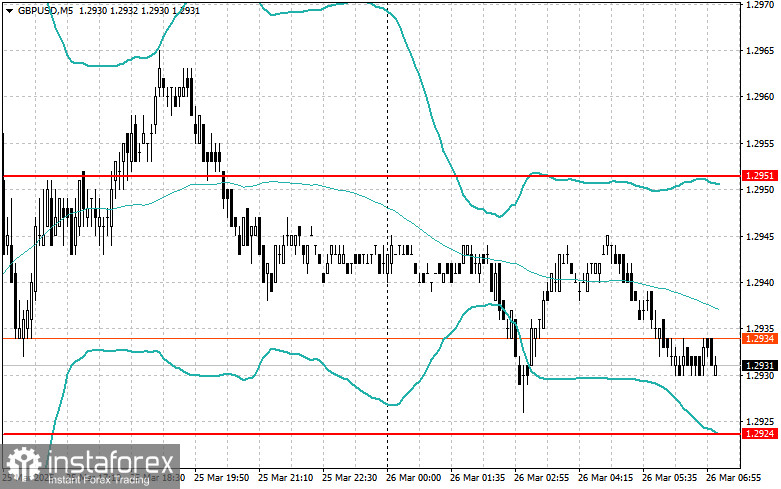

GBP/USD

Buy on a breakout above 1.2940. Target: 1.2970 and 1.2999

Sell on a breakout below 1.2925. Target: 1.2875 and 1.2841

USD/JPY

Buy on a breakout above 150.75. Target: 151.05 and 151.49

Sell on a breakout below 150.49. Target: 150.18 and 149.80

Mean Reversion Strategy (on pullbacks):

EUR/USD

Look to sell after a failed breakout above 1.0803 followed by a return below

Look to buy after a failed breakout below 1.0776 followed by a return above

GBP/USD

Look to sell after a failed breakout above 1.2951 followed by a return below

Look to buy after a failed breakout below 1.2924 followed by a return above

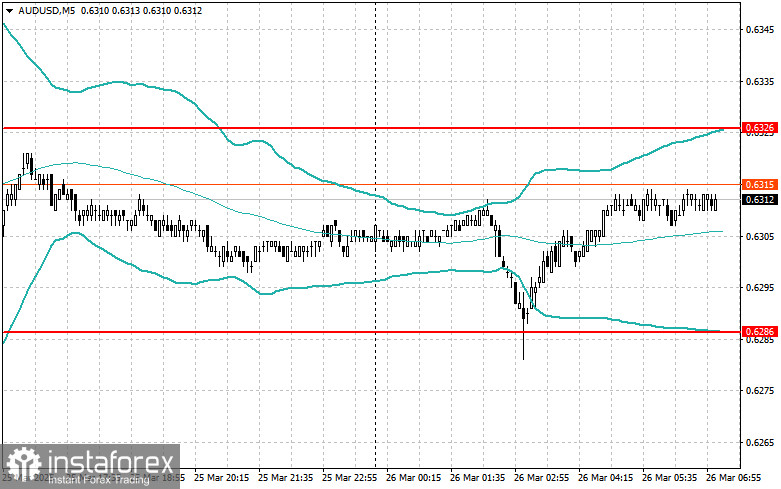

AUD/USD

Look to sell after a failed breakout above 0.6326 followed by a return below

Look to buy after a failed breakout below 0.6286 followed by a return above

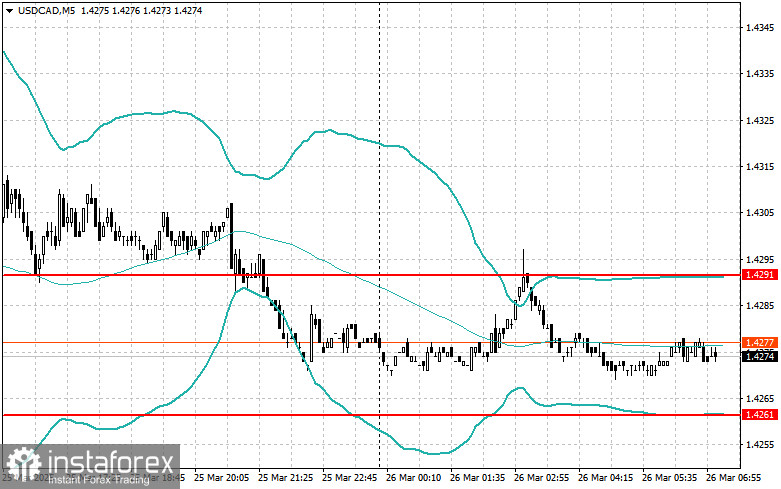

USD/CAD

Look to sell after a failed breakout above 1.4291 followed by a return below

Look to buy after a failed breakout below 1.4261 followed by a return above