The euro and pound showed gains, but it's still too early to say the downward corrections are over. Buyers will need to exert more effort to alter the current technical situation.

The U.S. Personal Consumption Expenditures (PCE) index matched economists' forecasts. This indicates that the trade policy pursued by the Trump administration has not yet significantly impacted inflation, which had been one of the Federal Reserve's main concerns. This situation gives the Fed room to maintain a more flexible monetary policy. At the same time, despite moderate price growth, the U.S. economy is showing signs of slowing down, as recent data suggest.

As a result, the Fed faces a complex challenge: on the one hand, there is no clear case for maintaining a tight monetary stance; on the other, there is a need to stimulate the economy to avoid a deeper downturn. Given this context, the Fed will likely remain in wait-and-see mode, carefully analyzing economic indicators and considering geopolitical risks before making rate decisions.

Several important economic reports are scheduled for release today, including Germany's retail sales and consumer price index. Similar inflation data from Italy will also be published. These indicators are significant, as they help assess the state of consumer demand and inflationary pressure in two key eurozone economies. A decline in German retail sales may signal slower economic growth, while a rise in the CPI would indicate increasing inflation.

A similar situation applies to Italy: inflation data will reveal how much prices are rising for Italian consumers. High inflation could negatively affect household purchasing power and reduce consumer spending. This data may influence the European Central Bank's monetary policy decisions. If inflation remains high, the ECB may keep interest rates unchanged, which would support the euro.

The Mean Reversion strategy is recommended if the data aligns with economists' expectations. If the figures deviate significantly (higher or lower) from expectations, the Momentum strategy is preferred.

Momentum Strategy (on breakout):

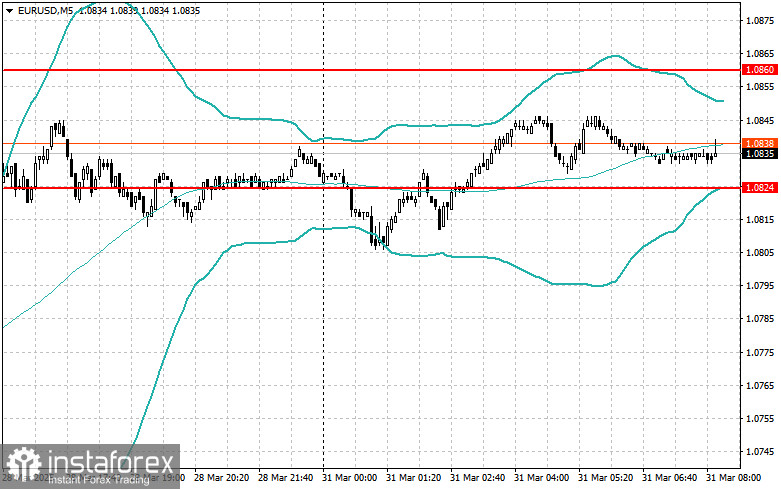

EUR/USD

Buying on a breakout above 1.0860 may lead to euro rising toward 1.0892 and 1.0923.

Selling on a breakout below 1.0829 may lead to euro falling toward 1.0798 and 1.0767.

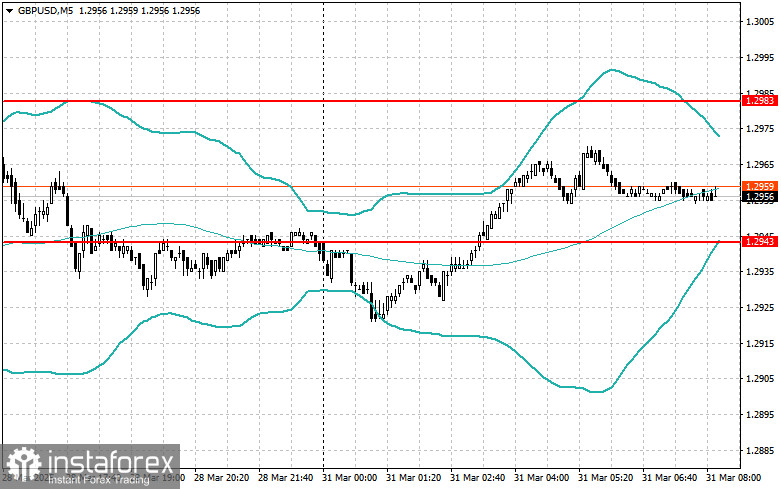

GBP/USD

Buying on a breakout above 1.2966 may lead to the pound rising toward 1.2988 and 1.3010.

Selling on a breakout below 1.2945 may lead to the pound falling toward 1.2922 and 1.2900.

USD/JPY

Buying on a breakout above 149.32 may lead to the dollar rising toward 149.62 and 149.92.

Selling on a breakout below 148.97 may trigger a decline toward 148.58 and 148.20.

Mean Reversion Strategy (on pullbacks):

EUR/USD

I will look to sell after a failed breakout above 1.0860, once the price returns below this level.

I will look to buy after a failed breakout below 1.0824, once the price returns back to this level.

GBP/USD

I will look to sell after a failed breakout above 1.2983, once the price returns below this level.

I will look to buy after a failed breakout below 1.2943, once the price returns back to this level.

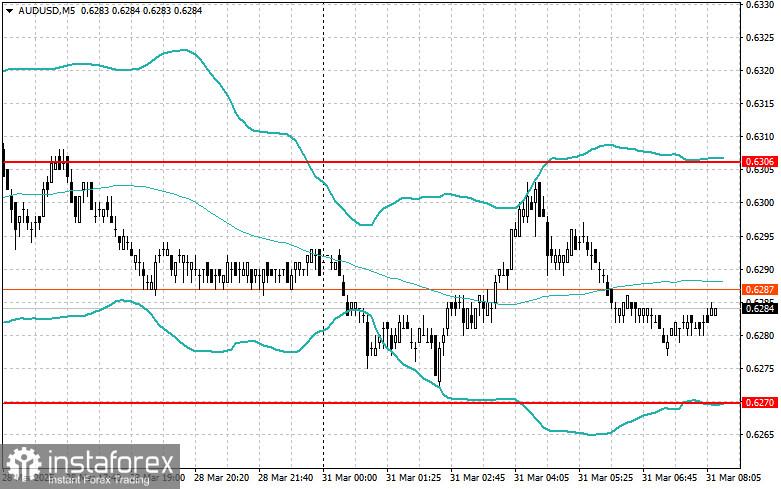

AUD/USD

I will look to sell after a failed breakout above 0.6306, once the price returns below this level.

I will look to buy after a failed breakout below 0.6270, once the price returns back to this level.

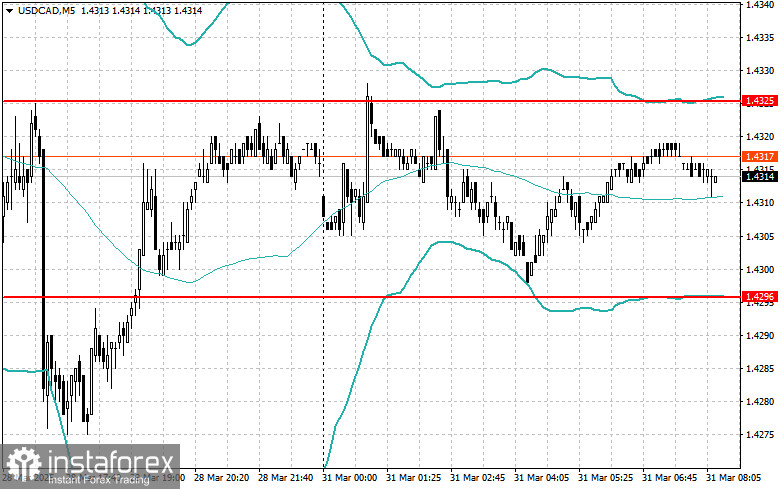

USD/CAD

I will look to sell after a failed breakout above 1.4325, once the price returns below this level.

I will look to buy after a failed breakout below 1.4296, once the price returns back to this level.