However, today will bring key data from both the U.S. and the Eurozone in the context of the ongoing tariff wars — the Purchasing Managers' Index (PMI) figures. Forecasts suggest that the advantage lies with the U.S. economy: Eurozone Manufacturing PMI is expected to rise from 47.6 to 48.7, while the U.S. Manufacturing PMI, though projected to fall from 52.7 to 49.8, will still surpass the European figure. According to the ISM, the U.S. Manufacturing PMI may decrease from 50.3 to 49.6, which is also better than the European result.

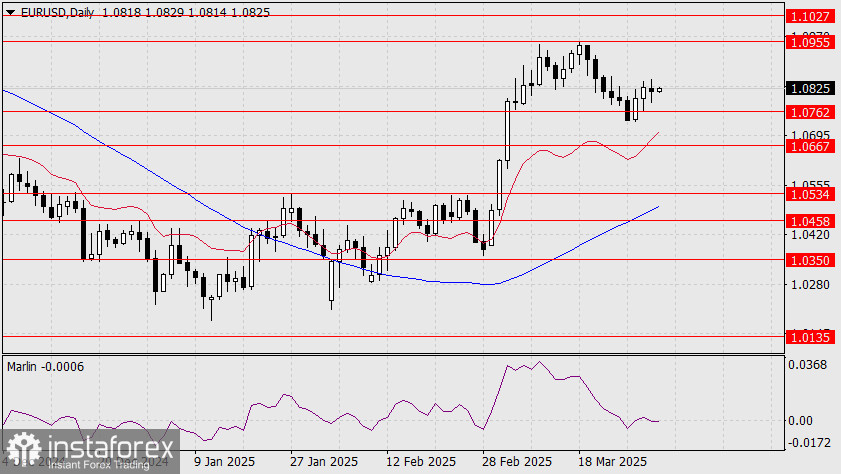

But here lies the usual trap of market psychology combined with algorithmic trading — if U.S. indicators are declining, then the logic becomes to buy the euro. And the growth of the S&P 500 (after a 10.7% correction), as we previously mentioned, could serve as a catalyst. While we do not doubt that the euro will experience a significant decline once all short-term events settle, for now, the upward movement continues. The nearest target is 1.0955, followed by 1.1027.

On the four-hour chart, the price is preparing to break through the MACD line near 1.0840. Marlin is already poised for growth — we just need to see the release of the PMI data.