The euro and the pound are once again in demand, while the U.S. dollar is under heavy pressure. I believe the reason behind this is apparent, although few likely expected such a breakout in risk assets on the currency market.

Yesterday, the euro and the pound posted substantial gains amid a broad weakening of the U.S. dollar following the introduction of trade tariffs by Donald Trump. The dollar's decline was tied to a downward revision in growth forecasts for the U.S. economy. Meanwhile, the euro's strength was supported by upbeat PMI data from eurozone countries, indicating a recovery in the region's economy. This boosted expectations for the European Central Bank to slow its active rate-cutting cycle. However, some traders believe the rally is temporary and simply a negative market reaction to Trump's policies, while others argue that the euro has room to strengthen further if eurozone economic performance continues to improve.

This morning, data on German industrial orders and a series of reports from Italy are expected. Investors will also be paying close attention to updates from the U.S. labor market.

Positive economic readings from Germany and Italy will create additional tailwinds for the euro. On the other hand, weaker data could trigger a correction. The UK will also publish its construction PMI, which could further support pound strength.

If data aligns with economist expectations, the Mean Reversion strategy is preferable. If data deviates significantly from forecasts, a Momentum strategy is preferred.

Momentum Strategy (on breakout):

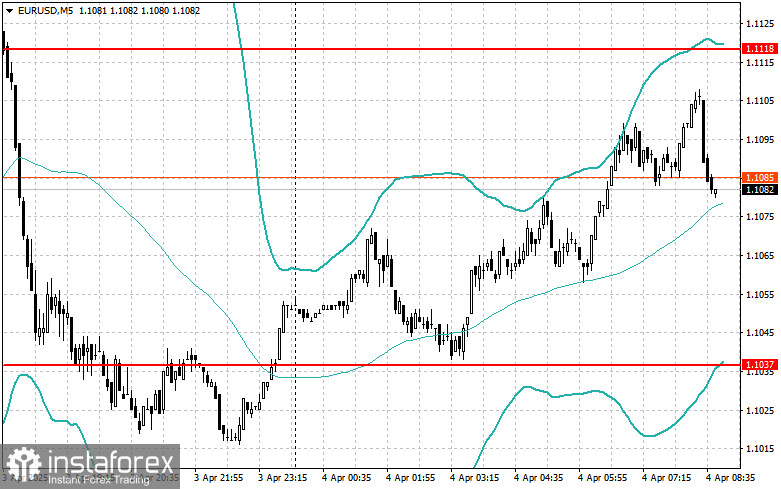

EUR/USD

Buying on a breakout above 1.1097 may lead to a rise toward 1.1143 and 1.1179.

Selling on a breakout below 1.1039 may lead to a decline toward 1.0994 and 1.0946.

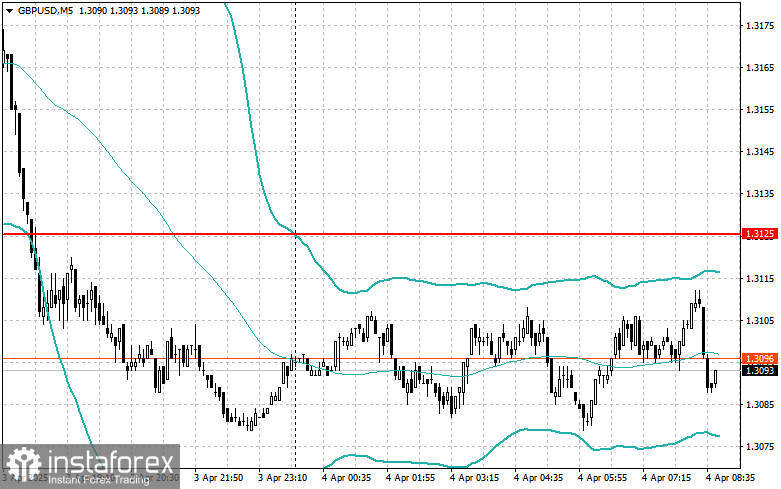

GBP/USD

Buying on a breakout above 1.3128 may lead to a rise toward 1.3171 and 1.3204.

Selling on a breakout below 1.3080 may lead to a drop toward 1.3027 and 1.2976.

USD/JPY

Buying on a breakout above 145.93 may lead to a rise toward 146.22 and 146.49.

Selling on a breakout below 145.60 may lead to a decline toward 145.28 and 144.95.

Mean Reversion Strategy (on pullbacks):

EUR/USD

I'll look to sell after a failed breakout above 1.1118 and a return below this level.

I'll look to buy after a failed breakout below 1.1037 and a return back to this level.

GBP/USD

I'll look to sell after a failed breakout above 1.3125 and a return below this level.

I'll look to buy after a failed breakout below 1.3070 and a return back to this level.

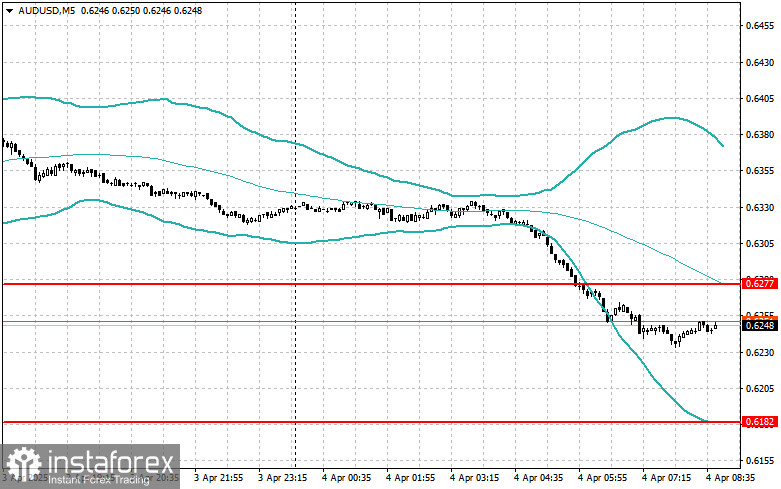

AUD/USD

I'll look to sell after a failed breakout above 0.6277 and a return below this level.

I'll look to buy after a failed breakout below 0.6182 and a return back to this level.

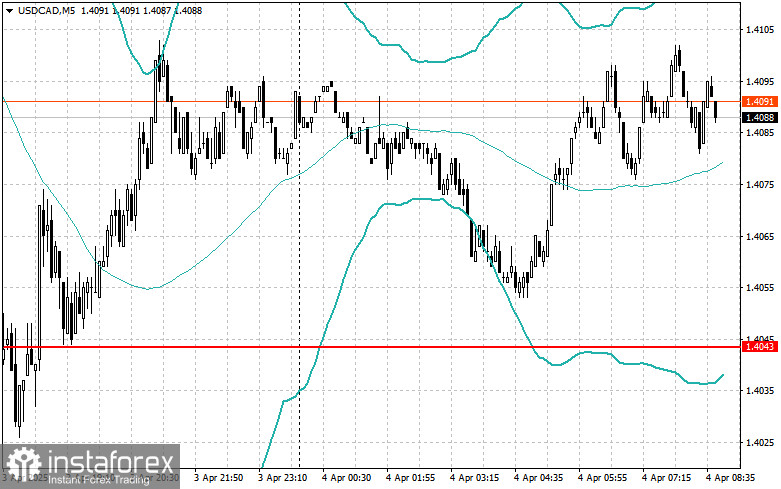

USD/CAD

I'll look to sell after a failed breakout above 1.4124 and a return below this level.

I'll look to buy after a failed breakout below 1.4043 and a return back to this level.