Bitcoin and Ethereum are gradually recovering after the sharp sell-off earlier this week. The situation in the U.S. stock market and its sharp decline are closely tied to the fall in the cryptocurrency market. Given investors' numerous challenges, some discuss the potential onset of a crypto winter.

The crypto market may enter a crypto winter in the face of rising global risks—such as inflation, recession, and conflict escalation. Fearing further declines in digital asset prices, investors might begin mass sell-offs, resulting in sharp price drops and intensifying the bearish trend that started in March of this year.

However, it's worth noting that the crypto industry has grown significantly over the past decade. Institutional investors have emerged, and trading strategies along with infrastructure have advanced. Therefore, if a crypto winter occurs, it may be less severe than in the past, serving instead as a period of consolidation.

The impact of U.S. policy and its correlation with the stock market are critical factors that should not be underestimated. As soon as volatility eases and investors see attractive prices, demand for risk assets may return quickly, so don't miss that moment.

As for intraday strategy in the crypto market, I'll continue to act based on any large pullbacks in Bitcoin and Ethereum, anticipating a continuation of the medium-term bull market, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy Scenario

Scenario #1:

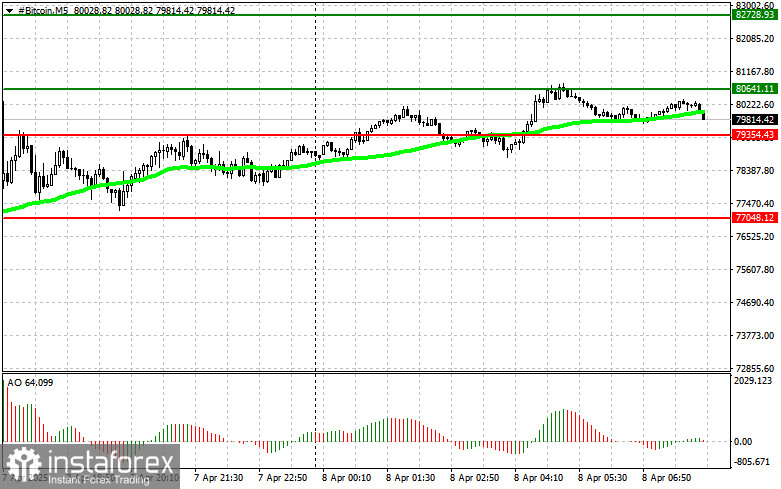

I plan to buy Bitcoin today at an entry point near $80,600, with a target of rising to $82,700. I'll exit long positions and sell on a bounce from $82,700.

Before entering a breakout trade, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2:

If the market does not react to a breakdown, buying from the lower boundary of $79,300 is possible, targeting a reversal to $80,600 and $82,700.

Sell Scenario

Scenario #1:

I plan to sell Bitcoin today at $79,300, targeting a decline to $77,000. I'll exit short positions and buy immediately on a bounce from $77,000.

Before entering a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2:

Selling from the upper boundary of $80,600 is possible if the market shows no reaction to a breakout, targeting a reversal to $79,300 and $77,000.

Ethereum

Buy Scenario

Scenario #1:

I plan to buy Ethereum today at an entry point near $1,608, aiming for a rise to $1,668. I'll exit long positions and sell on a bounce from $1,668.

Before buying a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2:

If there is no reaction to a breakdown, buying from the lower boundary of $1,562 is possible, targeting $1,608 and $1,668.

Sell Scenario

Scenario #1:

I plan to sell Ethereum today at $1,562, targeting a drop to $1,499. I'll exit short positions and buy on a bounce from $1,499.

Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2:

If the market does not react to a breakout, selling from the upper boundary of $1,608 is possible, targeting a return to $1,562 and $1,499.