Bitcoin and Ethereum collapsed by the end of Tuesday, continuing the heavy sell-off during today's Asian session. Another sharp decline in the U.S. stock market dragged other risk assets down, including the cryptocurrency market.

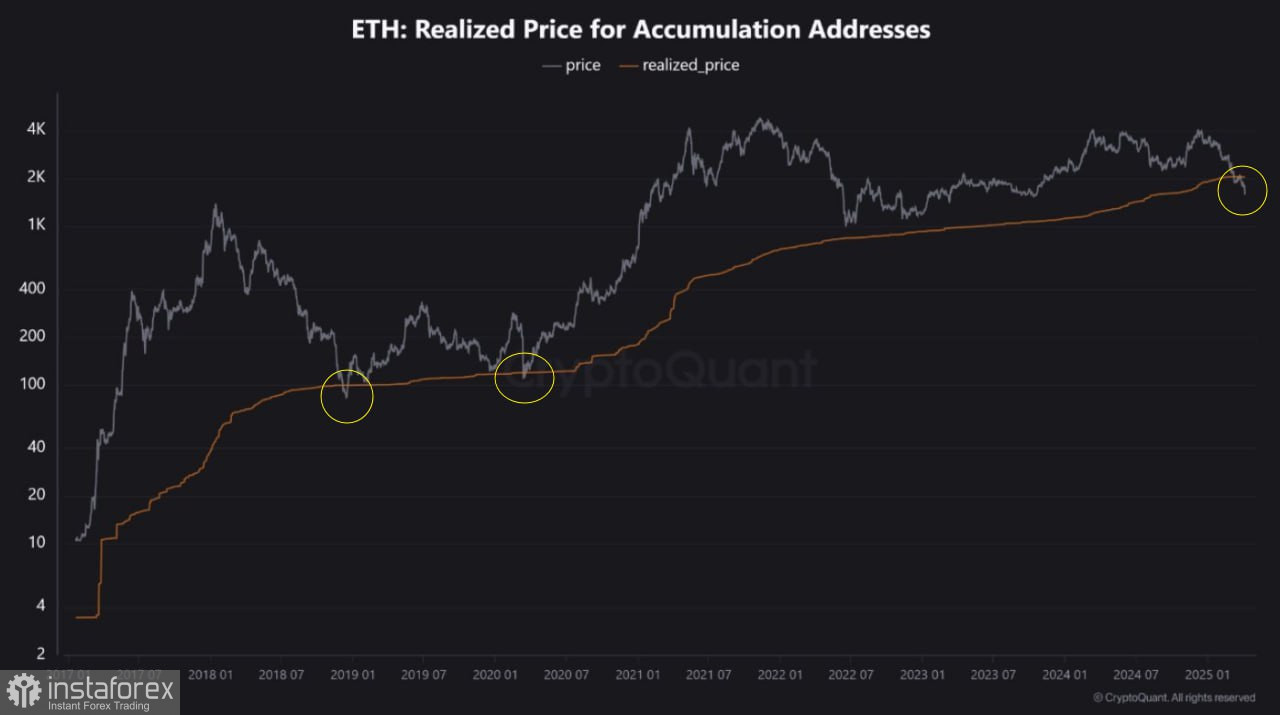

In February 2025, Bitcoin fell below the average aggregate break-even price of short-term holders — and yesterday, it was Ethereum's turn. According to CryptoQuant, ETH's drop below the average break-even level of traders signals the beginning of a key stage in the crypto market. This level represents the average purchase price at which most traders bought ETH. A break below it often triggers a cascade of liquidations and margin calls.

Analysts call this a "market cleansing," implying the removal of overly optimistic and overleveraged players from the market. It's a painful but necessary phase of recovery that creates the conditions for more sustainable growth. History shows that while such events are unpleasant in the short term, they often precede periods of recovery and growth in the medium term.

However, as long as the sell-off in the U.S. stock market doesn't stop, talking about buying in the crypto market remains inappropriate — the correlation between them has become too strong lately.

As for intraday strategies in the crypto market, I will continue to rely on any major pullbacks in Bitcoin and Ethereum, expecting the medium-term bull market to remain intact.

Below are the short-term strategies and conditions:

Bitcoin

Buy Scenario

Scenario #1: Buy Bitcoin today if the price reaches the entry point around $77,350, targeting a rise to $79,400. I plan to exit longs near $79,400 and sell immediately on a bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy Bitcoin from the lower boundary at $76,100 if there's no market reaction to a breakout, targeting reversals to $77,350 and $79,400.

Sell Scenario

Scenario #1: Sell Bitcoin today if the price reaches the entry point around $76,150, targeting a decline to $74,600. I plan to exit shorts near $74,600 and buy immediately on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell Bitcoin from the upper boundary at $77,400 if there's no market reaction to a breakout, targeting reversals to $76,100 and $74,600.

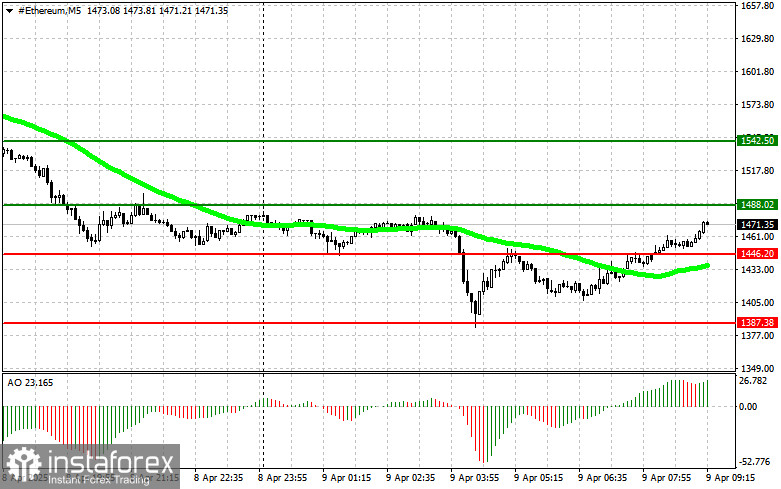

Ethereum

Buy Scenario

Scenario #1: Buy Ethereum today if the price reaches the entry point around $1,488, targeting a rise to $1,542. I plan to exit longs near $1,542 and sell immediately on a bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy Ethereum from the lower boundary at $1,446 if there's no market reaction to a breakout, targeting reversals to $1,488 and $1,542.

Sell Scenario

Scenario #1: Sell Ethereum today if the price reaches the entry point around $1,446, targeting a decline to $1,387. I plan to exit shorts near $1,387 and buy immediately on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell Ethereum from the upper boundary at $1,488 if there's no market reaction to a breakout, targeting reversals to $1,446 and $1,387.